Reviews (US)

Bank of America® Travel Rewards card review

Do you need a travel credit card to earn rewards and an intro APR period? If so, read our Bank of America® Travel Rewards card review and learn more!

Bank of America® Travel Rewards card: 0% intro APR period and no annual fee

If you love to travel, you probably love to win rewards while traveling. Well, that’s where a great travel rewards credit card can help you make the best out of your trips! Also, with a travel credit card, you can get perks, such as discounts, concierge services, and others! So, in this post, we will show you all the details about the Bank of America® Travel Rewards card. Therefore, keep reading our Bank of America® Travel Rewards card review to learn more!

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | 14.24% to 24.24% variable APR. |

| Welcome bonus* | You can earn 25,000 bonus points after spending at least $1,000 in purchases in your first 90 days. *Terms apply. |

| Rewards* | You can earn unlimited 1.5 points for each dollar you spend on every purchase your make with your card. *Terms apply. |

How to apply for Bank of America® Travel Rewards?

If you love to travel and want to earn rewards with no annual fee, read our post about the Bank of America® Travel Rewards card application!

How does the Bank of America® Travel Rewards card work?

With the Bank of America® Travel Rewards card, you can earn 25,000 online bonus points, redeeming for $250. Also, you can earn unlimited 1.5 points for each $1 you spend on every purchase you make with the card, anywhere you like. Moreover, you can enjoy all these perks for no annual fee! In addition, you can enjoy all your trips with no worry about foreign transaction fees. Moreover, as a new cardholder, you will earn a 0% intro APR.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Bank of America® Travel Rewards card benefits

This Bank of America® Travel Rewards card is loaded with great benefits. For example, a new cardholder can earn 25,000 bonus points. Plus, you’ll get a 15-billing-cycle 0% APR intro period. But, like any other card, this one has some drawbacks. So, see the pros and cons of this fantastic travel rewards card listed below!

Pros

- There is no annual fee.

- You can earn a 0% intro APR period of 15 billing cycles.

- There are no foreign transaction fees.

Cons

- The best rewards are only available for certain clients.

- You will need a credit score ranging from good to excellent to qualify.

How good does your credit score need to be?

You will need a relatively high credit score to have a chance of approval to get this Bank of America credit card. For example, you will need a credit score ranging from good to excellent to have a chance of qualifying. Also, there may be an impact on your score during the application process.

How to apply for Bank of America® Travel Rewards card?

You can easily apply for this Bank of America travel credit card. Also, you can do it all online and from the comfort of your home with a computer. Therefore, check out our post below to know the details of applying for the Bank of America® Travel Rewards card!

How to apply for Bank of America® Travel Rewards?

If you love to travel and want to earn rewards with no annual fee, read our post about the Bank of America® Travel Rewards card application!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to join CRED club?

Do you need to manage your finances better? You can start with keeping track of your credit score. So, read on to learn how to join CRED!

Keep Reading

Ally Bank review: get simplified solutions!

Interested in a simpler banking experience without missing on the quality? Check our Ally Bank review and learn all about it today!

Keep Reading

Credit One Bank NASCAR® Visa credit card full review

Looking for a card that allows you to rebuild credit score? Check the Credit One Bank NASCAR® Visa credit card full review out!

Keep ReadingYou may also like

Apply for the Southwest Rapid Rewards® Premier Credit Card

Our guide provides simple steps to apply for Southwest Rapid Rewards® Premier Credit Card. Earn up to 3 points per $1 spent and enjoy exclusive perks!

Keep Reading

Chase Bank review: is it the best choice for you?

Chase Bank is one of the largest banks in the United States. It has a long history and many satisfied customers. But should you start banking with Chase? Let's take a look at what they have to offer.

Keep Reading

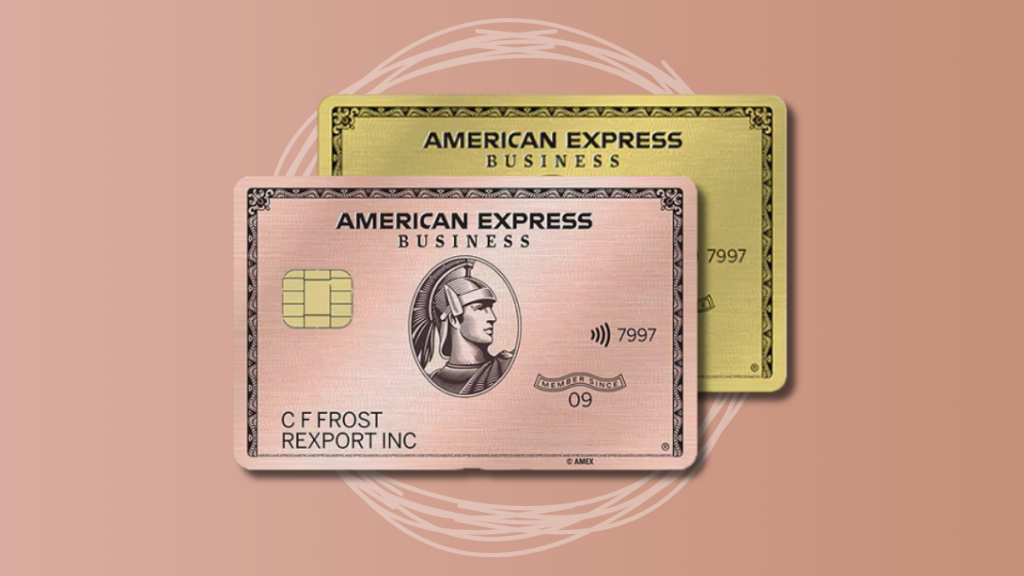

70K bonus points: Apply for American Express® Business Gold Card

As a business owner, you can apply for the American Express® Business Gold Card. Earn points on purchases and enjoy exclusive travel benefits! Read on!

Keep Reading