Credit Cards (US)

14 Best credit cards with cashback rewards of 2021

Come check out what are some of the best credit cards with cashback rewards of the year! Their features and benefits are incredible!

Find out everything about the best credit cards with cash back

Do you know what are the best credit cards with cashback rewards for the year 2021? Well, now you will. It is always good to keep yourself up to date regarding having credit products that value your money and your purchases.

Therefore, we have made a list of fifteen credit cards that offer good APR percentages, annual fees, as well as some amazing welcome bonuses and rewards.

In case your current credit card does not give you most of the benefits below, you may consider changing credit cards.

The 15 best choices for credit cards with good cash back rewards

See below our list of this year’s best credit cards with cashback rewards. They are organized in no particular order:

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Citi Custom Cash℠ Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 13.99% – 23.99% |

| Welcome Bonus* | 20 thousand ThankYou® Points or $200 redeemed cash back after $750 spent on purchases in the first three months *Terms apply |

| Rewards* | 1% to 5% cash back on purchases up to the first $500 spent *Terms apply |

American Express Blue Cash Preferred® Card

| Credit Score | Good to Excellent |

| Annual Fee | $95 |

| Regular APR | 13.99% – 23.99% |

| Welcome Bonus* | $0 annual fee during the first twelve months 0% regular APR during the first twelve months *Terms apply |

| Rewards* | 1% to 6% cash back on purchases *Terms apply |

Wells Fargo Active Cash℠ Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 14.99% – 24.99% |

| Welcome Bonus* | 0% APR during the first fifteen months on purchases and balance transfers $200 cash rewards during the first three months on purchases of $1,000+ *Terms apply |

| Rewards* | 2% cash rewards on purchases Cash rewards with no expiration date *Terms apply |

Wells Fargo Active Cash card full review

Learn everything about this amazing cash back card from Wells Fargo and its benefits!

Citi® Double Cash Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 13.99% – 23.99% |

| Welcome Bonus* | 0% APR during the first eighteen months on balance transfers *Terms apply |

| Rewards* | Up to 2% cash back rewards *Terms apply |

Capital One SavorOne Cash Rewards Credit Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 15.49% – 25.49% |

| Welcome Bonus* | 0% APR during the first fifteen months on purchases A $200 cash reward up to the third month on purchases of $500+ *Terms apply |

| Rewards* | Up to 8% cash rewards on purchases No foreign transaction fees *Terms apply |

Bank of America® Customized Cash Rewards Credit Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 13.99% – 23.99% |

| Welcome Bonus* | 0% APR during the first fifteen months on purchases and/or 0% APR during the first two months on balance transfers $200 cash rewards during the first three months on purchases of $1,000+ *Terms apply |

| Rewards* | Up to 3% cash rewards on purchases Rotating bonus categories Relationship rewards *Terms apply |

Chase Freedom Unlimited® Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 14.99% – 23.74% |

| Welcome Bonus* | 0% APR during the first fifteen months on purchases A $200 cash reward during the first three months on purchases of $500+ Up to 5% cash rewards on selected categories during the first twelve months *Terms apply |

| Rewards* | 1.5% cash rewards on purchases Up to 5% cash rewards on selected categories No minimum redemption amount *Terms apply |

Bank of America® Unlimited Cash Rewards Credit Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 13.99% – 23.99% |

| Welcome Bonus* | 0% APR during the first fifteen months on purchases and/or 0% APR during the first two months on balance transfers $200 cash rewards during the first three months on purchases of $1,000+ *Terms apply |

| Rewards* | Cash rewards with no expiration date Cash rewards with no limited amount *Terms apply |

Savor® Rewards from Capital One Card

| Credit Score | Good to Excellent |

| Annual Fee | $95 |

| Regular APR | 15.99% – 24.99% |

| Welcome Bonus* | A $300 cash reward during the first three months on purchases of $3,000+ *Terms apply |

| Rewards* | No foreign transaction fees Up to 4% cash rewards on selected categories Cash rewards with no expiration date and no limit amount *Terms apply |

Capital One® Walmart Rewards Credit Card

| Credit Score | Fair |

| Annual Fee | $0 |

| Regular APR | 17.99% – 26.99% |

| Welcome Bonus* | 5% cash reward during the first twelve months *Terms apply |

| Rewards* | Up to 5% cash rewards on selected categories No foreign transaction fees *Terms apply |

Discover it® Cash Back Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 11.99% – 22.99% |

| Welcome Bonus* | 0% APR during the first fourteen months on purchases and balance transfers *Terms apply |

| Rewards* | Up to 5% cash rewards on selected categories Cash rewards with no expiration date and no limited amount *Terms apply |

HSBC Cash Rewards Mastercard® Credit Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 3.99% – 23.99% |

| Welcome Bonus* | A low APR during the introductory period 3% cash rewards during the first year on purchases of $10,000+ *Terms apply |

| Rewards* | 1.5% cash rewards on purchases No foreign transaction fees *Terms apply |

Chase Freedom Flex℠ Credit Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 14.99 – 23.74% |

| Welcome Bonus* | A $200 cash reward during the first three months on purchases of $500+ 5% cash rewards during the first twelve months on selected purchases of $12,000+ *Terms apply |

| Rewards* | Rotating quarter to quarter categories Premium travel rewards *Terms apply |

U.S. Bank Cash+™ Visa Signature® Card

| Credit Score | Good to Excellent |

| Annual Fee | $0 |

| Regular APR | 13.99% – 23.99% |

| Welcome Bonus* | 0% APR during the first twelve months on balance transfers Up to $550 cash rewards during the first twelve months $150 cash rewards during the first three months on selected net purchases of $500+ *Terms apply |

| Rewards* | 2% cash rewards on one selected category of your choice 1% cash rewards on all selected purchases Cash rewards with no limited amount *Terms apply |

As it is possible to conclude, our list containing the best credit cards with cashback rewards has fifteen credit cards that have some features in common, such as: all of the abovementioned credit cards have a zero dollar annual fee.

Also, as well as their respective regular APR percentages, most of them offer a zero percent regular APR during an introductory period. Moreover, with any of the above cards, you will enjoy different types of cashback rewards.

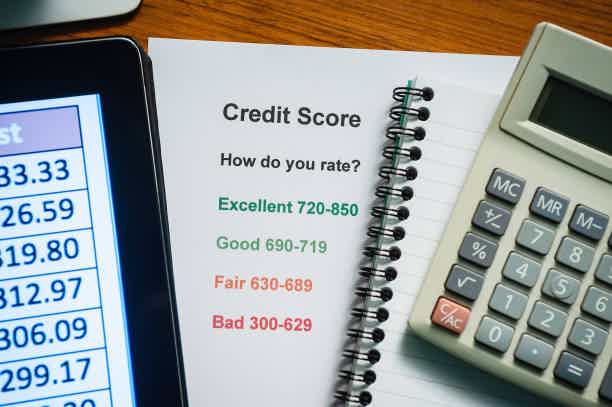

However, the majority of them ask that you have a good or an excellent credit score. So, if you want to know more about credit cards and credit scores, continue reading more of our articles!

What is a good credit score? Find out here!

Not having a good credit score can be what keeps you from enjoying the best credit products of the market. So, hear us out and learn more about credit scores!

About the author / Thais Daou

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Should you buy a house now? 8 advice to find out

Should you buy a house now or wait until next year? Here is some good advice to find out if it would be best to become a homebuyer in 2023.

Keep Reading

Blue Sky Financial review: Simple loans!

If you need a lending platform with quick cash for your personal need, read our Blue Sky Financial review to see its pros and cons!

Keep Reading

How to buy British Airways tickets on sale?

You can buy at British Airways Sales and get great flights! All you need is a guide to help you make the best out of it. So, read on!

Keep ReadingYou may also like

Learn to apply easily for the Rocket Mortgage

If you want to apply for a Rocket Mortgage, look no further. We can help you get the scoop on the process, so that you can do it more confidently. Read on!

Keep Reading

Figure Home Equity Line review: how does it work and is it good?

If you're looking to borrow against the equity in your home, our Figure Home Equity Line review is just what you need. Enjoy fast funding! Read on!

Keep Reading

Learn to apply easily for ClearMoneyLoans.com

Learn how to quickly and easily apply for a loan with ClearMoneyLoans.com - we simplify the process for you. Read on!

Keep Reading