Credit Cards (US)

7 best cards for electronic stores

Are you looking for the perfect card for rewards when shopping at your favorite electronic store? Read on to see the best cards for electronic stores!

Find out which are the best cards for electronic stores!

Are you an electronics enthusiast who wants to maximize the benefits of your purchases? If so, you can get the best cards for electronic stores!

Moreover, if you often find yourself in electronic stores looking for the newest gadget and technology release, we can help!

Also, in this post, we will discuss those cards in detail and give you even more information so that you can make an educated decision about which one is right for you.

So, if finding the best cards for electronic stores is at the top of your priority list, read on!

Best cards for purchases at electronic stores: 7 options!

We’ve done our research and narrowed down what we believe are currently the best cards when it comes to getting things from electronic stores.

Also, there are some great credit cards out there that offer rewards, discounts, and other features specifically designed to fit the needs of tech lovers. Moreover, there are regular cards that can help you too!

Therefore, check out our list below to learn more about the best cards for electronic purchases at stores!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Amazon Prime Rewards Visa Card

If you already have your Amazon Prime membership, this can be an incredible credit card to buy your electronics! Moreover, this card allows you to get gift cards, cash back, and much more!

Also, if you buy at Amazon.com, you can get even more perks with your Prime membership! In addition, there is no annual fee.

| Credit Score | Good. |

| APR* | 18.74% to 26.74% for purchases and balance transfers; Also, 29.49% for cash advances. *Terms apply. |

| Annual Fee | $0. |

| Welcome bonus* | $100 Amazon Gift Card instantly upon your approval. *Terms apply. |

| Rewards* | 10% cash back or more at select Amazon.com products and categories; 2% cash back at restaurants and gas stations; Also, 1% cash back on any other purchase with your card. *Terms apply. |

How to apply for the Amazon Credit Card?

Learn everything about the application process to get your Amazon credit card and enjoy its benefits.

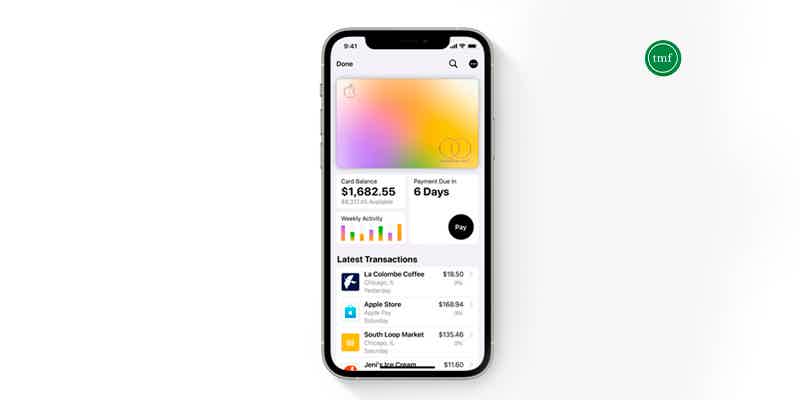

Apple Card

If you love to get Apple electronics, this can be an incredible card for you! Also, this card has incredible cash-back offers, such as up to 3% cash back for Apple and other eligible purchases.

Moreover, you won’t have to pay any annual fees or some other common credit card fees, such as foreign transaction fees or late fees.

| Credit Score | Good. |

| APR | 15.49% to 26.49% variable APR based on creditworthiness. |

| Annual Fee | $0. |

| Welcome bonus | N/A. |

| Rewards* | 3% cash back for Apple purchases and select merchants when using Apple Pay or your Apple Card (T Mobile, Mobil, and more); 2% cash back when using Apple Pay; Also, 1% cash back when using your titanium card in stores or virtual purchases online. *Terms apply. |

How to apply for the Apple credit card

Do you want to get the new Apple card? We'll show you how to apply and get great rewards! Read our Apple credit card application post!

Chase Freedom Unlimited®

This card can give you many perks for you to make the best out of your electronic purchases. Also, you’ll be able to get purchase protection and extended warranty protection!

Moreover, you’ll get cashback for your purchases and an intro APR on purchases and balance transfers that can help you even more!

| Credit Score | Good to excellent. |

| APR* | 0% intro APR for 15 months from your account opening (valid for purchases and balance transfers). Also, after that, a variable APR of 19.74% to 28.49%. *Terms apply. |

| Annual Fee | $0. |

| Welcome bonus* | Get a $200 bonus after spending $500 on purchases in your first 3 months from account opening. *Terms apply. |

| Rewards* | Unlimited 1.5% cash back or more on every card purchase; Also, up to 5% cash back on other eligible purchases, including travel that you buy through Chase. *Terms apply. |

How to apply for Chase Freedom Unlimited® card?

The Chase Freedom Unlimited® credit card allows you to access many benefits and perks, such as cashback rewards. So, check out how to apply for it!

Target RedCard™ Credit Card

With Target RedCard™ Credit Card, you’ll be able to get discounts and offers for Target electronic and other purchases! Moreover, you can get incredible cashback with this card!

In addition, you’ll be able to get all these perks for no annual fee!

| Credit Score | Good. |

| APR | 27.40% variable APR for purchases. |

| Annual Fee | No annual fees. |

| Welcome bonus | N/A. |

| Rewards* | 5% off every day at Target and Target.com; RedCard Exclusives, including special items and offers; 2% on dining and gas purchases; Also, 1% everywhere else outside of Target. *Terms apply. |

Chase Sapphire Reserve®

This Chase card is for those looking for a card with many different spending categories. Also, you’ll be able to make your electronic purchases with this card and get purchase protection.

Moreover, you’ll be able to make your purchases safely and get other varied perks, such as travel benefits and more.

| Credit Score | Good to excellent. |

| APR | 21.74% to 28.74% variable APR. |

| Annual Fee | $550. |

| Welcome bonus* | 60,000 bonus points after you spend $4,000 on purchases in your first 3 months from account opening. *Terms apply. |

| Rewards* | Up to 10x total points on eligible Chase categories, including hotels and car rentals through Chase; Also, 1 point per dollar you spend on any other purchases. *Terms apply. |

How do you get the Chase Sapphire Reserve® Card?

Do you want incredible travel and dining perks in one credit card? Then, read more to know how to apply for the Chase Sapphire Reserve card!

Wells Fargo Reflect® Card

With this Wells Fargo card, you’ll be able to get an incredibly long 0% Intro APR for 18 months on purchases and eligible balance transfers.

Moreover, you’ll be able to make the best out of your electronic purchases with this 0% intro APR!

Also, you’ll get Zero Liability Protection! In addition, there is no annual fee!

| Credit Score | Good to excellent. |

| APR* | 0% intro APR for 18 months on purchases and eligible balance transfers. Also, after that, there is a 17.74% to 29.74% variable APR. *Terms apply. |

| Annual Fee | No annual fee. |

| Welcome bonus | No bonuses besides the intro APR. |

| Rewards | N/A. |

How to apply for a Wells Fargo Reflect Card?

Enjoy intro APR for up to 21 months with a Wells Fargo Reflect Card. Check out how to apply!

Chase Freedom Flex℠

With this Chase card, you’ll be able to enjoy your electronic purchases by getting cash back for them and for other eligible purchases.

Moreover, you’ll be able to save money on purchases with the 0% intro APR valid for 15 months from your account opening.

| Credit Score | Good. |

| APR* | 0% intro APR for 15 months on purchases and balance transfers. Also, after that, there will be a 19.74% to 28.49% variable APR. *Terms apply. |

| Annual Fee | There is no annual fee. |

| Welcome bonus* | $200 bonus after you spend $500 on purchases in your first 3 months. *Terms apply. |

| Rewards* | 5% cash back on different categories and select online merchants on up to $1,500 total combined purchases (valid for each quarter you activate); Up to 5% cash back on eligible purchases, including travel you purchase through Chase; Also, 1% cash back on any other purchases. *Terms apply. |

How to apply for Chase Freedom Flex℠ card?

The Chase Freedom Flex℠ credit card is a good choice if you want a flexible cash back reward program. See how to apply for it now!

With these credit cards, you’ll get special conditions to buy your electronics. Stay updated with new trends and use the best gadgets always.

In the following, check a few more credit card options for online shopping.

Best Credit Cards for Online Shopping in 2023!

Are you shopping online more than ever and want to get the most out of your spending? Read on to see the best cards for online shopping!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

HSBC Cash Rewards Mastercard® credit card full review

Are you looking for a credit card that gives you a good pack? Then, check out the HSBC Cash Rewards Mastercard® credit card full review!

Keep Reading

How to apply for the Journey Student Credit Card from Capital One Card?

Journey Student Rewards from Capital One card offers unlimited 1% cash back on all purchases without an annual fee. Apply for it right now!

Keep Reading

TradeStation wallet review: how does it work?

If you are looking for a trading platform for experienced traders, TradeStation can be for you! So, read our TradeStation wallet review!

Keep ReadingYou may also like

Ally Invest review: Low transaction fees and no minimum account requirements.

Trying to decide whether Ally Invest is for you? We are going to help you with that. Read our Ally Invest review to see if this account is what you've been looking for.

Keep Reading

Copper - Banking Built For Teens review: fees, rates, and more

Does your teen need a jump-start into the world of finances? Check out Copper’s Banking Built for Teens account review! Learn about this innovative solution!

Keep Reading

Cheap flights on Momondo: find flights from $100!

Get the best deal for your next trip with a wide range of airlines and budget-friendly Momondo cheap flights. Keep reading and learn more!

Keep Reading