Loans (US)

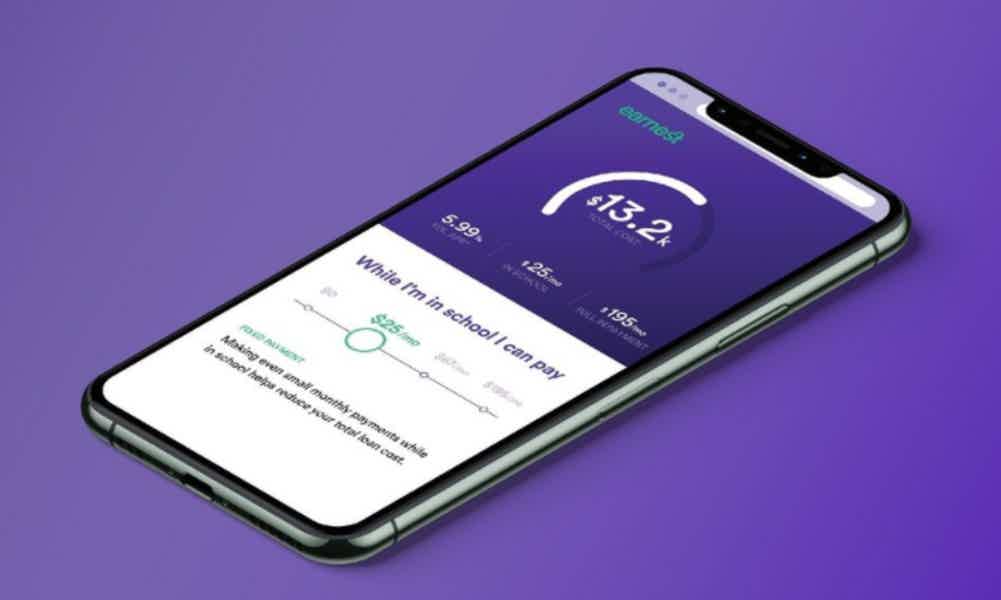

How to apply for the Earnest Private Student loans?

Earnest Private Student loans are best for those who look for affordable rates, flexible repayment options, and perks. Check out how to get yours!

Applying for Earnest Private Student loans: flexible terms, zero fees, and perks

Earnest offers private student loans full of benefits.

Affordable variable and fixed interest rates, flexible repayment options, no fees of any kind are just a few of all you can get by applying for its loans.

Unlike other lenders, this one offers a nine-month grace period and loan forgiveness in case the unthinkable happens to the borrower.

Also, you can skip a payment every 12 months.

This lender is available in all states except Nevada.

Furthermore, you can pre-qualify before applying and submitting the application.

Apply online

Access the Earnest Private Student Loan website and click on Get Started.

Note that it requires the consigner a minimum 650 FICO score. Also, you must have a Social Security Number or a consigner in the age of majority, being U.S. Citizen, or possess a 10-year Permanent Resident Card.

Then, fill in the forms with your personal and financial information.

Also, you can pre-qualify before submitting all forms.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Please apply using the Earnest website since it doesn’t offer the mobile app option.

Earnest Private Student loan vs. SoFi Private Student Loans

Both lenders offer competitive rates with zero fees. However, Earnest provides a minimum of $1,000 and discloses the credit score required for the application.

Also, it provides you with outstanding and humanly customer service and support.

Check out the comparison table below to decide which fits your needs better.

| Earnest Private Student Loans | SoFi Private Student Loans | |

| APR | Variable rates starting at 0.99%; Fixed rates starting at 2.94% (including 0.25% autopay discount) | Fixed and variable ranging from 1.74% to 6.94%. 0.25% discount for automatic payments |

| Loan Purpose | Educational (undergraduate, graduate, parent, MBA, Law, Medical loans); Refinancing | Educational (undergraduate, graduate, law & MBA, parent loans) Refinancing |

| Loan Amounts | Minimum of $1,000 | Minimum of $5,000 |

| Credit Needed | 650 credit score (fair) | Undisclosed |

| Terms | 5, 7, 10, 12, 15 years | 5, 7, 10, 15 years |

| Origination Fee | None | None |

| Late Fee | None | None |

| Early Payoff Penalty | None | None |

How to apply for SoFi Private Student Loans?

Flexible repayment options and no fees. Learn how to apply for SoFi Private Student Loans and get the benefits!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Gate City Bank Personal Loans review: flexible options

Check out the Gate City Bank Personal Loans review and learn how easy it is to get flexible loan options at competitive rates and low fees.

Keep Reading

How to apply for the Revvi Card?

The Revvi Card offers 1% cash back rewards^^, and it doesn’t require a perfect credit score. Check out how to apply for it right now!

Keep Reading

How to apply for the Coutts Silk Card

Check out the eligibility requirements and what else it takes for you to apply for a Coutts Silk Card. Read on for more!

Keep ReadingYou may also like

Learn to apply easily for the Citrus Loans

Need a loan? Learn how to apply now with Citrus Loans and get your money fast! They make getting the loan you need easy without all the hassle. Keep reading!

Keep Reading

Wells Fargo Autograph℠ Card application: how does it work?

Find out what is necessary to apply for the Wells Fargo Autograph℠ Card, and start enjoying cash back on your purchases as soon as possible. Keep reading and learn more!

Keep Reading

Budgeting for travel: see how to plan your next trip!

Find out what you need to do to start budgeting for your next trip. In this post, you'll find the best tips to help you save and have a stress-free vacation here. Read on!

Keep Reading