Credit Cards (US)

Mastercard® Black Card™ overview

Are you ready for a lifetime of high style and luxury? Then read this Mastercard® Black Card™ overview to learn how you can get it!

Mastercard® Black Card™: Achieve elite status for a lifetime!

Do you frequently travel and enjoy the finer things in life? If so, then you may be interested in this Mastercard® Black Card™ overview.

The Mastercard® Black Card™ is a luxurious offering that rewards extravagant spending. It comes with a variety of high-end features such as airport lounge access, and cashback rewards on purchases.

Travelers love the Mastercard® Black Card™ for its wide acceptance network, giving them the freedom to roam around the world without worry.

This exclusive credit card comes with a host of luxurious benefits, making it perfect for anyone who wants to get the most out of life. Keep reading our Mastercard® Black Card™ overview to find out more about what this card has to offer!

How to apply for the Mastercard® Black Card™

Do you want to have the luxury status that the Mastercard® Black Card™ can offer you? If so, read more to learn how you can apply for it!

| Credit Score | Excellent |

| Annual Fee | $495 |

| Regular APR | 17.99% variable APR for purchases and balance transfers. |

| Welcome bonus | N/A |

| Rewards* | 1X for every dollar spent on every purchase (no spending cap) The points that your earn with this card can be redeemed as a statement credit for 1.5% cash back or even as airline tickets (2% value redemption) *Terms apply |

What is special about the Mastercard® Black Card™

Mastercard® Black Card™

Achieve a luxurious status worldwide!

You will be redirected to another website

This card has special features related to luxury and status. However, those features are more just for show features. So, if you want a card that can make you look luxurious or that highlights the status your life already has, this can be a special card for you.

Moreover, this card offers a value of 2% for airfare points redemptions, 1.5% value for cash back that you redeem, and 1 point for each dollar spent.

In addition, this card offers a 24/7 luxury concierge, which you can contact by email, phone, or even through mobile chat. And an Airport Meet and Assist program to help you even more with your travels.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Who qualifies for the Mastercard® Black Card™?

People who qualify to have this luxury Mastercard credit card are looking for a card that can give them high status. Also, they have very good personal finances, and they have a somewhat luxurious lifestyle to maintain.

Moreover, they can pay for this card’s fee and the relatively high annual fee charged.

Mastercard® Black Card™ review

Do you want a card that can give you high status and luxury? If so, read our full review of the Mastercard® Black Card™!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

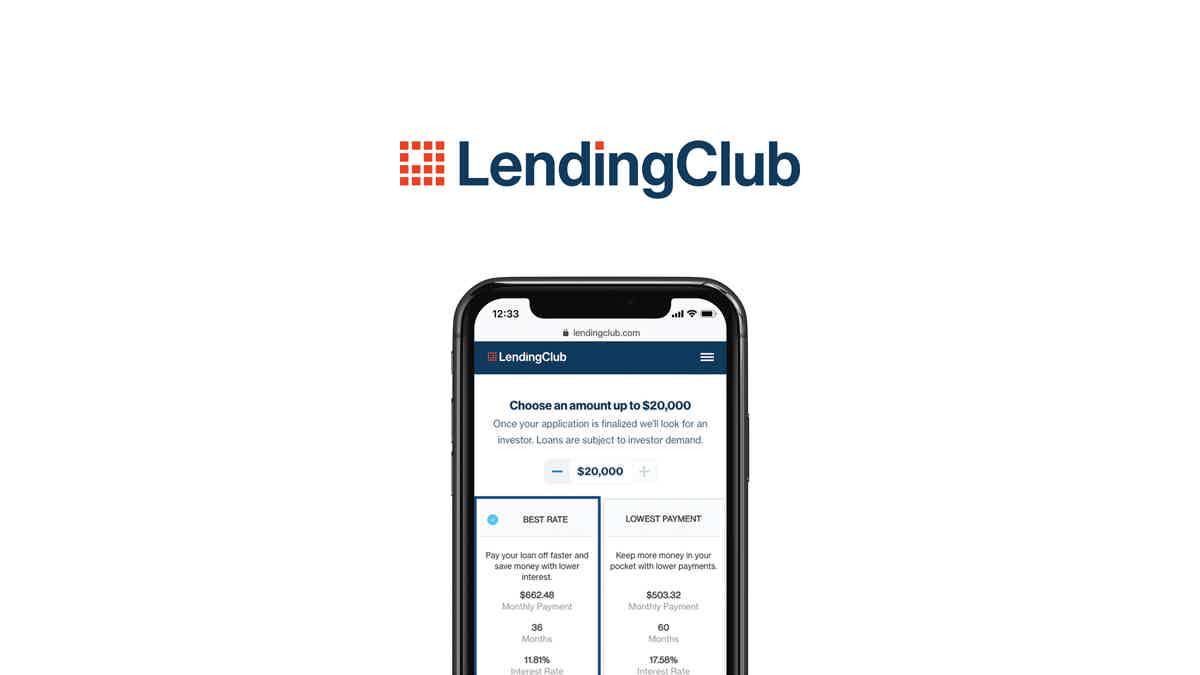

How to apply for the LendingClub Loan?

Applying for a LendingClub Loan is easy. Learn how to apply online and get your loan approved within a few minutes!

Keep Reading

How to apply for an American Express® Cash Magnet® card?

Check out how easy and fast it is to apply for an American Express® Cash Magnet® card and start earning 1.5% cash back on all purchases.

Keep Reading

Credit One Bank® Platinum Visa credit card review

In this Credit One Bank® Platinum Visa credit card review, you'll learn all about its perks, such as rewards on everyday purchases and more!

Keep ReadingYou may also like

Hawaiian Airlines: Follow this guide to track the best prices!

Are you in the market to buy cheap Hawaiian Airlines flights? Discover where to find low prices to enjoy paradise. Read on!

Keep Reading

Easy-to-get card: Apply for Merrick Bank Classic Secured Card

Find out how to apply for the Merrick Bank Classic Secured Credit Card, an excellent option to improve your credit. Keep reading!

Keep Reading

Ally Platinum Mastercard® review: boost your credit fast!

Looking for a budget way to build your credit? Read our review of the Ally Platinum Mastercard® for more information!

Keep Reading