Loans (US)

How to apply for the Education Loan Finance Private Student loans?

Education Loan Finance Private Student loans are low-cost, offer flexible terms, and provide a dedicated advisor to help you through the process. Learn how to apply for it!

Applying for ELFI Private Student loans: simple application with no fees!

Education Loan Finance or ELFI is a lender specializing in helping people pay for education. So, they believe it is empowering, and the pavement they help you build guarantees a brighter future for you or your children. Thus, Education Loan Finance Private Student loans offers a low variable and fixed APR, from 1.20% and 3.20%, respectively. Also, it gives you flexible terms from 5 to 15 years.

Plus, it provides a dedicated advisor who will help you through the process. And all of that with no application, origination, or prepayment fees.

In addition, the application is fast and straightforward. And you can pre-qualify without harming your credit score.

Apply online

Access the Education Loan Finance Private Student Loans website and click on Get Started. You can also find your rate and pre-qualify before applying for a loan.

Then, create a profile by filling in the forms with your personal information.

Note that you must meet the requirements, as follows:

- Be U.S. citizens or permanent resident aliens;

- Be at the age of majority or older;

- Have a minimum income of $35,000;

- Be enrolled in a program for a Bachelor’s, Master’s, or Doctoral Degree;

- Have a minimum credit history of 36 months with a good credit score;

- Be enrolled at least half-time in school if student;

And, if you are a parent applying for a loan, see the terms and conditions.

Finally, check out if the student attends an eligible school and send the documents.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

There is no mobile app available for this service.

Education Loan Finance Private Student loan vs. College Ave Student Loans

Are you searching for a loan? Don’t worry because we will help you! That’s why we have brought to you not one but two lenders for you to compare and decide which is the best.

| Education Loan Finance Private Student Loans | College Ave Student Loans | |

| APR | Variable: from 1.20% Fixed: from 3.20% | Undergraduate Student Loans: rates from 0.94% to 12.99%; Graduate Student Loans: rates from 1.99% to 11.98%; Parent Loans: rates from 1.04% to 12.99%; Refinancing: rates from 2.94% to 4.94% |

| Loan Purpose | Education | Personal – for students who want to make payments while in school, or who need to refinance it |

| Loan Amounts | From $1,000 | Minimum of $1,000 |

| Credit Needed | Good (680) | Approximately 600 |

| Terms | Students loans: 5 – 15 years Parents loans: 5 – 10 years Refinancing: 5 – 20 years | 5, 8, 10, and 15 years |

| Origination Fee | None | None |

| Late Fee | 5% of the past due amount or $50, whichever is less; And a $30 fee for insufficient funds or returned check | 5% of the amount due, or $25, whichever is less |

| Early Payoff Penalty | None | None |

How to apply for the College Ave Student loans?

Get a loan designed for you at College Ave Student loans! Learn how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Verve Credit Card overview

Check out this Verve Credit Card overview and learn how this card from Continental Finance can help you repair your credit score.

Keep Reading

How to apply for the World of Hyatt credit card?

See how the World of Hyatt credit card application works so you can enjoy a great staying at a Hyatt resort or hotel while earning rewards!

Keep Reading

Find the best cards if you have good credit

Not sure what are the best cards for people with good credit scores? Check our list of the very best options for you to build good credit!

Keep ReadingYou may also like

LendingClub Personal Loans review: how does it work and is it good?

Are you in need of a great loan to help your finances? If so, read our LendingClub Personal Loans review to learn more about this option!

Keep Reading

Apply for the Navy Federal GO REWARDS®: earn up to 3 points

Are you a Navy Federal member and want to know how to apply for the Navy Federal GO REWARDS®? Here is the guide you are looking for.

Keep Reading

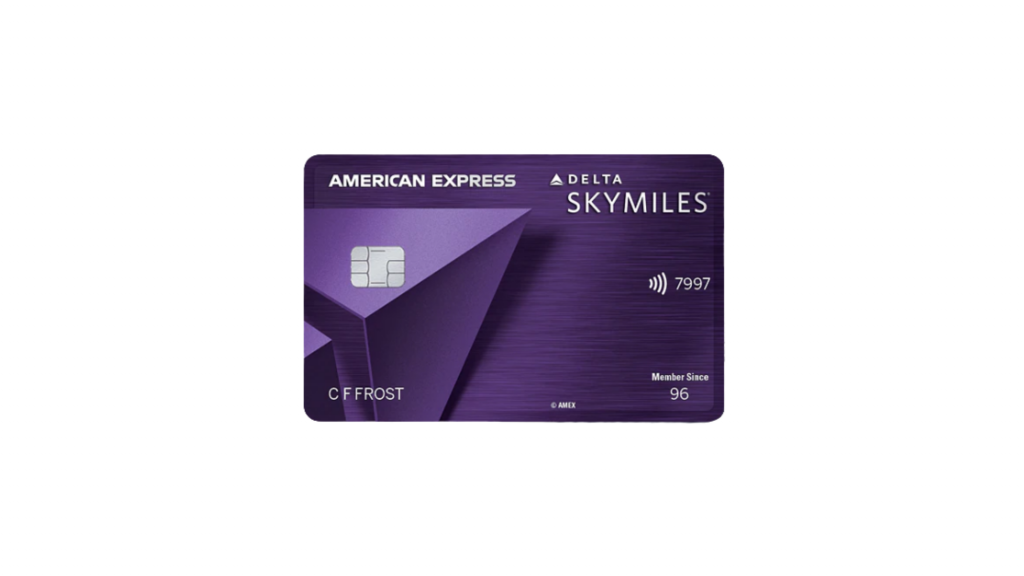

Apply for the Delta SkyMiles® Reserve American Express Card

Are you looking for an incredible travel credit card? If so, read our post about the Delta SkyMiles® Reserve American Express Card application process!

Keep Reading