US

WebBank/Fingerhut Credit Account review!

Are you looking for a credit account with perks and credit-building features? If so, read our WebBank/Fingerhut Credit Account review to learn more!

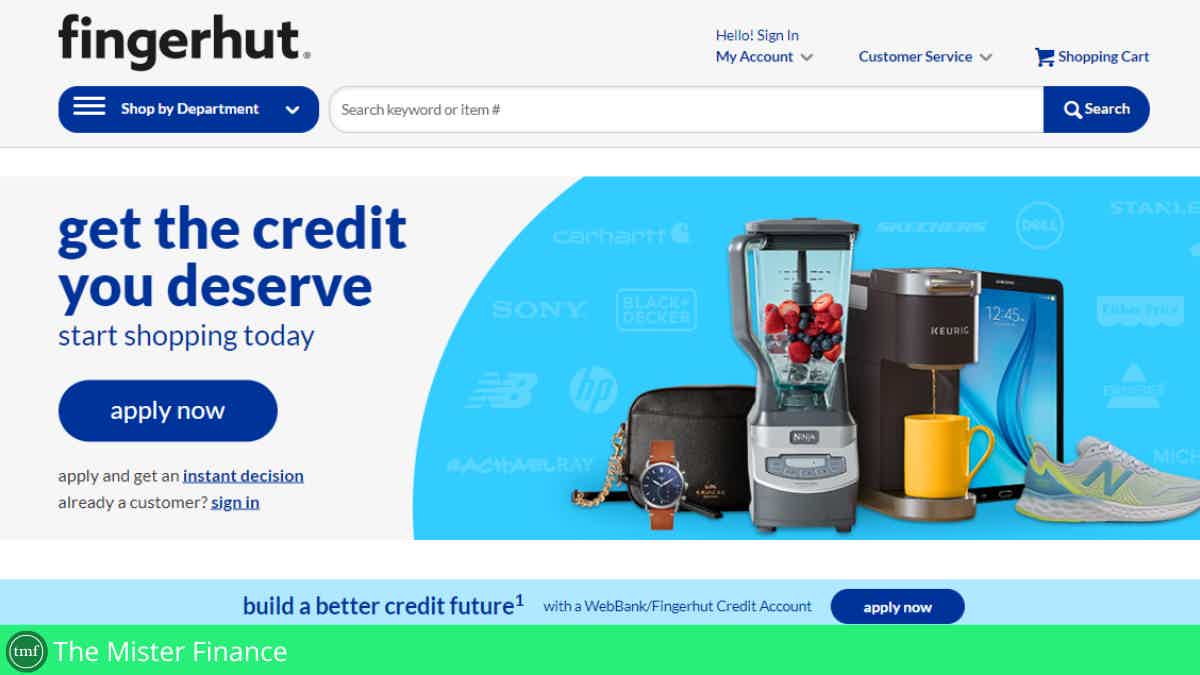

WebBank/Fingerhut Credit Account: Build your score!

Tired of struggling to find ways to improve your credit score? With the WebBank/Fingerhut Credit Account review, you can learn to purchase with an online credit line and see your score rise!

How to apply for the WebBank/Fingerhut account

Do you need to purchase at your favorite brands with no hidden fees? Read on to learn how to apply for the WebBank/Fingerhut Credit Account!

Moreover, whether you’re a student looking to build up their credit rating or someone with poor financial history checking out options, a Fingerhut Credit Account could be the perfect solution.

Therefore, keep reading our WebBank/Fingerhut Credit Account review and find out how this easily accessible account will help you achieve all of your money management goals!

Also, you’ll be able to get the ability to shop from thousands of products online! So, read on!

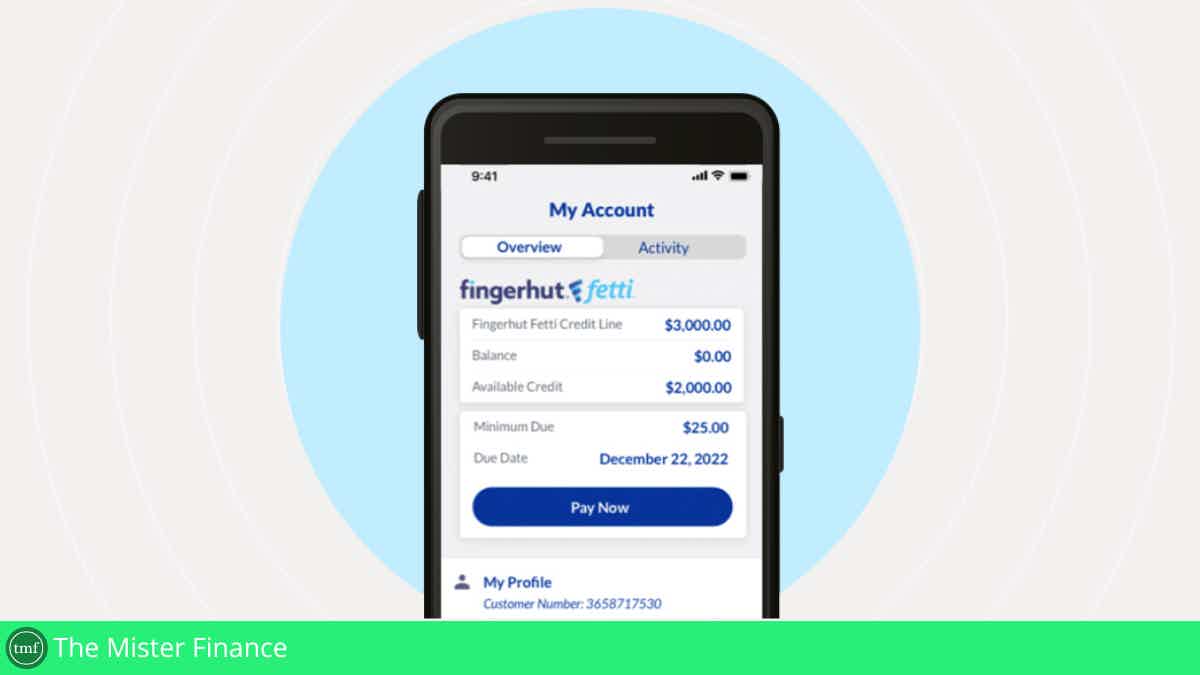

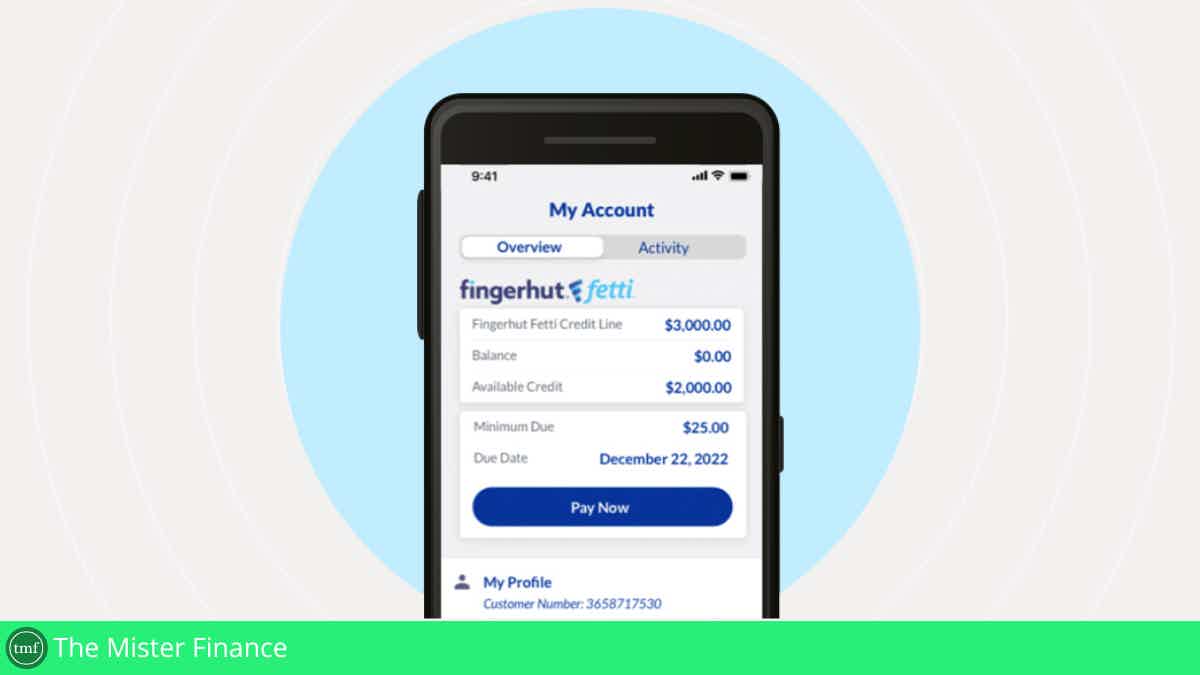

How does the WebBank/Fingerhut Credit Account work?

With the WebBank/Fingerhut Credit Account, you’ll be able to make purchases at over 100 select top brands and products, including Apple and more!

Moreover, you’ll be able to get a good credit limit if you have a good score. Also, you’ll be able to build your credit score if you make all your monthly payments on time!

Therefore, Fingerhut sends your monthly payment reports to all three major credit bureaus! However, you’ll need to use your credit account responsibly to improve your score.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

WebBank/Fingerhut Credit Account benefits

As we mentioned, the WebBank/Fingerhut Credit Account can offer many perks to its users.

Moreover, one of the best features is that you’ll be able to build your credit score if you make all your monthly payments on time.

However, as with any other service, this one also has its pros and cons. Therefore, you can read our pros and cons list below to learn more and see if this is the best credit account for your needs!

Pros

- You can shop at over 100 brands and products;

- There are no hidden fees to use the account;

- You can build your credit score if you make all your monthly payments on time.

Cons

- You may not get a high credit limit if you have a lower score;

- There could be more rewards and perks.

How good does your credit score need to be?

You’ll have chances to qualify for this product even if you have a low credit score. However, that can impact your credit limit and other fees.

Moreover, it is recommended that you can pay for the possible fees they may charge and don’t overspend.

Also, you’ll be able to check your FICO score for free through this platform. Moreover, they will send your monthly payment reports to all three major credit bureaus.

However, you’ll only be able to increase your credit score if you make sure you can make all your monthly payments on time!

How to apply for the WebBank/Fingerhut Credit Account?

You can easily apply for this product online by providing the personal information required on the official application form! Moreover, you’ll be able to get an instant decision on your application!

How to apply for the WebBank/Fingerhut account

Do you need to purchase at your favorite brands with no hidden fees? Read on to learn how to apply for the WebBank/Fingerhut Credit Account!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Amazon Rewards Visa Card review

The Amazon Rewards Visa Card offers cash back rewards and it's the perfect tool for Amazon shoppers! Read out full review to learn more.

Keep Reading

Types of credit cards

Check out the types of credit cards, how they work, and more. So, next time you apply for one you do it wisely to fit your needs and goals!

Keep Reading

Hard and soft credit check? Learn what this means!

Are you looking for information on what a hard and soft credit check is? You're in the right place! Read on to learn more about your score!

Keep ReadingYou may also like

How to buy cheap Southwest Airlines flights

Discounted tickets are available online, and in this post, you'll find out how to buy cheap Southwest Airlines flights. With our help, you can ensure you're using the right steps when booking to get a great deal. Keep reading!

Keep Reading

Surge® Platinum Mastercard® credit card review: credit limit even for the lowest scores

If you have a bad score or no score, this is an excellent way to fix it. Learn more about the advantages of this card and what makes it so successful in our Surge® Platinum Mastercard® credit card review!

Keep Reading

Luxury Black credit card review: is it worth it?

This review will show you the benefits you'll get with the Luxury Black credit card. Is this the ideal travel credit card for you? You'll find out reading this content.

Keep Reading