Reviews (US)

How to apply for the Aspiration Spend & Save™ Account?

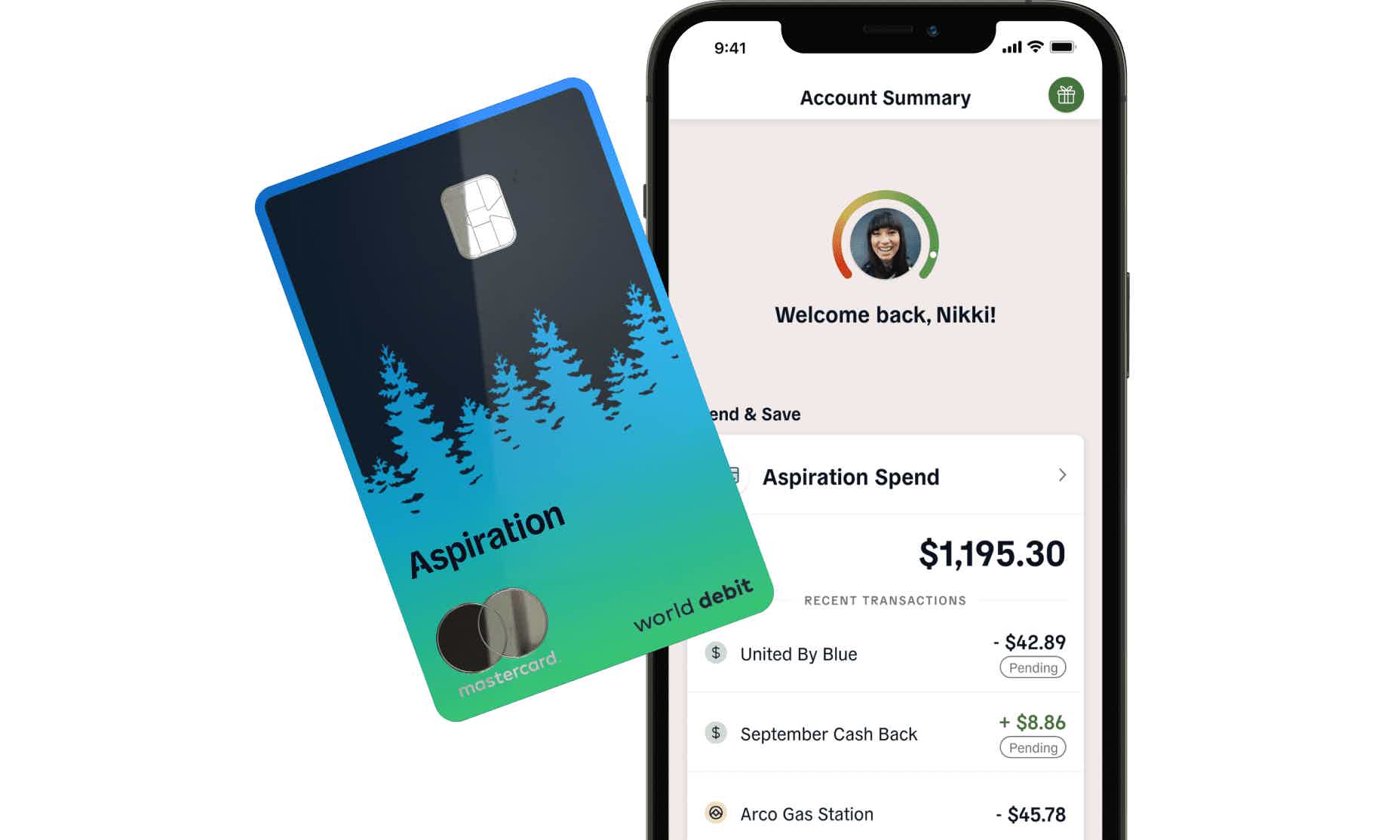

Are you environmentally committed? What do you think of saving money while managing your impact on the world through your financial activity? Then, check out how to apply for the Aspiration Spend & Save™ Account.

Aspiration Spend & Save™ Account application process

Are you looking for a way to balance your spending and saving? The Aspiration Spend & Save™ Account is the perfect account for those who want to spend responsibly on their wants, while still saving for the future.

Plus, this hybrid account offers cash back rewards, an average APY on savings, and some perks at the ATMs.

With no monthly or annual fees, you can manage your financial activity easily through the mobile app. And you control your environmental impact on the world.

But, note that the best perks come with a Plus signature.

Also, it charges foreign transaction fees. So, if you think this account is the right one for you, check out how to apply for it now!

Apply online

Access the Aspiration Spend & Save™ website at www.aspiration.com and click on Open or Apply Now.

Enter your email address and get started.

Fill in the form with your personal and employment information. Then, connect to your existing account to make the first minimum deposit.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

You can also download the app and click on sign up. Then, follow the steps, and you are good to go!

Aspiration Spend & Save™ Account and One Finance Account comparison

If you are doubtful about what hybrid account to sign up for, look at the comparison chart below and find out more about another great option available on the market, the One Finance Account. That way you can make a better decision and choose the best account for your financial needs!

| Aspiration Spend & Save™ Account | One Finance Account | |

| APY | Up to 5% (for Plus account with at least $1,000 purchases in debit card). 3% for Basic members (on balances up to $10,000 with $1,000 purchases in debit card). No APY when doesn’t apply the minimum requirements. | From 1% to 3% |

| Withdrawal options | Allpoint ATMs are unlimited and free. On others, up to 5 transactions, daily, up to $1,000. Plus members get one $0 out-of-network ATM fee. ACH transfer Wire transfer Mailed check ATM or Point-of-sale | Withdrawals up to $500 per day |

| Deposit options | Minimum of $10 to open the account ACH transfer Mailed check Wire transfer Mobile-deposited check | No minimum deposit required |

| Fees | $0 | $0 |

| Top perks | Cash back; FDIC insurance; AIM score; phone protection; mobile app. | Pockets free online feature; welcome bonus; Credit Builder. |

How to apply One Finance Account?

The One Finance hybrid Account allows you to save money with a high APY. Check out how to apply for it now!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to join BankProv? Start banking with this innovative bank

Check out how to join and start banking with BankProv and learn how to use innovative and technological solutions to manage your business.

Keep Reading

iSoftpull review: is it trustworthy?

Check out our iSoftpull review and learn how to access your credit score, reports, and much more information with only a soft pull running.

Keep Reading

One Finance Hybrid Account full review

With the One Finance hybrid Account, you can save money with no service monthly fees. Check out the full review and find out more benefits!

Keep ReadingYou may also like

Anxiety Relief Hypnosis App review: Reprogram your anxious mind

If you're looking for a helpful and affordable anxiety relief hypnosis app, look no further than this Anxiety Relief Hypnosis App review.

Keep Reading

How to start investing with Ally Invest?

Opening an account with Ally Invest is a simple process. In this article we’re going to show you how to do it. So read on and learn how to open your account!

Keep Reading