US

How to apply for the FlexShopper Wallet?

Do you need a way to purchase online and get perks? If so, read on to learn how to apply for the FlexShopper Wallet!

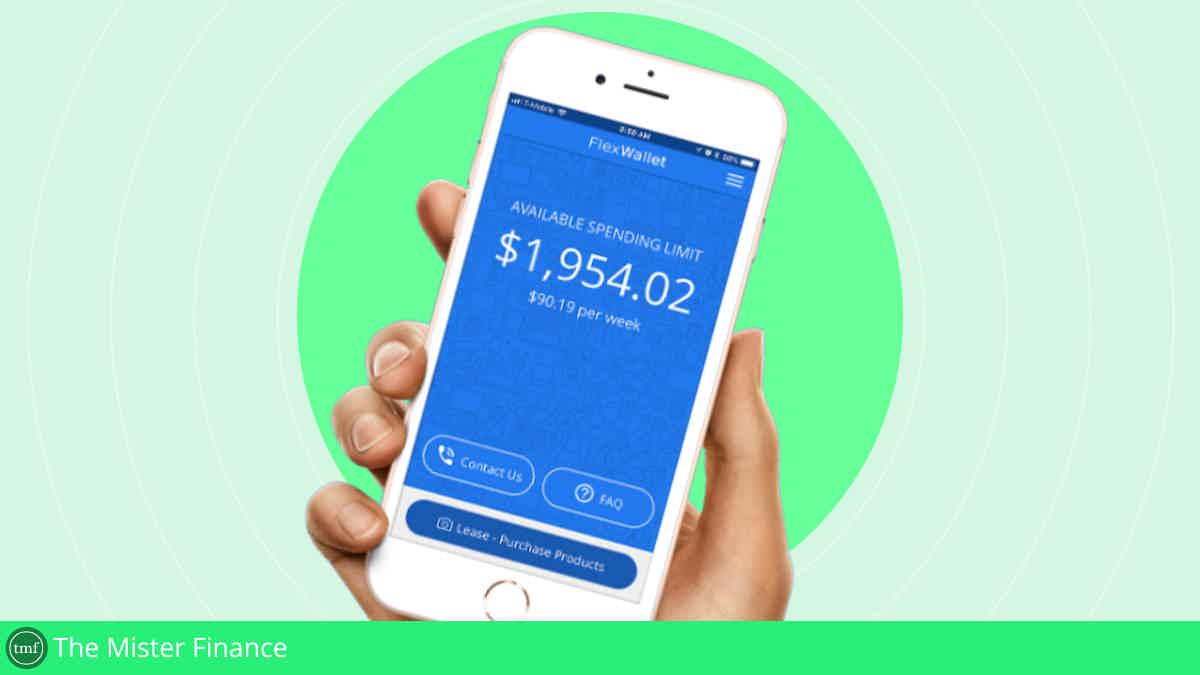

FlexShopper Wallet: Up to $2,500 spending limit!

Are you looking for a way to purchase items online with a generous spending limit? If so, you can try to apply for the FlexShopper Wallet!

Moreover, with this app, users can access up to $2,500 worth of items from eligible retailers!

In addition, as an added bonus, they are offering referral bonuses and other incentives that make accessing funds even easier.

Also, best of all, it’s secured by personal encryption to keep your information safe and secure.

Therefore, everyone deserves to enjoy the key benefits of shopping online without feeling weighed down by complicated fees or restrictions!

So, keep reading our post to learn our tips on how to apply for the FlexShopper Wallet today and get an instant decision!

Online Application Process

You can find most information about the application process online through the official website. Moreover, you’ll need to see if you meet the requirements before you start applying.

Therefore, here is a list of some of the requirements you need to meet to have more qualifying chances:

- You need to be at least 18 years old (19 years old for some states);

- Have a source of income;

- Reside in the U.S. states where the service is available (there are some exclusions);

- Have a checking account;

- Provide SSN, phone number, and other personal information.

Also, these are just some of the requirements to have more chances to qualify for this product.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

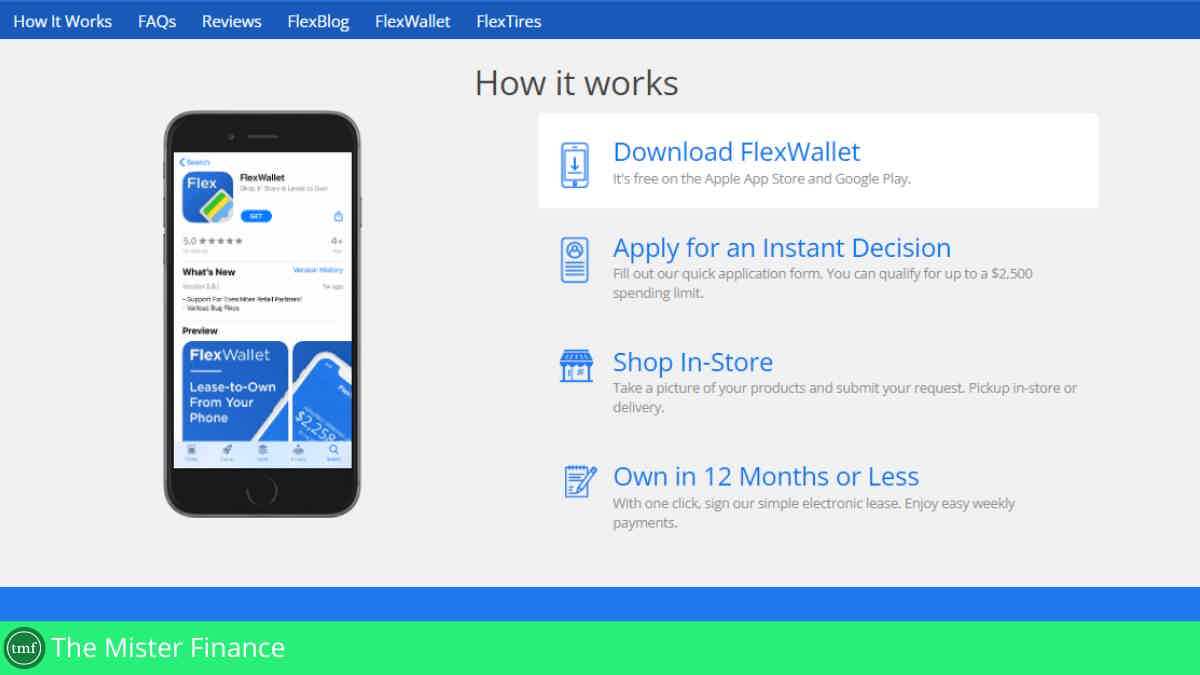

Application Process using the app

After you know that you have the requirements to apply for this product, you can download the app through the App Store or Google Pay.

Also, after that, you’ll be able to start your application. Moreover, you’ll need to provide the personal information required and other documents.

In addition, you’ll be able to get an instant decision on your application! Moreover, you’ll be able to qualify for a spending limit of up to $2,500!

FlexShopper Wallet vs. WebBank/Fingerhut Credit Account

Are you not so sure about using the FlexShopper Wallet? If so, you can try using the WebBank/Fingerhut Credit Account!

Moreover, with this account, you’ll be able to access 100+ brands and products and pay with low monthly payments!

Also, this account allows you to build your credit score. Therefore, they report your monthly payments to all three major credit bureaus!

In addition, you won’t need to pay any hidden fees to use this service! Also, you can choose between two types of services: a traditional credit account and an account for starters!

Therefore, with this, you’ll be able to get the right service for just what you need in your finances!

Moreover, you can have both accounts to see which one best meets your needs. However, make sure you know you can pay for the possible fees and don’t overspend!

How to apply for the WebBank/Fingerhut account

Do you need to purchase at your favorite brands with no hidden fees? Read on to learn how to apply for the WebBank/Fingerhut Credit Account!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

WebBank/Fingerhut Credit Account review!

Looking for an account to help you get perks and build your score with no hidden fees? Read our WebBank/Fingerhut Credit Account review!

Keep Reading

14 Best credit cards with cashback rewards of 2021

Come check out what are some of the best credit cards with cashback rewards of the year! Their features and benefits are incredible!

Keep Reading

Capital One Spark Miles Business review

Check out the Capital One Spark Miles Business review article and learn how to take advantage of this card for better business management.

Keep ReadingYou may also like

Discover it® Miles Credit Card review: Earn miles on purchases

If you're looking for a free way to earn miles? Then this Discover it® Miles Credit Card review is what you need! Get 0% intro APR and more! Keep reading.

Keep Reading

Learn to apply easily for the SoFi Personal Loans

Are you thinking about getting a SoFi Personal Loan, but aren't sure where to start? Here's a guideline to help you apply for a SoFi Personal Loan online. Read on!

Keep Reading

LendingClub Personal Loans review: how does it work and is it good?

Are you in need of a great loan to help your finances? If so, read our LendingClub Personal Loans review to learn more about this option!

Keep Reading