Comparison (US)

Amazon Prime Rewards Visa Signature Card vs Apple card: card comparison

Two great rewards cards, but only one is the best for you. So, which will you choose: Amazon Prime Rewards Visa Signature Card or Apple card? Keep reading to decide wisely.

Amazon Prime Rewards Visa Signature Card or Apple card: which is the best?

Are you trying to decide between the Amazon Prime Rewards Visa Signature Card or Apple card? If you are a big consumer at Amazon, Whole Foods, and Apple, you might be surprised to know how much you can earn with both of these products.

On one side, there is the Amazon Prime Rewards Visa Signature Card, full of perks and no annual fee when you maintain an active Amazon Prime membership.

On the other side, there is the Apple card for those who love to collect Apple products.

Both cards offer many benefits. But before applying to one of them, find out everything about them to decide which fits your profile better.

How do you get the Amazon credit card?

Are you interested in getting the best perks as a Prime member? Read more to know how to apply to get the Amazon Prime Rewards card!

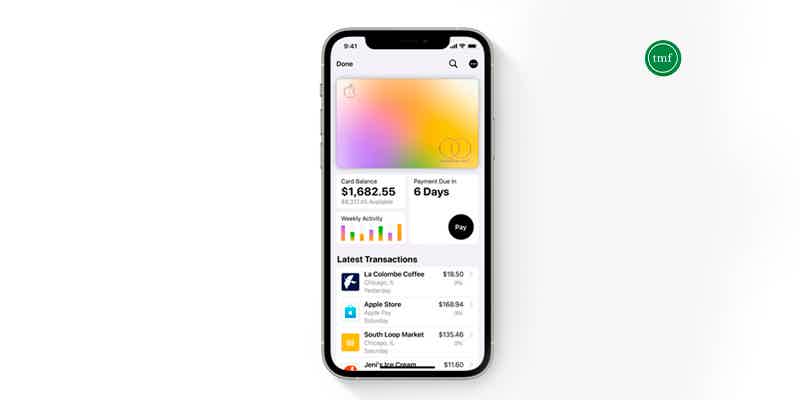

How to apply for the Apple credit card

Do you want to get the new Apple card? We'll show you how to apply and get great rewards! Read our Apple credit card application post!

| Amazon Prime Rewards Visa Signature Card | Apple card Card | |

| Sign-up bonus | Amazon gift card | None |

| Annual fee | $0 as long as you maintain active an Amazon Prime membership | $0 |

| Rewards | 5% back with an eligible Prime membership at Amazon and Whole Foods Market; 2% back at restaurants, gas stations, and drugstores; 1% back on all other purchases | 3% cash back on Apple purchases; 3% cash back on select merchants; 2% cash back when paying through Apple Pay; 1% cash back on all other purchases |

| Other perks | No foreign transaction fee; Bonus rewards at Amazon on select products; Travel and Emergency Assistance; Lost Luggage Reimbursement; Baggage Delay Insurance; Travel Accident Insurance; Roadside Dispatch; Auto Rental Collision Damage Waiver; Purchase Protection; Extended Warranty; Complimentary Visa Signature Concierge (terms and conditions apply) | No foreign transaction fee; Mastercard Priceless experiences; 24-hour hotline; ID theft protection; Apple Family Account Sharing; Virtual Card Numbers for online purchases |

| APR | 14.24% – 22.24%(variable) | 10.99% – 21.99%(variable) |

Amazon Prime Rewards Visa Signature Card

This credit card is suitable for those who love Amazon and/or buy at Whole Foods. Besides the fact you can get 1% back on all purchases, the rewards’ greatest level is activated when you purchase at Amazon and Whole Foods Market.

In addition, you can earn 2% back at restaurants, gas stations, and drugstores.

And it is pretty simple to redeem the rewards for direct deposit, a statement credit, or even Amazon purchases.

But if you think the main benefit you can get from this card is the reward rate, you are mistaken.

The Amazon Prime Rewards Visa Signature offers a complete package of perks, including Roadside Dispatch, Auto Rental Collision Damage Waiver, Purchase Protection, Extended Warranty, and 24/7 complimentary Visa Signature Concierge Service.

Also, if you love traveling, this Visa provides many benefits such as no foreign transaction fees, Travel & Emergency Assistance, Lost Luggage Reimbursement, Baggage Delay Insurance, and Travel Accident Insurance.

However, you must know some of those benefits are paid. The card provides you only access to them.

So, read the terms and conditions before signing up.

Furthermore, you have to maintain an Amazon Prime membership if you don’t want to pay an annual fee.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apple credit card

If you usually utilize Apple Pay on your purchases, an Apple credit card might be worth considering as your next card.

Besides the fact you can start using it immediately with Apple Pay, you can get unlimited 2% cash back when paying through it, 3% cash back on Apple purchases & select merchants, and 1% cash back on all other purchases.

This Mastercard doesn’t charge you any fees whatsoever.

Also, it claims to encourage people to pay less interest. One example of that is the fact that you can purchase select Apple products and pay for them in monthly installments interest-free.

Furthermore, it features Mastercard benefits like ID theft protection and the possibility to get an Apple Card Family for your entire family.

The card also features a whole new and high-security level through technologies like Face ID, Touch ID, and more.

Benefits of Amazon Prime Rewards Visa Signature Card credit card

The Amazon Prime Rewards Visa Signature Card offers a superior rewards rate for those who regularly purchase on Amazon and Whole Foods.

It is an excellent store card with plenty of perks for travelers and consumers.

Although some benefits require payment if you use them, this Visa provides access when you need it.

Moreover, the card offers a welcome bonus, a limited extra bonus at Amazon on select products, a simple and flexible rewards redemption plan, and no foreign transaction fee.

Plus, the annual fee is zero with an Amazon Prime membership.

Benefits of Apple credit card

If you are an Apple enthusiastic, the credit card offers a lot. One of its main benefits is the $0 fee. So, there is no annual fee, no foreign transaction fee, no late fee, cash advance, or over-the-limit fee.

The card allows you to buy selected Apple products and pay for them through interest-free monthly payments.

Also, you get the Mastercard package of protection and exclusive experiences, and a great rate of rewards.

Disadvantages of Amazon Prime Rewards Visa Signature Card

Unfortunately, the card requires a good credit score for those who want to apply for it. Also, you need to pay for some perks.

And you must maintain an active Amazon Prime membership in order to waive the annual fee.

Disadvantages of Apple card

Unlike Amazon card, the Apple doesn’t offer a welcome bonus.

In addition, it requires Apple hardware and Apple Pay for you to use it and get the full experience and rewards.

Amazon Prime Rewards Visa Signature Card or Apple card: which you should choose?

Both cards are worth considering if you are an Amazon or Apple consumer. So, if you use your Amazon Prime membership and purchase on Amazon or Whole Foods, the Amazon Prime Rewards Visa Signature might be a good option for you.

On the other hand, if you have an iPhone or other Apple product, and mainly use an Apple Pay, the card will be delightful for you.

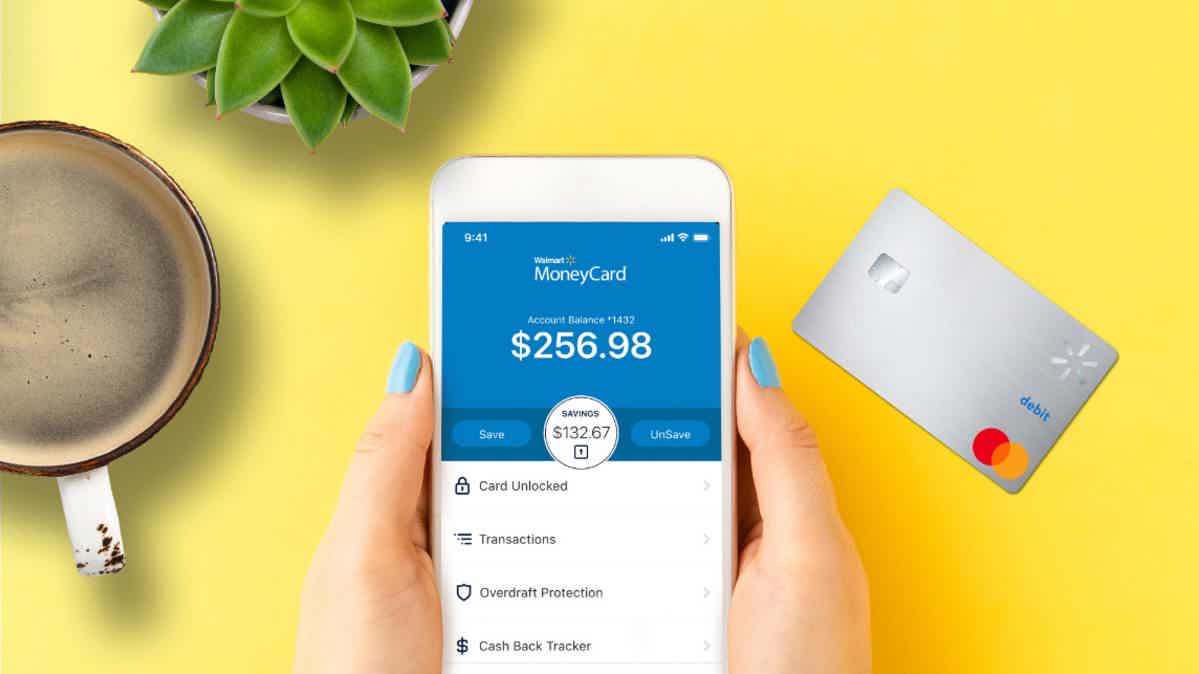

However, if you are looking for another store branded card with lots of exclusive perks, follow the recommended link for the application process of the Walmart Moneycard debit card. All credit scores are welcome to apply and you can get cash back on all your purchases!

How to apply for a Walmart Moneycard debit card?

Earn cash back while shopping at Walmart with a Walmart Moneycard! Check out how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Delta SkyMiles® Reserve Business American Express Card overview

Check out this Delta SkyMiles® Reserve Business American Express Card overview to learn the perks and benefits of this prestigious card!

Keep Reading

WebBank/Fingerhut Credit Account review!

Looking for an account to help you get perks and build your score with no hidden fees? Read our WebBank/Fingerhut Credit Account review!

Keep Reading

How to apply for the Aspiration Spend & Save™ Account?

The Aspiration Spend & Save™ Account is a hybrid account with perks and environmental conscience. Learn how to apply for it!

Keep ReadingYou may also like

Flagstar Bank Mortgage review: how does it work and is it good?

Looking for a mortgage? Check out our review of Flagstar Bank Mortgages - mortgages in all 50 states with fast appliction process.

Keep Reading

Capital One Spark Miles for Business application: how does it work?

Discover how you can easily apply for the Capital One Spark Miles for Business. It's simple and online. Read on to learn more!

Keep Reading

Mission Money debit card review: is it legit and worth it?

You can manage your expenses on the palm of your hand with the Mission Money debit card app. Stop paying fees to use your own money. This card is fee-free.

Keep Reading