Credit Cards (US)

Best cards for travel: choose the best one!

Our best cards for travel selection will tell you all you need to know when it comes to choosing your next travel credit card. See our post and learn from the experts before making the call!

Cash back for travelling? We’ll help you with the best choices: see our exclusive curation below and pick yours

Have you been wondering which are the absolute best cards for travel? Which ones provide the best rewards, all while featuring a solid subscription plan? Let’s be honest, when we look for those special options, we take several factors into consideration when picking our next credit card: fees, benefit plan, accessibility, convenience, coverage, and, last but not least, reward package!

Search no more. We at the Mister Finance team have just the right content for you and your next trip! Trust us to supply you with the key information and comparison of multiple cards we’ve covered in our past. Experience teaches best, and we have that! See below our most recommended travel cards that will suit your financial life!

Here are our top 4 choices for the best travel cash back credit cards

No point in dallying then, right? We’ll go through a very simple and straightforward overview of the cards, then present you with a full in-depth analysis so you can choose to learn more about the cards that seem best for you. See below and start learning more about our selection for the best cards for travel.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover it® Miles Card

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | 11.99% to 22.99% variable APR |

| Cash back rewards* | Earn unlimited 1.5X Miles on every dollar spend. No minimum amount for redemptions. Turn your Miles into cash. *Terms apply |

Discover it® Miles Card Highlights

With the Discover it® Miles Card, you can get the best out of all your trips! Also, you can use this card to turn your miles into cash. Moreover, you can get 1.5 miles on each dollar you spend on any purchase you make with the card. And you can get all of this for no annual fee!

- As a new cardholder, you can get all your Miles matched by Discover by the end of your first year.

- There are no minimum spending requirements to get your fantastic rewards!

So, if you love to travel and want to save more money on your trips, check out our post below to learn how to apply for this excellent Discover travel card!

How do you get the Discover it Miles card?

Are you looking for a travel card that offers good benefits and a unique sign-up bonus? Read more to know how to apply for the Discover it Miles card!

Discover it Miles credit card full review

Would you like to get good benefits from a straightforward travel credit card? Then keep reading to see our full review of the Discover it Miles credit card!

Chase Sapphire Preferred Card

| Credit Score | Good to excellent. |

| Annual Fee | $95. |

| Regular APR | 16.24% to 23.24% variable APR. |

| Cash back rewards* | 5 points on travel. 3 points for purchases related to dining and eligible delivery services. 2 points on any other travel purchase you make with your card. *Terms apply. |

Chase Sapphire Preferred Card Highlights

Present in almost every list of the best cards for travel, with the Chase Sapphire Preferred Card, you can earn up to 5 points on purchases related to travel you make with Chase Ultimate Rewards. Also, you can earn up to 3 points on purchases related to dining and qualifying delivery services. And the best is that you can earn 2 points on any other travel purchase you make with the card!

- As a new cardholder, you can earn 80,000 bonus points after spending $4,000 on purchases in your first three months with the card.

If you love to travel and want to get rewards for it, read our post below to know how to apply for this Chase travel card!

How do you get the Chase Sapphire Preferred card?

If you have the requirements, then you must want the Chase Sapphire Preferred card. Read more to know how to apply for this great travel card!

Chase Sapphire Preferred credit card full review

The Chase Sapphire Preferred credit card has an incredible welcome bonus and amazing travel and dining benefits. Read our full review of this rewarding travel card!

Capital One Venture Rewards Credit Card

| Credit Score | Good to excellent. |

| Annual Fee | $95. |

| Regular APR | 16.24% to 24.24% variable APR |

| Cash back rewards* | 2 miles for each dollar on any purchase. 5 miles per dollar on hotels and rental cars (booked through Capital One Travel). *Terms apply. |

Capital One Venture Rewards Credit Card Highlights

With the Capital One Venture Rewards Credit Card, you can earn unlimited 2 miles for each dollar on all purchases you make with the card. Also, you can earn 5 miles for each dollar on purchases related to hotels and rental cars. However, you need to book the hotels and rentals through Capital One Travel. See below why the Capital One Venture Rewards is considered one of the best cards for travel.

- As a new cardholder, you can earn unlimited 2 miles points after you spend $3,000 on purchases in your first three months with the card!

- There are no foreign transaction fees.

Check out our post below to learn all the details on how to apply for the Capital One Venture Rewards Credit Card!

How to apply for Capital One Venture Rewards

Come and check how you can apply for the capital one venture rewards card and benefit from its many perks and travel opportunities.

Capital One Venture Rewards credit card review

If I were you, I would check out our full review on Capital One Venture Rewards credit card. Come and see this card's premium benefits.

Bank of America® Travel Rewards credit card

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | 0% intro offer for your first 15 billing cycles. Then, 14.24% to 24.24% variable APR. |

| Cash back rewards* | Unlimited 1.5 points for each dollar you spend on any purchase you make with the card. *Terms apply. |

Bank of America® Travel Rewards credit card Highlights

With the Bank of America® Travel Rewards credit card, you can earn great rewards, such as 1.5 points for each dollar you spend on any purchase with your card. Also, as a new cardholder, you can get a 0% intro APR for your first 15 billing cycles. However, the rewards offers and welcome bonuses can be limited. This happens because the bonuses change depending on the time of your application.

- You can get 25,000 online bonus points if you spend $1,000 in purchases in your first 90 days with the card.

- There is a 0% intro APR offer for your first 15 billing cycles for purchases.

If you loved this Bank of America card, check out our post below to know more about how to apply for it!

How to apply for Bank of America® Travel Rewards

Do you need a credit card with no annual fee to help you spend less on your trips? If so, read our post about the Bank of America® Travel Rewards card application!

Bank of America® Travel Rewards card review

Do you need a travel credit card to earn rewards and an intro APR period? If so, read our Bank of America® Travel Rewards card review and learn more!

Do you stack credit card rewards? Learn how to start!

Now that you know the best cards for travel, do you want to learn how to optimize your purchase process and start stacking rewards? After picking one from our selection, maybe you would like to know more about the techniques we can teach you to save more money and enjoy all the benefits possible when spending your money.

See our post below and find out the way to make your financial life even more sophisticated, reaping rewards like you’ve never collected before!

Learn how to start stacking credit rewards!

We have prepared a list of tips on how to stack credit card rewards. Learn today how to maximize your earnings and pile up your rewards!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

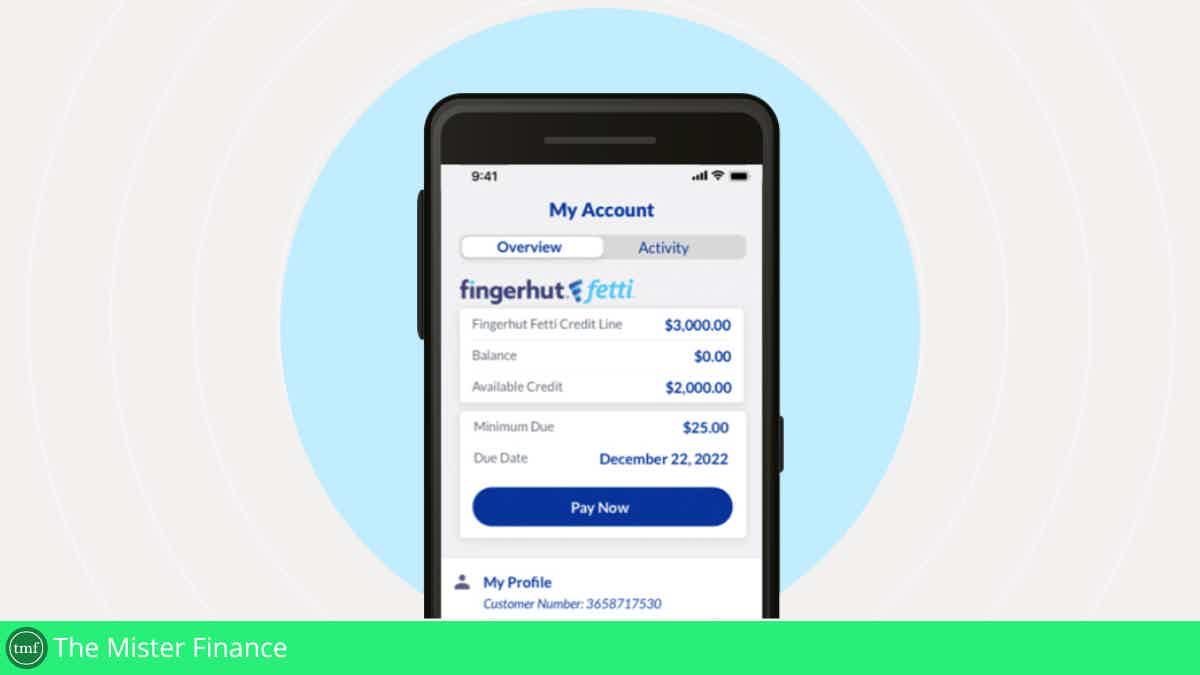

WebBank/Fingerhut Credit Account review!

Looking for an account to help you get perks and build your score with no hidden fees? Read our WebBank/Fingerhut Credit Account review!

Keep Reading

Upgrade Visa® Card with Cash Rewards application

See how you can easily apply for an Upgrade Visa® Card with Cash Rewards and learn how to earn great rewards on purchases!

Keep Reading

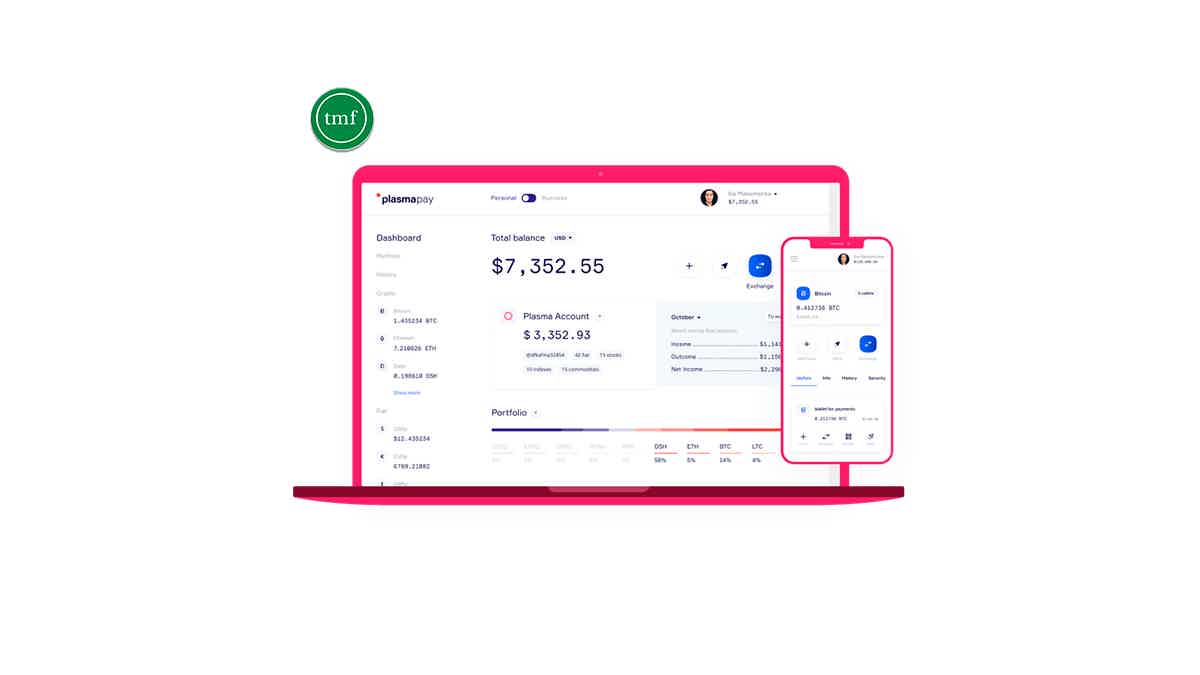

PlasmaPay crypto wallet full review

Looking for a crypto wallet that offers more than 300 coins and tokens? If so, check our PlasmaPay crypto wallet review to learn more!

Keep ReadingYou may also like

Where Zero Means More: Navy Federal Platinum Card Review

Get everything you need to know about the Navy Federal Platinum Card in our review and discover why "zero" is a great value - pay no hidden fees!

Keep Reading

How to prepare for buying a house in 2023

Want to buy a house in the near future? Start planning now with these tips on saving money, building your credit score, and more. Read on!

Keep Reading

Cheap flights on Priceline: save up to 50%

Travel more, paying less with Priceline cheap flights. Find out how to book tickets to different locations at low cost. Keep reading!

Keep Reading