Read on to learn how this credit card can help you access world-class private banking among various other premium benefits!

Platinum Credit Card – earn up to 5% cash back on eligible purchases, discounts on your favorite brands, and insurance!

Platinum Credit Card offers the widest list of premium benefits, including cashback, discounts, insurance, and access to many other exclusive perks. Also, this Mastercard allows you to access world-class private banking at a very reasonable cost, personalized interest rates, and a credit limit that starts at R 250 000.

Platinum Credit Card offers the widest list of premium benefits, including cashback, discounts, insurance, and access to many other exclusive perks. Also, this Mastercard allows you to access world-class private banking at a very reasonable cost, personalized interest rates, and a credit limit that starts at R 250 000.

Platinum Credit Card provides you with exclusivity, accessibility, convenience, and protection. Basically, all premium clients will enjoy it on a daily basis. So, check out the main points about this Platinum Mastercard and apply for it within minutes!

Platinum Credit Card offers one of the widest lists of benefits available on the market. Then, take a look at the main perks you can get by applying for it: Up to 5% cash back when using the card and booking on Booking.com; Up to 20% discount on Emirates flights when booking through Leisure Desk; Up to 15% discount on an international car rental when booking through Avis and a 10% discount on car rental through Rentalcars.com; 12 visits per year to Bidvest lounges and 12 visits per year to the Library lounge at OR Tambo International Airport (Domestic Departures); Access to exclusive experiences through Priceless Cities; Access to Lifestyle benefits, including discounts on brands; Basic travel insurance, ATM Robbery Insurance, and Purchase Protection. Additionally, this Mastercard offers personalized interest rates and a credit limit that starts at R 250 000.

Platinum Credit Card charges a monthly service fee of R 103.00. Besides that, this card charges: Initiation fee: R180.00; Additional card: R25.00; Cash withdrawal: Branch – R80 + R2.50 per R100 or part thereof / ATM – R2.20 per R100 or part thereof; Cash deposits at ATM: R1.20 per R100 or part thereof / Notes and coin cash deposit at branch – R80 + R2.50 per R100 + R10 per R100 & part thereof; Online inter-account transfers: R4; Branch inter-account transfers: R87; Online account payments: R9; Branch account payments: R87; POS: purchase – Free / purchase with cashback – R1.40 per R100 or part thereof / cashback – R1.40 per R100 or part thereof; ATM balance enquiry – no slip: Free / with slip – R1.80; Branch balance enquiry: R15; Other banks ATM balance enquiry: R10. Also, there is an international transaction fee of 2,50%.

To qualify for a Platinum Credit Card, you must: Must be at least 18 years old; Must have a South African ID or passport if not an SA citizen. Furthermore, you must earn at least R58 000 as a monthly income.

You can apply for a Platinum Credit Card through the official Standard Bank website, by signing into Internet Banking or completing the Call Me Back form.

If you are interested in holding a Platinum Credit Card, learn how to apply for it now!

How to apply for the Platinum Credit Card?

Learn how to apply for a Platinum Credit Card and start enjoying the wide scope of premium benefits, including rewards and travel insurance.

Now, if you are interested in a cheaper alternative, check out the Absa Flexi Core Credit Card review and learn how to apply!

How to apply for the Absa Flexi Core Credit Card?

Learn how easy and fast it is to apply for an Absa Flexi Core Credit Card and start earning rewards and building your credit history today!

Trending Topics

How to apply for the Nedbank Personal Loans?

Check out how to apply for Nedbank Personal Loans and borrow up to R300,000 with flexible terms and the possibility of earning cash back.

Keep Reading

How to apply for a Money Credit Card?

Check out how to apply for a Money Credit Card and earn up to 3% on online or in-store eligible purchases. Applying for it is easy and fast!

Keep Reading

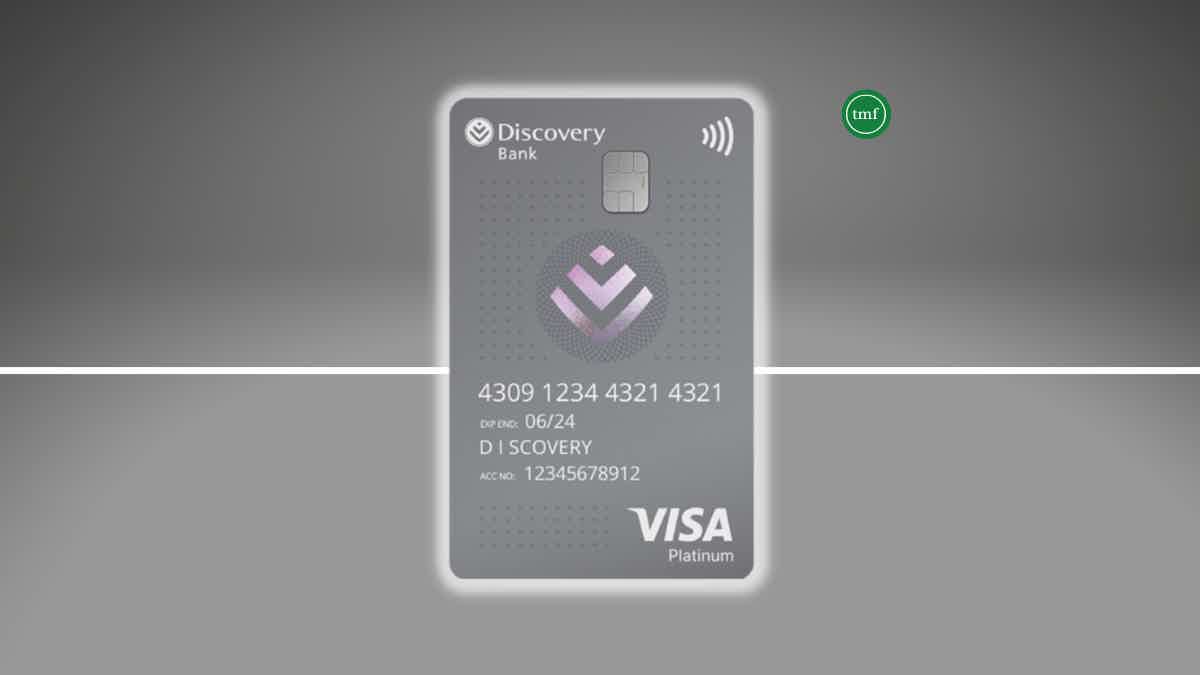

How to apply for the Discovery Bank Platinum Card?

If you need a card with rewards, travel discounts, and much more? Read on to apply for the Discovery Bank Platinum Card!

Keep ReadingYou may also like

What are student loans: a 101 guide to finance your studies

What are student loans? In this comprehensive guide, you'll learn all about student loans - including how to get them, the different types available, and what fees to expect. Keep reading!

Keep Reading

Learn to apply easily for CashUSA.com

Find out how to apply easily for CashUSA.com. This quick and easy guide will how to ensure up to $10,000 for multiple purposes! Read on!

Keep Reading

Simplify experience: PayPal Prepaid Mastercard® Review

Ready to make the switch to a prepaid card? This review breaks down the pros and cons of getting a PayPal Prepaid Mastercard®, so you can decide if it's right. Read on!

Keep Reading