Finances (US)

Seasonal tokens: What is it?

Have you heard about seasonal tokens and want to learn more? If so, read on to see how these tokens work!

Learn all about seasonal tokens and other cryptos!

Are you interested in learning about the different types of tokens available and what makes seasonal tokens unique? If so, you can read our post!

Moreover, cryptocurrency has been around for a few years now, and the possibilities of investing in digital currency have become more abundant.

This way, with so many options out there, understanding what each token does can be difficult to follow.

Therefore, the information we share today will provide an overview of seasonal tokens and the different types of cryptocurrencies available on the market today!

Also, we’ll explain how they work, how they differ from one another, and where you can find them online.

So, take some time to explore all that cryptocurrency has to offer as we uncover these valuable insights into seasonal tokens and other cryptos!

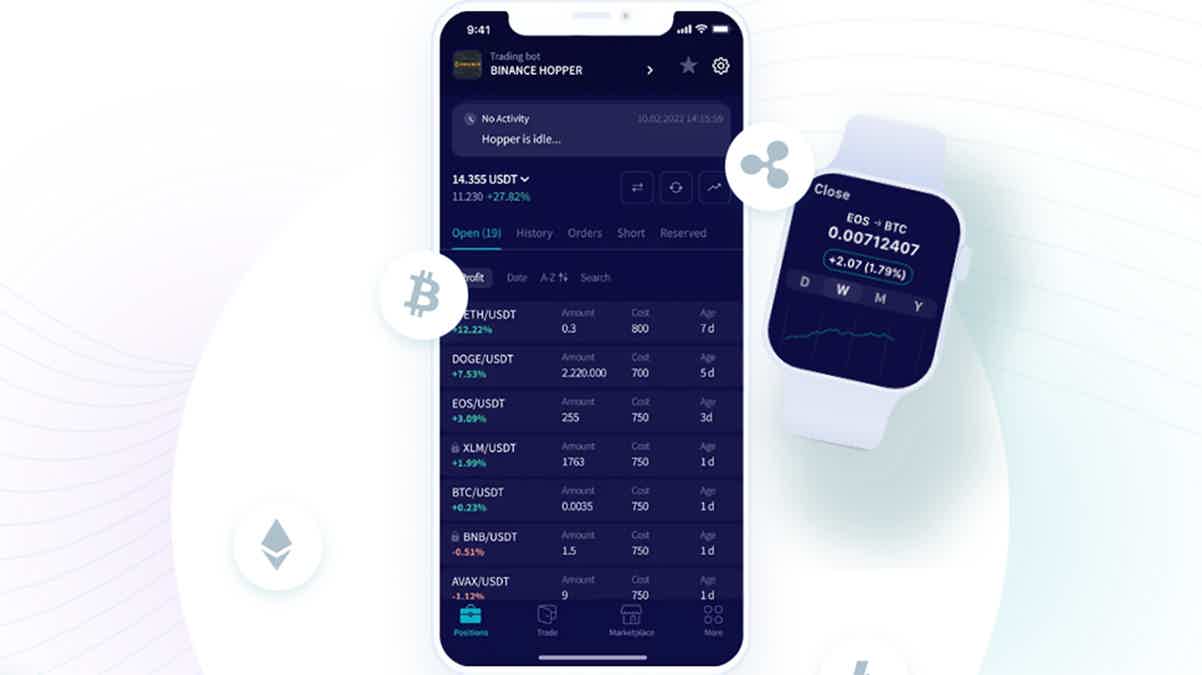

Cryptohopper review: Powerful Crypto Trading bot

Check out the Cryptohopper review and learn how the most powerful crypto trading bot works and how you can take advantage of it.

What are crypto tokens?

Tokenized assets or interests are represented digitally as crypto tokens. People add these tokens to the blockchain of a cryptocurrency that is already in use.

Moreover, crypto tokens and cryptocurrencies have many similarities. However, people primarily use the latter as a means of trade, payment, and record-keeping of wealth.

To fund new companies, initial coin offers (ICOs) are a kind of crowdfunding that enables the creation, distribution, sale, and circulation of crypto tokens.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Types of crypto tokens

Now that you’ve learned more about tokens, we will show you some types of tokens for you to get a better understanding. Read our list below!

Utility tokens

Utility tokens are blockchain-based digital assets that serve a specific function within the ecosystem of a cryptocurrency project.

Moreover, while people design cryptocurrencies like Bitcoin to use as a medium of exchange in the real world, utility tokens serve a different purpose.

Security tokens

Security tokens are digital assets that indicate ownership interest in an asset. Also, you can compare them to traditional securities, but people issue them digitally (tokenized) to use the blockchain.

Non-fungible tokens

Non-fungible tokens (NFTs) are tokens that exist on the blockchain and represent non-fungible assets like artwork, digital property, or media.

Also, you can use NFTs to prove ownership of any asset, whether it’s digital or real. Moreover, you can use it as an irrevocable digital proof of ownership and authenticity.

What are seasonal tokens?

People mine all four seasonal tokens via proof-of-work and are completely trustless, decentralized cryptocurrencies.

Moreover, people expect prices to move in a narrow band for a prolonged period.

So, as time goes on, investors may be able to increase the value of their holdings. This way, they will trade expensive tokens for cheaper ones.

Also, the pace at which people produce tokens halves every nine months. So, the pace at which the token is generated falls from the greatest among the four to the lowest.

Moreover, the market’s reaction to the declining supply drives up that token’s price, eventually making it the priciest option.

How do these tokens work?

As we mentioned, Bitcoin’s value increases despite production speeds being cut in half every four years, and production costs increase by a factor of two.

Therefore, there will be a shortage of Bitcoins, and investors will have to wait for the market to rebalance to the lower supply and higher manufacturing costs. The potential for financial gain is enormous.

However, this happens just once every four years. So, this effect will be available to investors every nine months due to the design of the tokens.

Moreover, nine months after the token production rate was cut in half in the spring, it will be cut in half again in the summer, and so on.

In addition, every token experiences a supply shock in its own right.

Therefore token values rise in a predictable pattern starting in the spring and continuing through the summer, fall, and winter, and then back to the spring.

An investor can slowly build up their total number of tokens by trading more expensive tokens for cheaper ones.

At this time, Spring tokens are the cheapest, while Winter tokens are the most expensive.

Moreover, investors might see a 60% gain in token value by making the seasonal transition from Winter to Spring.

People expect that the value of Spring will skyrocket later this year. At that point, it will be worth more than any other token in circulation.

Therefore, if investors sell their Spring tokens in exchange for the then-cheaper Summer tokens and then buy more of each, they may be able to recoup some of their losses.

So, people can buy and sell tokens inside the market, giving investors a chance for a larger return on investment.

What are the problems with crypto tokens?

People use elliptic curve encryption, public-private key pairs, and hashing algorithms, among other cryptographic methods, to hide information.

On the other hand, cryptocurrencies are safe digital payment systems that work online.

Also, a big worry is that criminals will steal from investors who don’t know what’s going on because they use crypto tokens to make money.

It’s not always easy to tell if a token represents a reputable business or is a scam.

Are seasonal tokens part of a solution to the crypto problem?

Unlike Bitcoin and Litecoin, mining seasonal tokens may be profitable again after a halving. The presence of four distinct tokens in the system allows for this.

Moreover, the value of the other three tokens works as a reservoir of hash power and money, mitigating the effect on the mining economy when the value of one token is half.

So, miners could easily switch to another cryptocurrency if needed to keep their mining business profitable.

Miners will be able to make the switch again. This will happen once they move enough money from the other three tokens to the one that they cut in half.

Overall, this process will soften the blow that the halving will have on miners and investors.

If you’d like to keep learning about cryptocurrencies and how to invest in them, check the following content about crypto tokens!

Cryptocoins or tokens? What’s the difference?

Which one should you choose: cryptocoins or tokens? Read this article to learn the difference between them and the pros and cons before trading and investing.

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

What’s Generational Wealth?

Generational wealth refers to financial assets transferred from one generation to another. See how it works and learn issues related to it.

Keep Reading

How to use Chase Sapphire Preferred for lounge access?

Learn how to use your Chase Sapphire Preferred for lounge access and level up your status while enjoying the wide range of premium benefits.

Keep Reading

7 financial tips for a fresh start in 2023

Check out the list of the 7 best financial tips for a fresh start in 2023, and start tracking your finances to build a solid plan to success.

Keep ReadingYou may also like

Choose the best card to build your credit score: improve your finances!

Unsure of which card is right for you? Read this guide to find out how to choose the best card to build your credit score and start improving your financial situation today!

Keep Reading

Marcus by Goldman Sachs Personal Loans application: how does it work?

If you want to learn how to apply for a personal loan at Marcus by Goldman Sachs Personal Loans, we can help. The application process is easy and pre-qualification doesn’t harm your credit score.

Keep Reading

How to build credit to buy a house: 10 best tips

Creating your strategy is key, but some steps you can take will immediately impact your score if you want to know how to build credit to buy a house. Keep reading!

Keep Reading