Credit Cards (US)

Mastercard® Black Card™ review

If you're looking for the best way to enjoy elite travel benefits, the Mastercard® Black Card™ is your solution. Learn more about this top-of-the-line credit card today!

Mastercard® Black Card™: Get exclusive travel benefits and access to VIP Airport Lounges!

If you’re the type of consumer who appreciates luxury and the finer things in life, then you have to check out Mastercard® Black Card™ review.

This card offers unbeatable levels of exclusivity, giving card members access to PVD-black coated metal cards, members-only adventures, tailored concierge service, exclusive offers on entertainment, travel discounts and more.

Mastercard® also allows shoppers to take advantage of a zero liability guarantee against unauthorized charges and fraud prevention services for all account holders – an added bonus that means one less thing for you to worry about.

The Mastercard® Black Card™ is a must-have if you’re looking for something truly opulent with plenty of noteworthy perks. To learn more about it, keep reading our Mastercard® Black Card™ review.

How do you get the Mastercard® Black Card™?

Do you want to have the luxury status that the Mastercard® Black Card™ can offer you? If so, read more to know how to apply!

How does the Mastercard® Black Card™ work?

Once you become a cardholder, this card gives you a 2% value for redemptions related to airfare, 1.5% for cash back redemptions that you make, $100 in annual credit for airline-related spendings.

In addition, you can have the 24/7 support of a luxury card concierge through your phone, email, or even through mobile chat.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Mastercard® Black Card™ benefits

If you’re looking for a credit card with elite benefits, the Mastercard® Black Card™ might be right for you. While it has a high annual fee, the card comes with a number of perks that can make it well worth the cost. See the pros and cons next in our Mastercard® Black Card™ review.

Pros

- This card does not charge foreign transaction fees.

- You can get a 1.5% and 2% redemption.

- Get great perks when traveling, such as Global Entry and TSA PreCheck.

- 0% introductory APR for the first 15 months from account opening.

*Terms apply.

Cons

- This card charges a hefty $495 annual fee.

- The perks offered by this card can be found in other similar cards.

- This card does not offer a welcome bonus for new cardholders.

- There is a 3% fee for balance transfers.

Should you get a Mastercard® Black Card™?

If you are thinking about getting this credit card, maybe consider checking out some other similar luxury travel cards that can give you status and better rewards. However, if you want the high status and luxury appearance offered by this card, this can be a great card for you.

How good does your credit score need to be?

To get this luxury credit card, we recommend that you have an excellent credit score. That means that your score should be at least 800 points to have a chance of getting this card. So, if you want to get this card and can pay for the hefty annual fee, having this score should be no problem.

How to apply for a Mastercard® Black Card™?

You can make your application to get this card once you know you have the requirements and fit the profile to be a card owner of this Mastercard card. So, if you want to know how to apply to become a cardholder, read our post below!

How do you get the Mastercard® Black Card™?

Do you want to have the luxury status that the Mastercard® Black Card™ can offer you? If so, read more to know how to apply!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to use the Bitsgap trading bot?

Is the Bitsgap trading bot the best option for your trading? Find out here and learn how to use the Bitsgap trading bot platform!

Keep Reading

Citi Premier® Card overview

Check out this Citi Premier® Card overview to learn how benefitial this credit card can be for your daily purchases !

Keep Reading

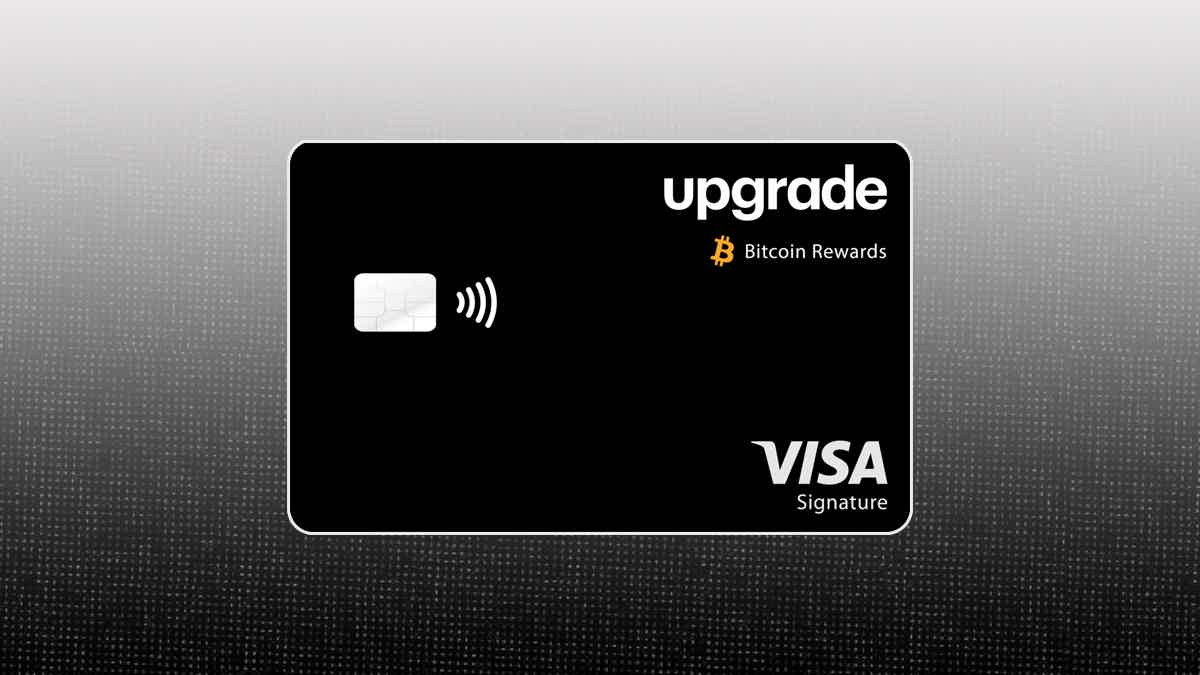

Upgrade Bitcoin Rewards Visa® Card application

The Upgrade Bitcoin Rewards Visa® Card is a hybrid credit card and personal loan with low costs and rewards. Learn how to apply for one!

Keep ReadingYou may also like

Choose the best card to build your credit score: improve your finances!

Unsure of which card is right for you? Read this guide to find out how to choose the best card to build your credit score and start improving your financial situation today!

Keep Reading

Apply for the Navy Federal nRewards® Secured Card: $0 annual fee

No credit history? No problem! Apply for the nRewards® Secured and join thousands who have successfully built their credit scores with Navy Federal.

Keep Reading

Discover it® Balance Transfer Credit Card review: 0% intro APR

Learn all about the Discover it® Balance Transfer Credit Card! Pay no annual fee and enjoy several perks! Stick with us and find out more!

Keep Reading