Reviews (US)

One Finance Hybrid Account full review

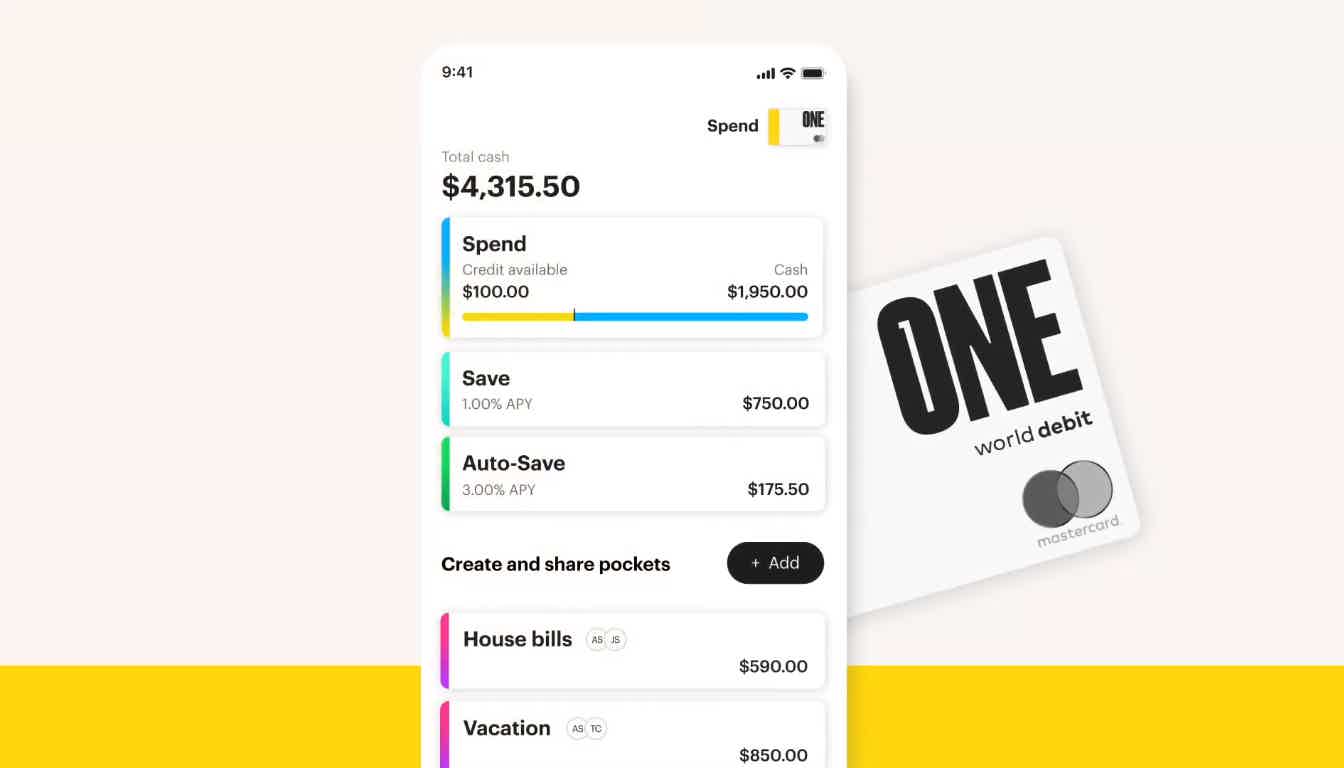

The One Finance hybrid account is a self-explanatory type of pocket, where you have a checking and a saving account at the same place. And all of it with a high APY. Find out more with our full review!

One Finance Hybrid Account overview

Looking for an account that features a checking and a saving account at the same place? The One Finance hybrid Account offers you that.

Also, there is no minimum deposit and no monthly service fee whatsoever.

This Account is supported by the Coastal Community Bank, so you can rely on it.

Furthermore, it allows you to put your savings on auto-pilot, with 3% APY.

Keep reading to learn more about it.

| Intro Balance Transfer APR | N/A |

| Regular Balance Transfer APR | N/A |

| Balance Transfer Fee | N/A |

How to apply One Finance hybrid Account?

The One Finance hybrid Account allows you to save money with a high APY. Check out how to apply for it now!

Learn how the One Finance Hybrid Account works

The One Finance Hybrid account is an account that blends checking and saving accounts in the same place.

With no credit check, you can sign in, transfer money to your One and start using it and saving. As a welcome bonus, you can earn $5.

Also, there are no fees or minimum deposits required. Plus, it features high APY if compared to other banks.

Moreover, you can customize your account as you wish by creating the Pockets that help you with financial categories.

Finally, you can build a credit history by Credit Builder, which makes on-time payments automatically.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

One Finance Account advantages e disadvantages

The One Finance features an All-in-one online account that helps you with your financial planning through the pockets feature.

Therefore, you can earn a 1% and a 3% APY if you put money on your Save Pocket and Auto-Save pocket, respectively.

Also, it includes a credit line, but note that it charges 12% APR (1% per month).

In addition, note that there is a limit on the saving pocket, as fallow:

- $5,000 without direct deposit

- $25,000 with direct deposit

If you exceed this limit, you won’t earn any interest in it.

Furthermore, you can share your pockets with another person as you wish, to manage your bills and more.

Pros

- All-in-one free online account

- High APY (savings interest rate)

- No fees

- No minimum deposit required

- Easy to manage by the Pockets feature

Cons

- Credit line with 12% APR

- No weekend customer service

Credit score required for the application

The One does not require any credit history for the application, so you can build your credit score.

Learn how to apply for a One Finance Account

Looking for an account that hybrids checking and saving? The One Finance hybrid account has it all. Check out now how to apply for it!

How to apply One Finance hybrid Account?

The One Finance hybrid Account allows you to save money with a high APY. Check out how to apply for it now!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Avant Personal Loans review

Do you need a loan for home improvement, debt consolidation, or others? The Avant Personal Loans can help you. Read our review to know more!

Keep Reading

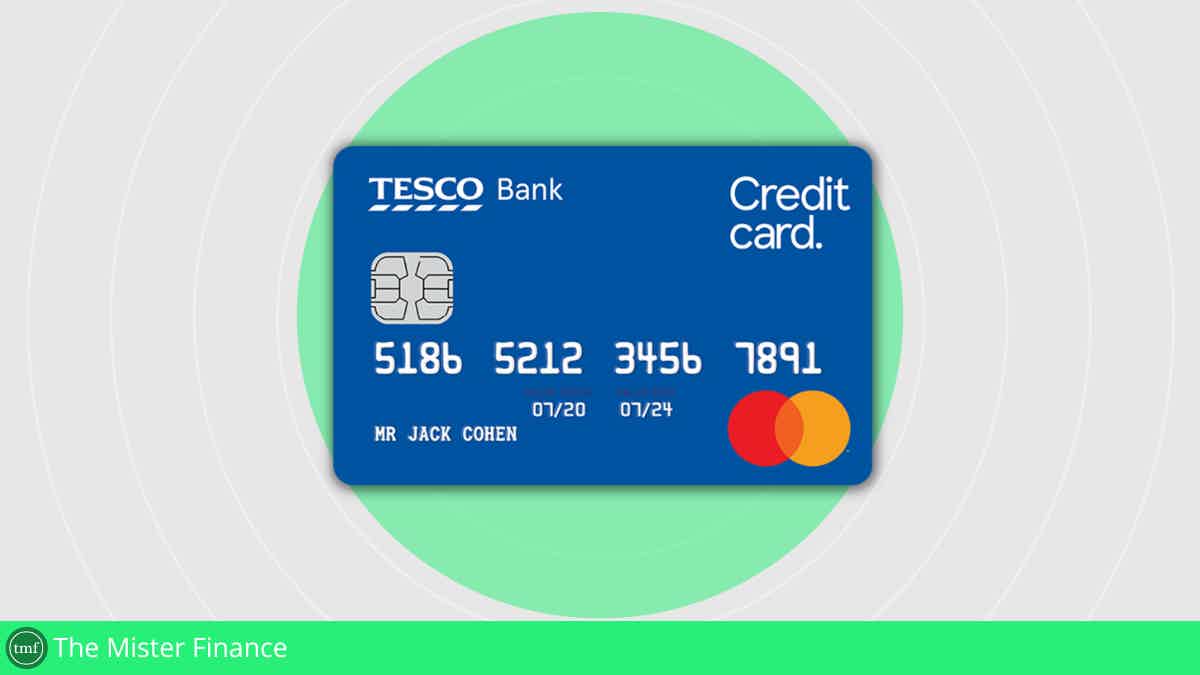

How to apply for the Tesco Bank Foundation Credit Card?

Check out how to apply for a Tesco Bank Foundation Credit Card and build credit while earning points on purchases and paying no annual fee.

Keep Reading

Emirates Airline Sales review: find special offers

Emirates Airlines is one of the top-rated airlines in the world. If you want to learn more about it, read our Emirates Airline Sales review!

Keep ReadingYou may also like

Learn to apply easily for the Bank of America Mortgage

Do you need a guide to apply for the Bank of America Mortgage? Then read on! Learn how to qualify for personalized rates in no time!

Keep Reading

Costco Anywhere Visa® Business Card by Citi review

If you're a small business owner looking for a great deal on gas and discounts at Costco, the Costco Anywhere Visa® Business Card by Citi review is worth checking out. Read on!

Keep Reading

How to buy cheap flights on Momondo

Finding the lowest fares has never been easier! Learn how to buy cheap flights on Momondo, with a wide range of airlines! Save big on your next trip!

Keep Reading