Loans (US)

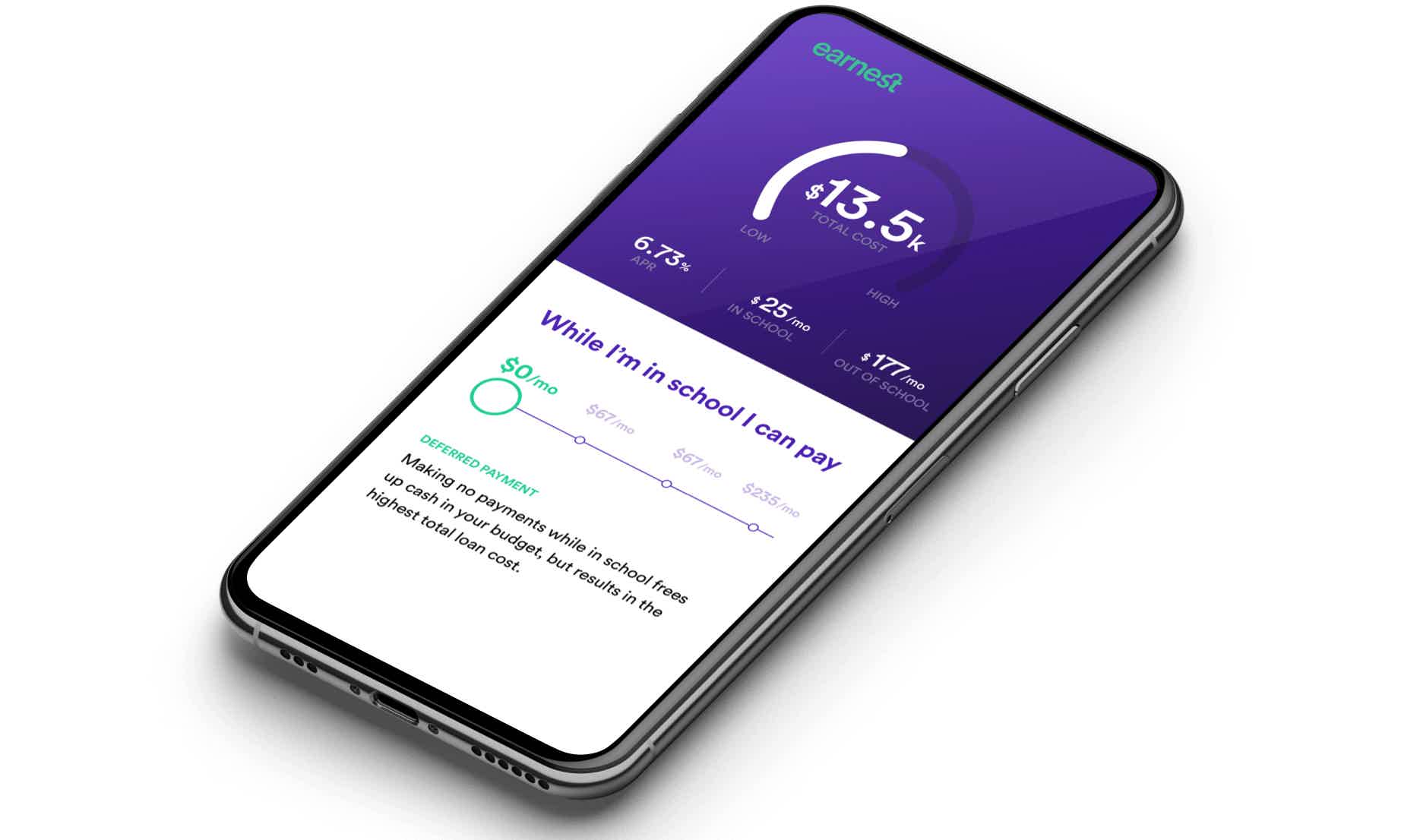

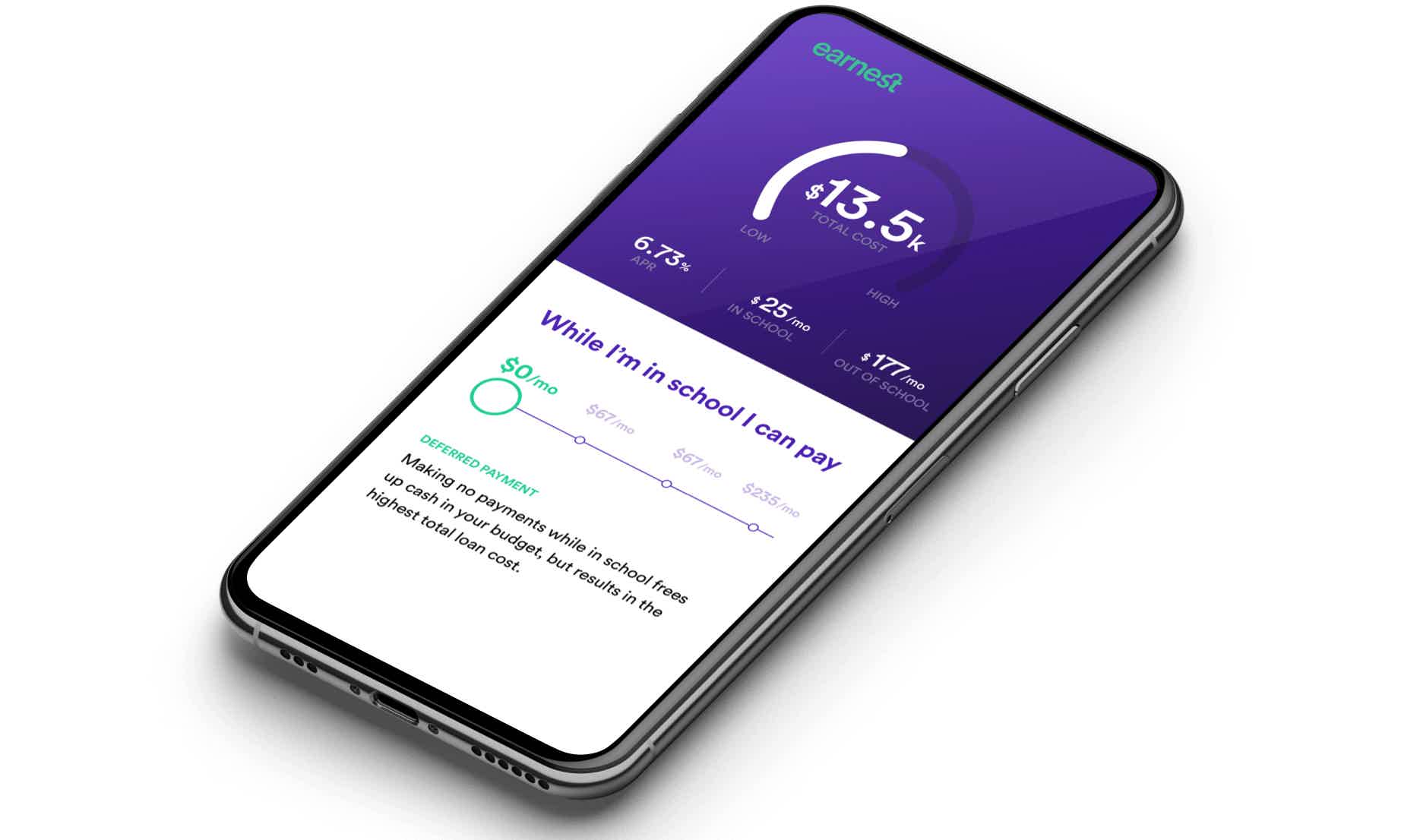

Earnest Private Student loans review

This Earnest Private Student loans review article will explain how these loans work and how you can get all their benefits to help you with your tuition!

Earnest Private Student loans: flexible terms with low rates

Earnest offers loans for private students, including undergraduate, graduate, parent, MBA, medical & law, refinancing student loans, and personal loans, and you’ll learn all about it in this Earnest Private Student loans review!

It features low rates that include automatic payments discounts and flexible repayment options ranging from 5 to 15 years.

Plus, there are no fees of any kind. It means that it doesn’t charge application, origination, late, or early payoff penalty fees whatsoever.

So, if you are looking for a student loan to achieve your educational and career goals, Earnest might be an excellent option for you.

| APR | Variable rates starting at 0.99%; Fixed rates starting at 2.94% (including 0.25% autopay discount) |

| Loan Purpose | Educational (undergraduate, graduate, parent, MBA, Law, Medical loans); Refinancing |

| Loan Amounts | Minimum of $1,000 |

| Credit Needed | 650 credit score (fair) |

| Terms | 5, 7, 10, 12, 15 years |

| Origination Fee | None |

| Late Fee | None |

| Early Payoff Penalty | None |

How to apply for Earnest Private Student Loan?

Find a low-interest rate at Earnest Private Student loans. Learn how to apply for it and get all the benefits!

How do the Earnest Private Student loans work?

Earnest Private Student Loan offers flexibility, affordability, and customer service that is ranked as one of the best in the market.

It isn’t easy for most people to get all educational costs paid. And when applying for a loan, it is not usually easy to get the humanly help you need, too.

Earnest delivers variable and fixed low-interest rates, zero fees, and excellent support.

If your profile fits better the fixed APR, you may apply for an autopay option and get a discount. So, it will range from 2.94% to 12.78%.

Otherwise, if you choose the variable one, it will range from 0.99% to 11.44%, including automatic payments discount.

Also, the terms are flexible, and the minimum loan amount is $1,000. But you can cover up to 100% of your cost of attendance for the academic year.

As a bonus, you can skip one payment every 12 months, and you can get a nine-month grace period, unlike other lenders use to offer.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Earnest Private Student loans benefits

This lender is quite unique. Besides the zero fees, competitive rates, and flexible repayment options, Earnest Private Student Loan provides you with some benefits other lenders don’t.

For example, in case the unthinkable happens, like an accident that leads to a permanent disability or death, Earnest will forgive the loan.

Plus, it offers a grace period of 9 months, knowing that the national average is 6. In addition, you can skip a payment every year and save up with the autopay option.

Also, it requires a fair credit score, which is less than other lenders do.

Unfortunately, it isn’t available in Nevada. And the borrowers must be enrolled full-time or at least half-time for graduate students and college seniors.

Pros

- It doesn’t charge any fees of any kind, and offers flexible repayment options;

- It charges low-interest rates, with autopay discounts;

- Besides, it provides a 9-month grace period;

- You can skip one payment every 12 months;

- You can cover up to the entire cost of attendance for the academic year.

Cons

- It is not available in Nevada.

Should you apply for Earnest Private Student loans?

These loans are best for students or parents who look for zero fees, flexible terms, and affordable rates.

Also, note that Earnest offers outstanding customer service if you need help through the process.

Can anyone apply for a loan from Earnest?

The eligibility criteria require that both primary and cosigner live in the District of Columbia or other states except Nevada.

Also, the cosigner must be the age of majority, a U.S. Citizen, or possesses a 10-year Permanent Resident Card.

Plus, the student must be enrolled in school full-time for College Freshmen, Sophomores, and Juniors. And at least half-time for College Seniors and graduate students.

What credit score do you need for Earnest Private Student loans?

As a financial requirement, a cosigner must show a FICO score of 650. Note that primary is not required to have a minimum credit score.

How to apply for an Earnest Private Student loan?

I guess you are searching for an affordable and flexible private student loan. So, you have come to the right place. Read our next post to learn how to apply for one.

How to apply for Earnest Private Student Loan?

Find a low-interest rate at Earnest Private Student loans. Learn how to apply for it and get all the benefits!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Chase Ink Business Preferred® Credit Card review

Are you looking for a card to earn points for your business? Read our Chase Ink Business Preferred® Credit Card review to learn more!

Keep Reading

First Access Visa® Card application

First Access Visa® credit card helps you build your credit score and it doesn’t need a secured deposit. Check out how to apply for it now!

Keep Reading

Reflex® Platinum Mastercard® Overview

Are you ready to start a new financial chapter in your life? Then read our Reflex® Platinum Mastercard® overview to learn how to do it.

Keep ReadingYou may also like

Children's Health Insurance Program (CHIP): see how to apply

Learn how to apply for the Children's Health Insurance Program, what documents you need, and what steps are involved in the application process. Keep reading!

Keep Reading

Marcus by Goldman Sachs Personal Loans application: how does it work?

If you want to learn how to apply for a personal loan at Marcus by Goldman Sachs Personal Loans, we can help. The application process is easy and pre-qualification doesn’t harm your credit score.

Keep Reading

Delta SkyMiles® Platinum Business American Express Card review

If you want a business card with miles, you should read this Delta SkyMiles® Platinum Business American Express Card review!

Keep Reading