SA

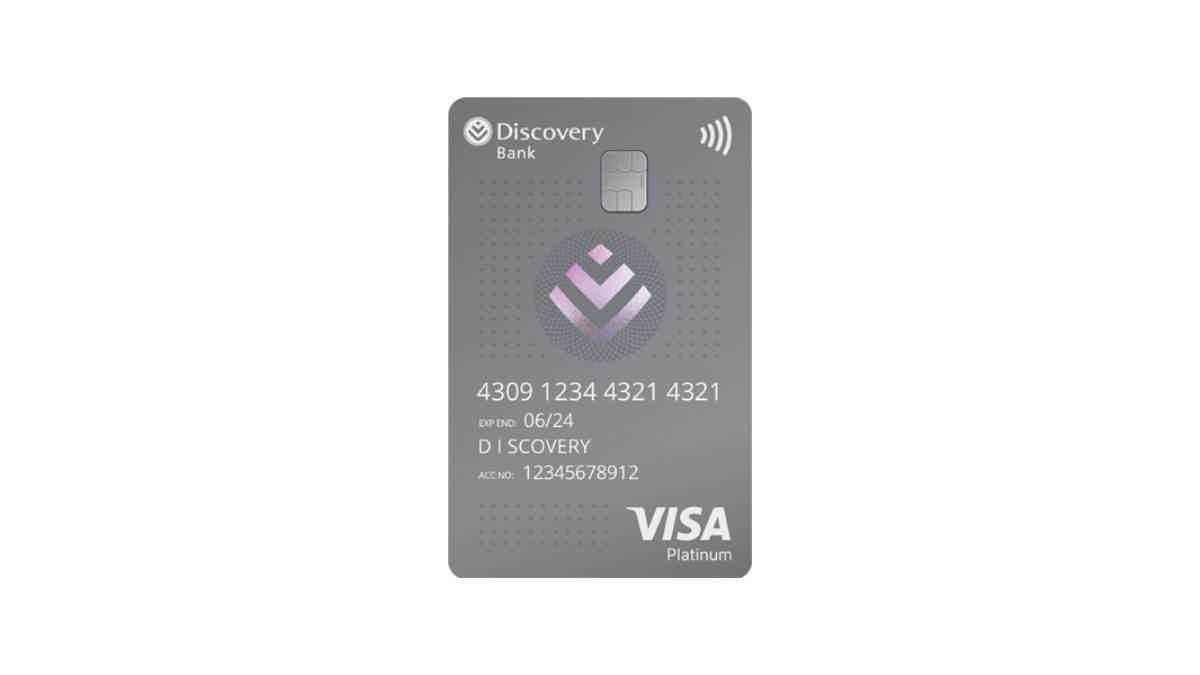

How to apply for the Discovery Bank Platinum Card?

Do you need a card with a perfect way to earn travel and cashback rewards? If so, read on to learn how to apply for the Discovery Bank Platinum Card!

Discovery Bank Platinum Card application: Find travel perks!

Are you a savvy South African looking for the perfect credit card to help you with your travels and daily spending? If so, you can learn how to apply for the Discovery Bank Platinum Card!

Also, this card can be a useful little pocket buddy that offers great financial benefits, such as cashback rewards on Uber rides, travel insurance, and HealthyCare discounts!

So, with all these advantages packed into one card, why look elsewhere? Read on to learn how to apply for the Discovery Bank Platinum Card and see exactly how this incredible banking product can make your life easier than ever before!

Online Application Process

You’ll need to open a Discovery Bank account before you can apply to get your Platinum card. Therefore, you’ll need to go to their official website to fill out a form so they can find the best card for you.

Also, after you fill out the form, you can provide the personal information required to get the card you want and wait for a response.

You will be redirected to another website

Application Process using the app

Also, you can use the Discovery Bank mobile app to manage your account and card 24/7. However, the best way to apply is online through the website.

Discovery Bank Platinum Card vs. Discovery Bank Gold Card

If you’re not so sure about getting the Discovery Bank Platinum Card, you can try applying for the Discovery Bank Gold Card!

Also, with the Discovery Bank Gold Card, you’ll be able to get very similar cashback options. However, you can apply more easily with a lower monthly fee!

Even though there is a lower monthly fee, you’ll earn fewer rewards. For example, instead of earning up to 50% cashback on HealthyFood items, you’ll earn up to 40% cashback.

So, you can read our comparison table below to learn more about this card and see how it compares to the Discovery Bank Platinum card version!

| Discovery Bank Platinum Card | Discovery Bank Gold Card | |

| Requirements* | To get your card, you’ll need to earn an income ranging from R350,000 to R850,000 per year. | Income from R100,000 to R350,000/year. |

| Initiation Fee | N/A. | N/A. |

| Monthly Fee* | R145 total monthly account fee to use your Discovery Bank Platinum card. | You’ll need to pay an R90 monthly fee *Terms apply. |

| Fees* | 55 days interest-free; You can pay up to 4% less on your borrowing rates; Cash withdrawals at local ATMs: R5 +2.25% of withdrawals amount; International ATM cash withdrawals: R80; There could be more card and account fees. *Terms apply. | Up to 55 days interest-free; Monthly additional and secondary physical cards: R40; No fees for virtual cards; *Terms apply. |

| Rewards* | Up to 50% cash back on HealthyFood-eligible purchases with your Discovery Bank Platinum card; Get up to 50% off eligible local flights; Up to 15% cash back on eligible Uber rides; Up to 15% cash back on eligible fuel purchases at BP and Shell; Earn Discovery Miles to find more ways to spend and get rewards! *Terms apply. | 40% cashback on HealthyFood purchases; 10% cashback on Uber rides and fuel purchases you make at BP and Shell; Up to 5.50% interest on demand savings accounts; *Terms apply. |

If you’d like to apply for the Discovery Bank Gold credit card, check the next article on the following link.

How to apply for the Discovery Bank Gold Card?

Looking for a card with cashback for everyday purchases and discounts? Read on to learn how to apply for the Discovery Bank Gold Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the FNB Business Gold Credit Card?

See how to apply for an FNB Business Gold Credit Card to access flexible repayment methods, rewards, travel insurance, and more at low costs.

Keep Reading

Capfin Personal Loan full review: simple and affordable

This Capfin Personal Loan review will show whether this credit option fits your budget and objectives. Read the details about Capfin loans!

Keep Reading

How to apply for the Absa Flexi Core Credit Card?

Learn how easy and fast it is to apply for an Absa Flexi Core Credit Card and start earning rewards and building your credit history today!

Keep ReadingYou may also like

True American Loan review: how does it work and is it good?

Find out how to get a personal loan of $5,000+ with the True American Loan Review. Understand the conditions, pros and cons and much more. Let's get started!

Keep Reading

An Irresistible APR To Smash Debt: PNC Core® Visa® review

Slash your interest rates and eliminate your debts with the card in our review: the PNC Core® Visa® Credit Card! Pay $0 annual fee!

Keep Reading

Apply for the Navy Federal GO REWARDS®: earn up to 3 points

Are you a Navy Federal member and want to know how to apply for the Navy Federal GO REWARDS®? Here is the guide you are looking for.

Keep Reading