Reviews (US)

FamZoo Prepaid card full review

If you need a card to teach your kids how to manage their own money, the FamZoo card can be just for you! Read our FamZoo Prepaid card review to know more!

FamZoo Prepaid card: teach your kids how to manage their money

If you have kids and need a card to help them learn how to manage their finances, a prepaid card can be perfect! With a prepaid card, you can load just the right amount your kid needs to learn how to manage their money. Also, the FamZoo Prepaid card can be an excellent option to help you control and teach your kids how to use their own money. Therefore, keep reading our FamZoo Prepaid card review to learn more!

| Credit Score | All scores. |

| Bank and ATM Fees* | Monthly fee of $5.99. No ATM withdrawals fees. $4.95 cash reload fee. *Terms apply. |

| Cash Withdrawals* | No fees for cash withdrawals. Maximum of $510 per day. *Terms apply. |

| Welcome bonus | No welcome bonus. |

| Rewards | No rewards program. |

How to apply for the FamZoo Prepaid card?

Are you looking for a card to teach your kids about finances? If so, read our post about the FamZoo Prepaid card application!

How does the FamZoo Prepaid card work?

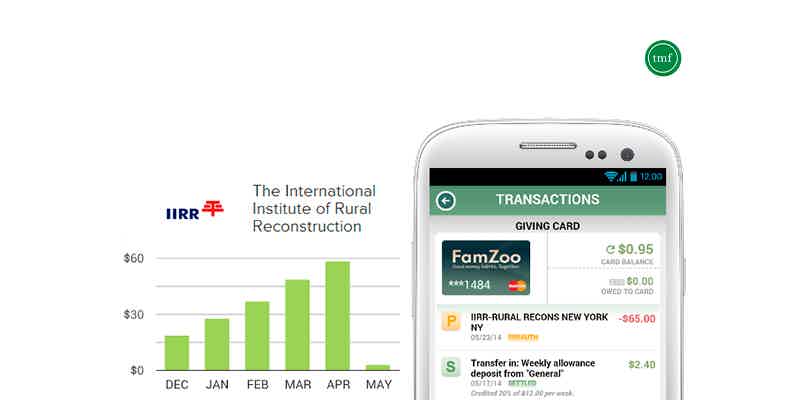

With the FamZoo prepaid card, you can control your kids’ financial learning and load just the right amount for them to use in a certain period. For example, you can have access to your kid’s funds and transactions. Also, you can easily share your funds with your kid’s account. Moreover, your kid can sign in in a completely different place so that you can differentiate your accounts.

In addition, you do not need to have a bank account to apply. However, you have to pay a small monthly fee to use the account’s features. Therefore, you need to understand the company’s terms and conditions before considering applying to get this card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

FamZoo Prepaid card benefits

The FamZoo card is designed to help you teach your kids how to manage their own money from a young age. This is a great option for parents because they can control their child’s spending and teach them money management skills. But, like any card, the FamZoo prepaid card has some drawbacks. For example, using the card’s features costs money.

Pros

- There are separate accounts for parents and kids.

- You can use this card’s features to teach your kids how to manage their own money.

Cons

- There is a monthly fee to use the card’s features.

How good does your credit score need to be?

Since it is a prepaid card, you do not need to worry about your credit score before applying. However, we recommend that you read the card’s terms and conditions before submitting your application. Therefore, you can know exactly how much you have to pay and how much you can load on the card and other information.

How to apply for a FamZoo Prepaid card?

You can easily order your FamZoo prepaid card through FamZoo’s official website. And you do not need a fancy smartphone to do this. All you need is internet access and a computer. Therefore, read our post below to know all about how to order your FamZoo prepaid card!

How to apply for the FamZoo Prepaid card

Are you looking for a card to teach your kids about finances? If so, read our post about the FamZoo Prepaid card application!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Can you be a millionaire by day trading? 9 myths and facts!

Can you be a millionaire by day trading? 9 myths and facts before starting investing in this market so you can analyze, plan, and go for it!

Keep Reading

How to Join Ally Bank: banking with variety!

Want to find out all you need to do to join Ally Bank and start managing money with ease? Check our post and learn all about it!

Keep Reading

HSBC Cash Rewards Mastercard® credit card full review

Are you looking for a credit card that gives you a good pack? Then, check out the HSBC Cash Rewards Mastercard® credit card full review!

Keep ReadingYou may also like

How to request US Bank Altitude® Go Visa Signature® Card

Check out how to apply for the US Bank Altitude® Go Visa Signature® card and start earning rewards and cash back today! Plus, you don't have to worry about annual or foreign transaction fees.

Keep Reading

Navy Federal GO REWARDS® Review: Dine, Travel, Thrive

A versatile credit card for members with points on purchases and flat fees, this is the Navy Federal GO REWARDS®. Keep reading to get familiar with all the features.

Keep Reading

National School Lunch Program (NSLP): Assistance for Children

Get to know the National School Lunch Program - NSLP, a federally funded program that supports low-income children in getting access to nutritious meals.

Keep Reading