Credit Cards (US)

Credit One Bank NASCAR® Visa credit card full review

Are you looking for a credit card that helps you with rebuilding your credit score? Then, check out all about the Credit One Bank NASCAR® Visa card right below!

Cash back and more with Credit One Bank NASCAR® Visa

The Credit One Bank NASCAR® Visa credit card is suitable for people who love NASCAR and automotive purchases.

But not only that, with a variable cash back program on eligible purchases, you can enjoy the perks without being concerned about a security deposit.

Also, it doesn’t require a good credit score to apply for the card. So, you can rebuild your score while shopping and paying it off on due time.

See the full review below!

| Credit Score | Bad – Fair |

| Annual Fee | From $39 to $99 |

| Regular APR | 23.99% variable APR |

| Welcome bonus | N/A |

| Rewards | From 1% to 2% cash back on eligible purchases |

How to apply for Credit One Bank NASCAR® Visa card

The Credit One Bank NASCAR® Visa credit card is a good choice if you love NASCAR and want to rebuild your credit score. See how to apply!

Credit One Bank NASCAR® Visa credit card explained

Are you a NASCAR fan? If so, let us present to you the Credit One Bank NASCAR® Visa credit card. If not, keep reading because this card offers the opportunity to rebuild your credit score.

Firstly, this Visa credit card rewards you with 1% cash back on eligible purchases in gas and automotive categories. Also, you can earn 2% cash back on purchases at NASCAR Shop.

However, it charges from $39 to $99 as an annual fee, which is high. There is no Intro APR or welcome bonus either.

On the other hand, it includes features like ID Theft protection, $0 Fraud Liability, and flexibility on the due date.

Also, it doesn’t require a security deposit. But, the credit limit ends up being low: $300 minimum at the beginning.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Credit One Bank NASCAR® card benefits and more

Although it has a high annual fee, this card from Credit One Bank offers a chance to rebuild your credit score, as it only requires a fair score for the application.

And with a variable reward program based on automotive categories, you can earn from 1% to 2% cash back that will be redeemed as a statement credit.

Plus, as a Visa cardholder, you can enjoy Visa benefits such as shopping discounts and protection against fraud and ID Theft.

In addition, obviously, the card’s main benefit is written on its name: special discount at NASCAR Official Club and Shop.

Finally, you may apply for a different offer if you are a Covered Borrower in the Military Lending Act.

Check out the list of pros and cons, then.

Pros

- Flexible cash back reward program

- It doesn’t require security deposit

- NASCAR and Visa discounts

- It doesn’t require a good credit score

- Good choice for rebuilding credit score

- Flexibility on the due date, as you can choose 6 days before or after the assigned date

- $0 fraud liability and ID theft protection

Cons

- Limited cash back rates and categories

- No Intro APR

- No welcome bonus

- High annual fee

- Foreign transaction fees of 1% or 3%, whichever is greater

- Low credit limit

See how good your credit score needs to be for the application

The Credit One Bank NASCAR® Visa credit card only requires a bad to fair credit score. So, it allows you to rebuild your score.

Learn how to apply for a Credit One Bank NASCAR® Visa card

If you decide that this credit card fits your profile and lifestyle, you can apply for it right now by checking out our next post!

How to apply for Credit One Bank NASCAR® Visa card

The Credit One Bank NASCAR® Visa credit card is a good choice if you love NASCAR and want to rebuild your credit score. See how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to use and maximize your Capital One miles: 10 best ways!

Do you want to make the best of your Capital One miles? Read more to learn how to use Capital One miles and maximize them!

Keep Reading

How to apply for the Education Loan Finance Private Student loans?

Education Loan Finance Private Student loans help you accomplish the dream of a brighter future for yourself or your children. Apply now!

Keep Reading

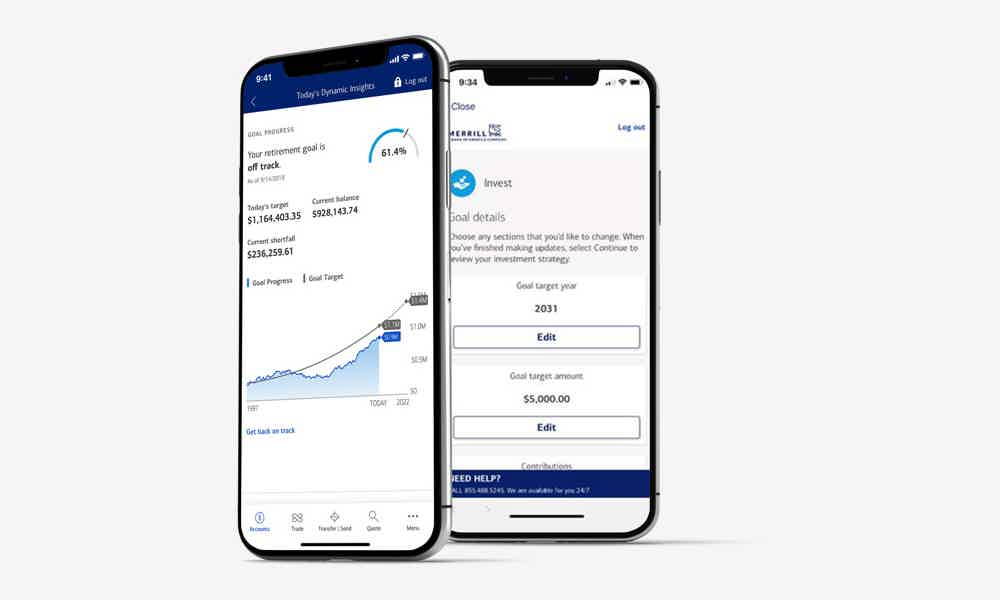

Merrill Edge investing full review

Get a full range of investment choices with no annual account fees investing at Merrill Edge. Check out the Merrill Edge investing review!

Keep ReadingYou may also like

Sable Card application: how does it work?

Applying for a Sable card is an excellent idea. Open your account online and get your debit card with no fees. This article will show you how to get a Sable card.

Keep Reading

Aer Lingus Visa Signature® Card review: up to 3 Avios per dollar spent

If you love traveling, we'll present a product to cut expenses. Here is the full Aer Lingus Visa Signature® Card review. $0 foreign transaction fees!

Keep Reading

Ally Bank Mortgage review: how does it work, and is it good?

If you're in the market for a new mortgage, be sure to read our Ally Bank Mortgage review. We'll tell you everything you need to know about this product, including how it works and whether or not it's a good option for you. Read on!

Keep Reading