Credit Cards (US)

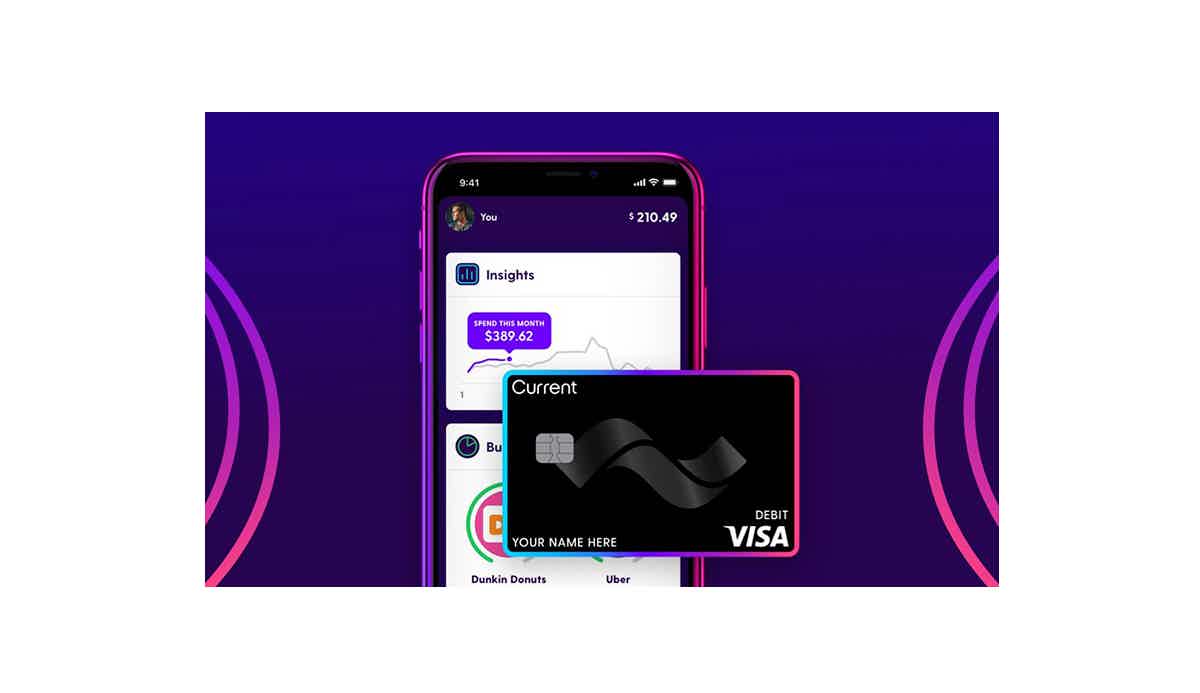

Current Visa debit card review

This Current Visa debit card review is specially written for parents who want to give their children financial freedom with a bit of control. Check it out!

Current Visa debit card: financial freedom for teens, control for parents!

If you have a teenager under your roof, you have probably faced situations where you try to give some freedom but need to hold a little because you know they are teens. This Current Visa debit card review is specially written for you.

Also, you know the importance of leaving a financial legacy for your kids. So, nothing is better than teaching them day by day with tools that allow financial discipline.

Then, you should meet the Current, a financial technology company provided by Choice Financial Group and Metropolitan Commercial Bank, FDIC members.

It offers banking for all families. And its account and debit card are perfect tools for your kids to build their financial path under your supervision.

Check out the full review!

| Credit Score | Not required |

| Annual Fee | $36 |

| Regular APR | None |

| Welcome bonus | None |

| Rewards | Up to 15x points for eligible purchases |

How to apply for a Current Visa debit card?

Give your teen financial freedom with a Current Visa debit card! Check out how apply for it!

How does the Current Visa debit card work?

A debit card for a teen may be seen as frivolous, but let me ask you something: how many times has your kid asked you for cash? And do you keep track of that? How much have they spent? And where?

If at least one of these questions was answered with a “no”, you should probably consider a debit card for your teenager.

Current features a new way of banking for all families. First of all, it provides an account besides the debit card, so the teen is able to learn financial discipline and start saving money.

Also, thinking about the parent, Current provides cashless convenience, notifications for all purchases, the ability to block specific merchants, set spending limits, and chores to complete.

Then, your kids will have the freedom they need, and you will be able to control and supervise.

Furthermore, this Visa offers up to 15 points for eligible purchases. And even though it charges $36 per teen per year, there is no minimum balance required, no overdraft fees, no activation, or transfer fees.

You need to deposit money since it is a debit card, but you can do it using the Current App and connect it to your bank account. It is easy and fast.

Last but not least, the account and the debit card are full of security features like fingerprint and facial recognition, so you can enjoy peace of mind knowing your family is protected.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Current prepaid Visa debit card benefits

This prepaid card is a way to start your kid’s financial activity with your supervision and control.

Besides the fact it offers rewards, convenience, and protection, Current provides fantastic 24/7 customer support.

There are no hidden fees, the annual fee is fair, and the app is easy-to-use. Moreover, the application takes less than 2 minutes.

Pros

- The card allows parents to control the spending and financial activity;

- There are no overdraft fees, no activation, or transfer fees;

- It provides 24/7 support and protection;

- There are many ATMs available for free;

- The mobile app is fantastic and full of features.

Cons

- There is an annual fee.

How good does your credit score need to be?

Since it is a debit card that works in a prepaid option, you don’t need a perfect credit score to apply for it. But, it requires deposits.

How to apply for Current debit card?

If you are thinking about giving your teens financial freedom under your supervision, a Current debit card is a perfect choice for you and your family. Check out how to apply for it!

How to apply for a Current Visa debit card?

Give your teen financial freedom with a Current Visa debit card! Check out how apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Huntington Bank Voice Rewards credit card review

Read the Huntington Bank Voice Rewards credit card review article to learn about its benefits, rewards, perks, pros, and cons. Check it out!

Keep Reading

Ethereum crypto: how does it work?

Ethereum crypto is a cryptocurrency alternative to Bitcoins that has been getting more attention. Keep reading and learn all about it.

Keep Reading

Mastercard® Black Card™ overview

If you want to achieve elite status, this Mastercard® Black Card™ overview will help you get there. Read on to learn more about it!

Keep ReadingYou may also like

First Access Visa® Card review

You may have heard of the First Access Visa® Card, but are you looking for a review? If so, this is the right place! Find out if it's worth it to spend your money on one.

Keep Reading

Application for The Centurion® Card from American Express: how does it work?

The Centurion® Card from American Express is an ultra-exclusive travel card. To have one, you have to be invited. Learn how to apply for the invitation here!

Keep Reading

A simple process: Apply for the PayPal Prepaid Mastercard®

Ready to apply for your own PayPal Prepaid Mastercard®? Learn about all the steps required in detail - simplify your finances quickly!

Keep Reading