Credit Cards (US)

How to apply for the Apple credit card?

Wondering how to apply for the new Apple credit card? We'll show you how easy it is to get started. Read more to know about the Apple credit card application!

Apple credit card application: learn how to apply and get rewards for Apple purchases

If you’re a fan of Apple products, you may be interested in the company’s new credit card. The Apple Card is designed to make it easy for customers to earn rewards and manage their finances. Also, you can get cash back rewards and other perks if you love Apple products. We’ll explain the application process and what you can expect if you are approved! So, if you’re curious about how to apply, keep reading our post about the Apple credit card application!

Apply online

You can easily apply for the Apple credit card through Apple’s official website. You can click on Apply now, and you’ll be redirected to a page to start your application process. Also, before you start the official process, you can see if you are pre-approved with no impact on your credit score. Moreover, you need to provide your Apple ID to start your application process. After that, you can provide your personal information and see if you’re pre-approved in minutes.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

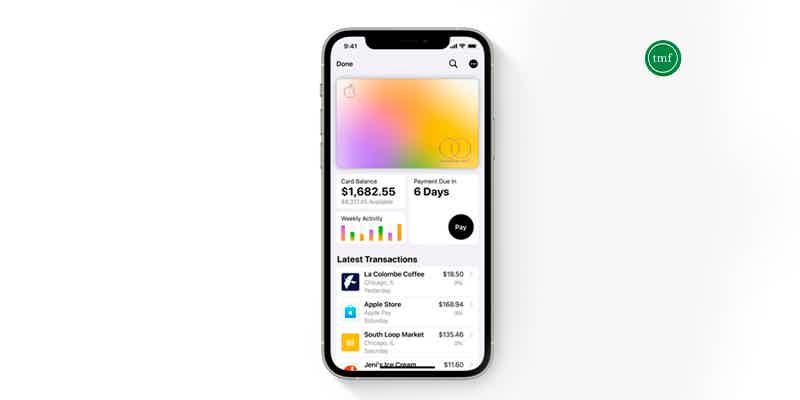

Apply using the app

Although you need to follow the tips in the topic above to apply for an Apple credit card, you can use the mobile app to manage your card. Also, you can access your account through your iPhone in your Wallet app. Therefore, you can sign in and start using your Apple credit card after you already have an account.

Apple credit card vs. Amazon credit card

If you still don’t know if you want to apply for an Apple credit card, we can give you other options. For example, the Amazon credit card gives you perks if you love Amazon products. Therefore, check out our comparison table below to help you decide which one of these excellent credit cards you want to apply for.

| Apple credit card | Amazon credit card | |

| Credit Score | Fair to excellent. | Good to excellent. |

| Annual Fee | No annual fee. | $0 with Prime Membership. |

| Regular APR | 10.99% to 21.99% variable APR. | 14.24% to 22.24% variable APR |

| Welcome bonus | No welcome bonus. | You can get a $100 Amazon Gift Card. |

| Rewards* | Unlimited 3% daily cash back for purchases made at Apple. 2% daily cash back when you make purchases through Apple Pay. 1% cash back on every other purchase you make with the card. *Terms apply. | Prime Members get 5% back at drugstores, gas stations, and restaurants. 2% back at drugstores, restaurants, and gas stations. 1% back on all other purchases. |

How to apply for the Amazon credit card

Are you interested in getting the Amazon Prime Rewards card? You can get special rewards like 5% unlimited cash back at Amazon.com! Keep reading to know how to apply!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Mission Lane Visa® Card?

The Mission Lane Visa® Card is a financial tool that helps you rebuild your credit score. Check out how to apply for it today!

Keep Reading

What Happens When You’re Caught Driving Without Car Insurance?

Do you know what Happens When You Are Caught Driving Without Car Insurance? Find out everything about risks and if it is worth taking them.

Keep Reading

Student Loan refinance: how does it work?

Student Loan refinance: how it works? Learn all about it and the advantages and disadvantages of deciding to apply for one. Find out more!

Keep ReadingYou may also like

Application for the GO2bank™: how does it work?

Here is a full review about the GO2bank™ application process. Learn who is eligible for an account, and how you can apply online today. Read on!

Keep Reading

First Citizens Bank Rewards Credit Card Review: 0% intro APR

First Citizens Bank Rewards Credit Card: Should it be your next card? It boasts no annual fee and rewards on everyday spending. We break it down in our post. Read on!

Keep Reading

How to get a personal loan: 6 steps to secure funding

Here are six simple tips on how to get a personal loan. This guideline can help you improve your chances of getting the money you need and get informed about the process. Read on!

Keep Reading