Credit Cards (US)

How to apply for the FamZoo Prepaid card?

Wondering how to teach your kids to manage their finances? If so, read our post about the FamZoo Prepaid card application!

FamZoo Prepaid card application: learn how to order this card and help your kid’s finances

If you are looking for a new prepaid card to help your kids learn how to use their own money, the FamZoo card can be for you. Also, the FamZoo card allows you to have a separate account from your kid to help you control how they are spending. Therefore, keep reading our post about the FamZoo Prepaid card application to learn how to apply!

Apply online

You can easily order your FamZoo card through FamZoo’s official website. All you need is a computer with internet access. So, you can go to the website and look for the prepaid card option. Then, you can click on order cards and provide some of your personal information.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

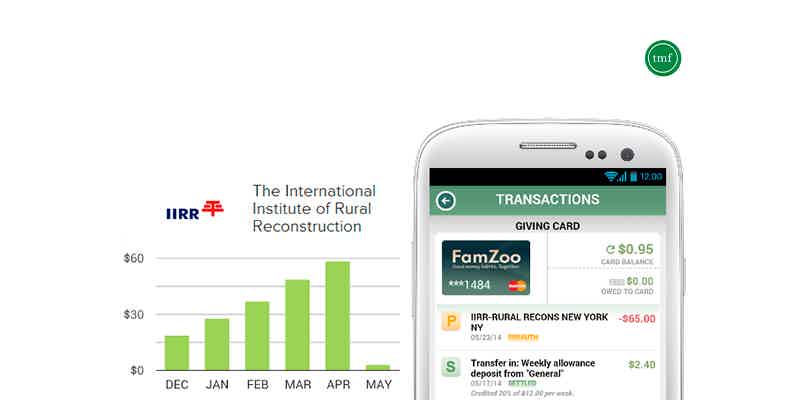

Apply using the app

You can you the FamZoo app to manage all your card’s finances and your kid’s money. However, you need to follow the steps on the topic above to order your card before you start using the mobile app.

FamZoo Prepaid card vs. Prepaid card CIBC

If you are unsure about getting the FamZoo Prepaid card, we can give you a different prepaid card option. The CIBC prepaid card can also be a great option for parents that need to teach their kids how to use their own money. However, this card would be a better option for teenagers. This is because it does not have the account option to have parental control. So, check out our comparison table below to help you choose your next prepaid card!

| FamZoo Prepaid card | Prepaid card CIBC | |

| Credit Score | All scores. | All scores. |

| Bank and ATM Fees* | There is a monthly fee of $5.99. You don’t have to pay ATM withdrawals fees. There is a $4.95 cash reload fee. *Terms apply. | No fees per transaction and no annual fees. *Terms apply. |

| Cash Withdrawals | There are no fees for cash withdrawals. However, there is a maximum of $510 per day. *Terms apply. | If you made withdrawals in Canada, you don’t have to pay any fees. But if you make withdrawals in another country, you have to pay a $2.50 CAD fee per month. *Terms apply. |

| Welcome bonus | There is no welcome bonus. | There is no welcome bonus. |

| Rewards | There are no rewards programs. | No regular rewards. |

How to apply for the Prepaid card CIBC?

If you are looking for a card that can give you more control over your money, check out our post about the CIBC Smart™ card application!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Find organizations like Feeding America to help!

If you want to know how organizations like Feeding America work, check out our post to see the leading organizations that aim to stop hunger!

Keep Reading

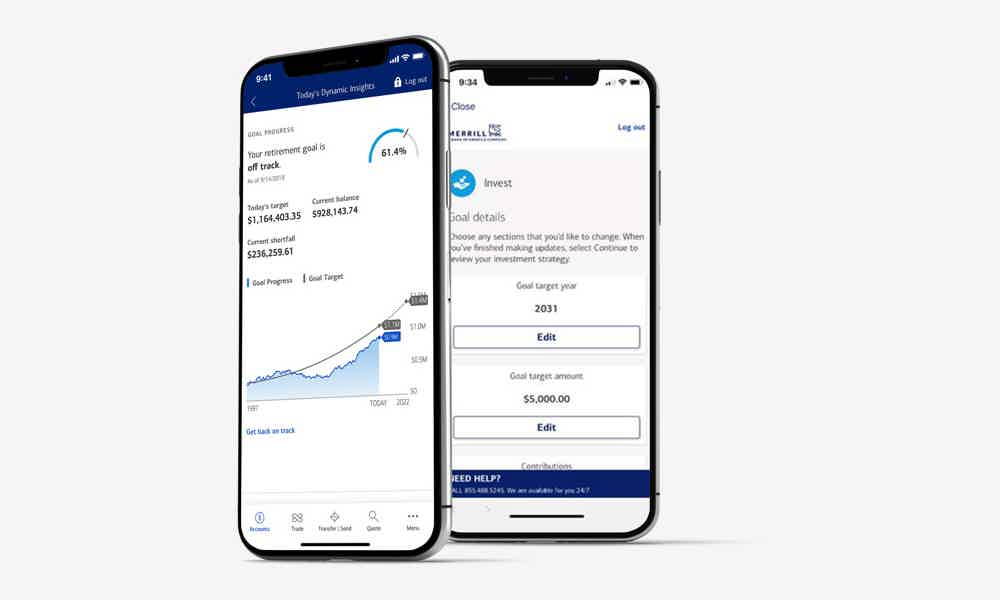

Merrill Edge investing full review

Get a full range of investment choices with no annual account fees investing at Merrill Edge. Check out the Merrill Edge investing review!

Keep Reading

Current Visa debit card review

This Current Visa debit card review will show you how this card for teens works. Check it out and learn how your kids can benefit from it!

Keep ReadingYou may also like

Bad Credit Loans review: how does it work and is it good?

Read the Bad Credit Loans review and learn what to look for in a loan provider, how the process works, and if you can use this loan to fix credit problems. Keep reading!

Keep Reading

Delta SkyMiles® Reserve Business American Express Card application

Learn about the eligibility requirements and how to make an application for the Delta SkyMiles® Reserve Business American Express Card. Read on!

Keep Reading

Juno Checking Account application: how does it work?

Ready to take control of your financial future? Start today with a Juno Checking Account! Enjoy 80K+ fee-free ATMs. Keep reading for more!

Keep Reading