Read on to see a lending company that can help you get the loan you need!

FreedomPlus, loan amounts of up to $50,000 and no hidden fees!

With the FreedomPlus lending company, you can get loan amounts that range from $5,000 to $50,000. Plus, you don’t need to pay any early payoff fees and, there are no hidden fees! Also, they will consider other financial aspects besides your credit score during the loan application process! And you can talk to real people about their customer service!

With the FreedomPlus lending company, you can get loan amounts that range from $5,000 to $50,000. Plus, you don’t need to pay any early payoff fees and, there are no hidden fees! Also, they will consider other financial aspects besides your credit score during the loan application process! And you can talk to real people about their customer service!

Check out the main perks of getting a loan through FreedomPlus!

Yes, FreedomPlus is a real, trusted lending company. They offer loans of up to $50,000, and they have good customer reviews almost anywhere on the internet. Also, they promise to give you good customer services where you can talk to real people and get the help you deserve!

You can get approved for a loan on the same day that you complete your application process. And depending on your financial situation, you can get your loan fund in up to 72 hours from the application! So, you can consider that this is a fast period to receive your loan funds, depending on your situation.

FreedomPlus advertises that they will consider more than just your credit score during the application process. However, they will also consider your score, and you can get lower rates if you have a higher credit score and your finances are in good standing. If you have a bad score, you can have a chance to get a loan, but with higher interest rates and other fees.

Yes, if you complete the application process to get a loan through FreedomPlus, you may have your credit score impacted by it. FreedomPlus considers more than just your credit score when you apply, but they perform hard credit checks as well. So be careful when applying for a loan.

Now that you know that FreedomPlus is a safe company with good benefits, you can check out our post below to learn all about the loan application process and get your funds fast!

How to apply for FreedomPlus?

Do you need a loan to get the best our of your vacation or even just to pay-off debt? Read our post to learn how to apply for FreedomPlus loans!

With FreedomPlus, you can get loans for travel and vacation. However, with Merrick Bank Recreation Loans, you can get specific loans for this type of activity! You’ll find incredible terms to raise money for your adventures. You can find boat loans, cargo trailer loans, and much more!

Therefore, if you want to see a different lending company option and learn about how to apply for Merrick Bank Recreation Loans, check out our post below!

How to apply for Merrick Bank Recreation Loans?

Do you need help raising money for your next adventure? Keep reading to learn more about how to apply for Merrick Bank Recreation Loans!

Trending Topics

How to apply for the Merrick Bank personal loan?

Merrick Bank loan features a quick and easy application process with fair rates. Learn how to apply for it and enjoy its benefits!

Keep Reading

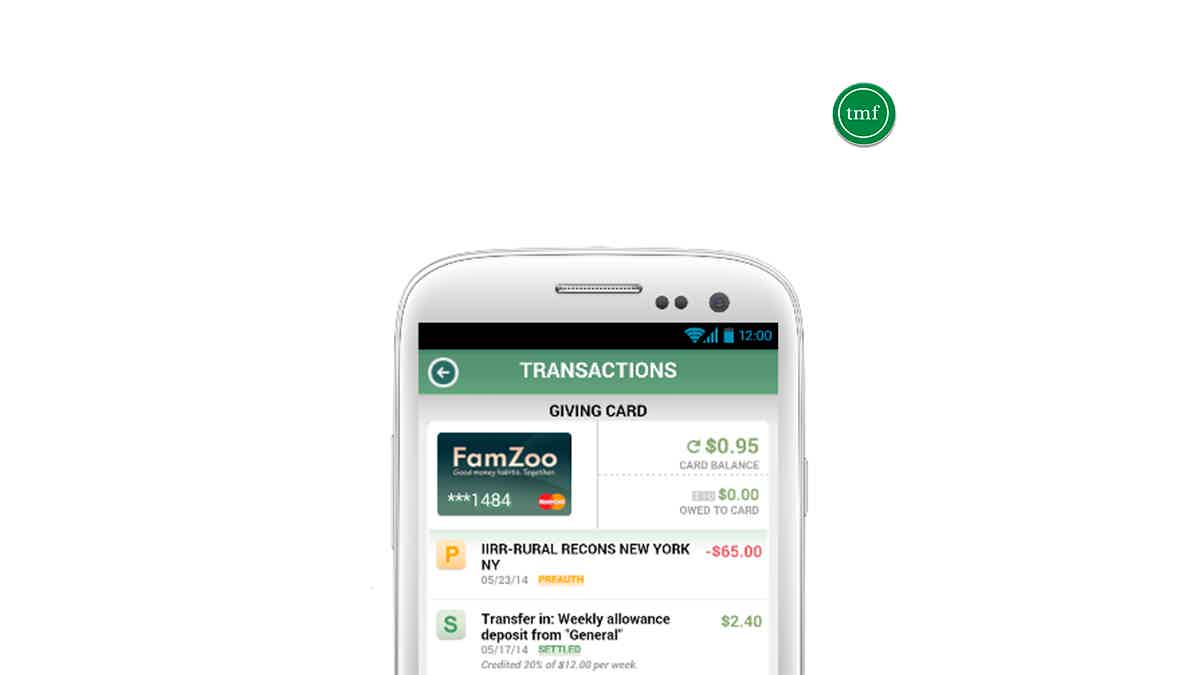

FamZoo Prepaid card full review

Do you need a card to help your kids learn how to use their money? Read our FamZoo Prepaid card review to learn more about this product!

Keep Reading

What’s Generational Wealth?

Generational wealth refers to financial assets transferred from one generation to another. See how it works and learn issues related to it.

Keep ReadingYou may also like

15 questions to ask when renting an apartment

What questions to ask when renting a new apartment? Here are the most important ones. Read on!

Keep Reading

Luxury Titanium or Luxury Black card: choose the best!

Are you trying to decide between Luxury Titanium or Luxury Black? This review will help you decide, showing the benefits and disadvantages of each one. Please read on to find out the best travel card for you!

Keep Reading

Accepted Account application: how does it work?

If you are on the market for a credit line that you can use at an exclusive outlet, look no further than Accepted Account. Here you'll learn everything about the application process. Read on!

Keep Reading