Credit Cards (US)

Find the Best Visa Credit Cards and enjoy benefits!

Are you in search of a Visa credit card but unsure of which one to pick from the wide variety of products and providers? See our Best Visa Credit Cards listing and check our Visa credit card reviews to make a solid decision for your financial life!

Looking for a Visa card? See our selection of the very best this brand has to offer in the credit market today!

We all know Visa, right? Recognized as one of the most accepted credit brands in the world, it’s been featured in Hollywood movies, magazine pages, and bank advertisements throughout the globe. Hence our list of the Best Visa Credit Cards can be a great asset in choosing of your next credit card! See our Visa credit card reviews listing and make a solid decision!

Here we will go over the very best Visa offers among different formats, APRs, and reward plans. You may even get a welcome bonus or two on the side! Rest assured, we will only feature the greatest offers Visa has for you. In conclusion, a post made so you can have all the information you need to make the best decision for your financial life!

Here are our top 5 choices for the best Visa credit cards with reviews!

As always, we will go over the cards pragmatically, addressing the stronger perks of each offer and providing you with a concise view of the product as a whole. Should you be interested in one of the credit cards here, feel free to check our full reviews for it and learn even more about what piques your interest! We are here to serve you in your decision-making process.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One Venture Rewards Credit Card

| Credit Score | Excellent |

| Annual Fee | $95 |

| Regular APR | From 16.24% to 24.24% variable APR |

| Cash back rewards | Earn from 2 to 5 miles for every dollar spent on eligible purchases |

Capital One Venture Rewards Card Highlights

If you’re in search of an amazing travel credit card under the Visa banner, the Capital One Venture Rewards is definitely a great option for you to consider! It features a great reward plan and not-so-high APRs based on your creditworthiness. In conclusion, a solid choice for you to reap rewards traveling with Capital One!

- Get 75,000 welcome bonus miles after spending $4,000 in the first 3 months after opening your account.

- 2 to 5 miles for every dollar spent on all eligible purchases.

- No foreign transaction fees.

- Several travel-related benefits from TSA PreCheck® credit to Capital One Lounge visits.

How to get the Capital One Venture Rewards card?

Come and check how you can apply for the capital one venture rewards card and benefit from its many perks and travel opportunities.

Capital One Venture Rewards credit card review

If I were you, I would check out our full review on Capital One Venture Rewards credit card. Come and see this card's premium benefits.

Bank of America® Customized Cash Rewards Secured Credit Card

| Credit Score | Poor to Limited |

| Annual Fee | No annual fee |

| Regular APR | 24.24% variable APR |

| Cash back rewards | Limited 2% to 3% cashback – 1% cashback on all eligible purchases |

Bank of America® Customized Cash Rewards Secured Card Highlights

It’s not only the most privileged credit scores that get access to a good Visa brand credit card featuring a solid reward plan, and the Bank of America® Customized Cash Rewards Secured is here to prove just that. In conclusion, great for you to build your credit with a reward package that saves you money!

- Choose which category benefits you the most for your biggest limited cashback amounts.

- 1% unlimited cashback on all eligible purchases.

- No annual fees.

- Rewards for life with no expiry date.

- Secured deposit can be refunded based on your relationship with Bank of America.

How to apply for Bank of America Customized card?

Are you looking for a card that accepts low scores and has rewards? The Bank of America Customized Cash Rewards Secured card can be for you. Learn how to apply now!

Bank of America Customized Cash full review

The Bank of America Customized Cash Rewards Secured credit card can be very useful for those who need a secured card with rewards. So, check out our full review!

United℠ Explorer Credit Card

| Credit Score | Good to Excellent |

| Annual Fee | No annual fee for the first year – $95 after |

| Regular APR | From 16.74% to 23.74% variable APR |

| Cash back rewards | 1 mile per dollar spent on all eligible purchases |

United℠ Explorer Card Highlights

Another travel card option under the Visa brand, the United℠ Explorer credit card, is a solid choice offering good benefits for those seeking affordability and a welcome bonus that fits a prestigious financial lifestyle. See below what this card can do for you!

- Get 70,000 to 80,000 welcome bonus miles after spending $3,000 to $6,000 in the first 6 months after opening your account.

- 1 to 2 miles for every dollar spent on all eligible purchases.

- Other travel-related benefits from TSA PreCheck®, Global Entry, or NEXUS credit to Priority Boarding.

How to apply for the United℠ Explorer card?

Are you wondering how to apply for a travel card with a huge welcome bonus and travel perks? If so, keep reading our post about the United℠ Explorer card application!

United℠ Explorer card full review

Wondering if the United℠ Explorer card is worth it? Check out our in-depth United℠ Explorer card review of all its features and benefits to see if it suits your needs!

Chase Freedom Unlimited® Credit Card

| Credit Score | Good to Excellent |

| Annual Fee | No annual fee |

| Regular APR | From 15.24% to 23.99% variable APR |

| Cash back rewards | 1.5% to 5% cashback on all eligible purchases |

Chase Freedom Unlimited® Card Highlights

A full-blown excellent Visa brand credit card, Chase’s Freedom Unlimited® card is a great option for those who seek great rewards and a hefty welcome bonus on the side! All this with no annual fees and one of the most accepted credit card brands in the world! See how this great option can enhance your financial life:

- Get a $200 welcome bonus after spending $500 in the first 3 months after opening your account.

- 1.5% to 5% cashback on all eligible purchases.

- No annual fees.

- Great insurance package.

How to apply for the Chase Freedom Unlimited®?

The Chase Freedom Unlimited® credit card is that card that gives you what you need: flexibility and cashback. Are you wondering how to apply for it? Just keep reading!

Chase Freedom Unlimited® credit card full review

A credit card with no annual fee, but with many features? That is how the Chase Freedom Unlimited® credit card works. So, check out the card's full review!

Upgrade Visa® with Cash Rewards Credit Card

| Credit Score | Fair to Good |

| Annual Fee | No annual fee |

| Regular APR | From 8.99% to 29.99% variable APR |

| Cash back rewards | 1.5% cashback on all payments |

Upgrade Visa® with Cash Rewards Card Highlights

Upgrade’s more accessible solution for good credit and a solid reward plan comes in the form of the Upgrade Visa® with Cash Rewards credit card, a simple and straightforward product made to simplify your financial life. With no annual fee, this card can be a good solution that doesn’t rely solely on high credit scores in the application process.

- $200 welcome bonus when you open a checking account and make 3 debit card transactions

- 1.5% unlimited cashback on all eligible purchases upon balance payment.

- No annual fees.

How to apply for the Upgrade Visa® credit card?

An Upgrade Visa® with Cash Rewards features credit card and personal loan functions under the same roof. And you get unlimited rewards. Learn how to apply for it today!

Upgrade Visa® with Cash Rewards credit card review

In this Upgrade Visa® with Cash Rewards review post, we will explain how this credit card works and all the benefits you get by applying for one. Read now and learn more!

Do you prefer American Express cards? Learn the best options!

There you have it. These are our suggestions for the best Visa Credit Cards. Not looking for a Visa card anymore? Unsure of which brand to pick from the different options, or what difference does it make from one to the other? Let us recommend you another one then! There are very few more prestigious credit card brands than American Express, recognized far and wide across the globe.

See our post listing the very Best American Express cards and make a solid decision based on our recommendations and the expertise accrued from our many years of experience in the subject! You won’t be disappointed with what we have to offer.

Best American Express cards

There is an Amex credit card for you, no matter your needs and goals. Learn the ten best American Express cards!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Citi® Diamond Preferred® Card?

If you love a card with no annual fee and intro APR periods, check out our post about the Citi® Diamond Preferred® Card application process!

Keep Reading

How to apply for the Axos Rewards Checking account?

An Axos Rewards Checking account features high-interest earnings with unlimited domestic ATM fee reimbursements and more. Learn how to apply!

Keep Reading

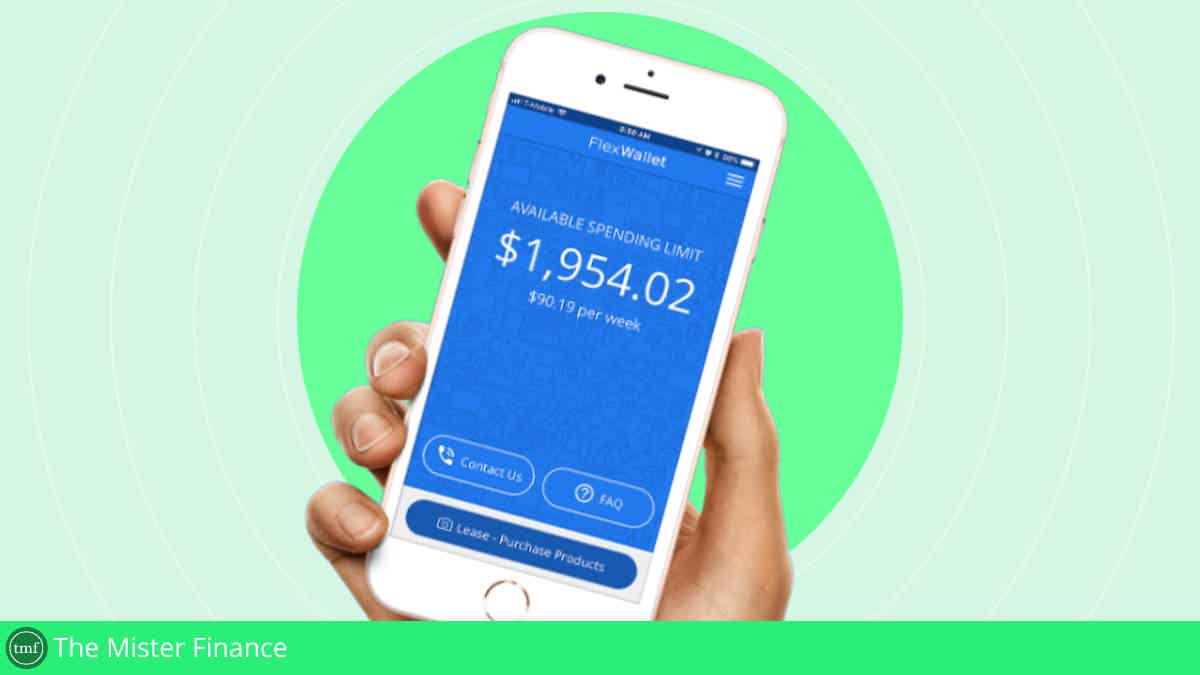

How to apply for the FlexShopper Wallet?

If you need a wallet to help you get a good spending limit for your purchases, read on to learn how to apply for the FlexShopper Wallet!

Keep ReadingYou may also like

Learn how to download the Breathwrk App and manage your anxiety and stress

If you want to improve your anxiety and well-being, learn how to download the Breathwrk app. Here's the complete guide. Read on!

Keep Reading

Mogo Prepaid Card Review

By getting a Mogo Prepaid Card, you can save money while reducing your environmental impact. Check our Mogo Prepaid Card review to learn all that this product can do for you and for the planet.

Keep Reading

Indigo® Mastercard® for Less than Perfect Credit application

Are you looking for a credit card with no security deposit to help you build credit? Read our post to learn how to apply for Indigo® Mastercard® for Less than Perfect Credit!

Keep Reading