Credit Cards (US)

5 easy steps to pick the best credit card for you

Turn you credit card into your new ally! Learn here step by step which factors you should consider when choosing the best credit card for you, according to your lifestyle and needs.

Find out which is the best credit card option

Unlike purchasing with a debit card, when you purchase with a credit card, you only have to worry about paying at a later date. And this is just one of the many advantages of using a credit card. However, the advantages or disadvantages of credit cards depend on who is using them.

The best choice does not always include having instant credit, easy payment or installment options, practicality, or agility. If organizing, planning, and maintaining financial control are not your strong points, be careful so that impulse buys do not get the best of you.

So now let´s understand which is the best way to pick a credit card. Then, stay with us and have a good reading!

5 easy steps to pick the best credit card for you

In addition, when choosing your credit card, make sure to read between the lines, by looking for options with fee exemptions or differentiated rates. After all, with technological advances and increased competition in the banking industry, every financial institution wants to earn your trust!

Therefore, your greatest advantage will be to benefit from the growing diversity of such institutions, thus diversity of credit cards, to choose the best credit card that suits your needs.

With good financial planning, and after finding the best credit card options, you will be able to better use all your card’s benefits. To help you in this mission, here are five steps you should pay attention to before choosing the best credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

1. Check your credit score

Start by understanding your limits. After all, the best way to get wealthier is to live one step below what you and your family earn. This is very important because the banks will be looking at your relationship with the credit market and how you pay your bills to determine whether you qualify for credit and what credit limit to grant you.

And all of this can impact your credit score, which, by the way, you can easily access through the credit reporting agencies in your country. And do not worry there are several credit card options for people with all types of credit score.

If you want to know more about this subject, you will find specific articles about credit scores on our website, as well as the best credit card options for each type of score.

Best cards for low credit score

See throughout this article the best cards for low credit scores and all information related to them and which area of operation each card is most suitable for.

2. Choose one type of card

When it comes to choosing the best credit card, you should consider which brand is most widely accepted in the shops you usually buy from. For example, three large internationally accepted credit card networks are Visa, Mastercard, and American Express.

Regarding the type of card, there is the best credit card for every need. Considering the most internationally used credit card brands, if you travel frequently, an international card, or one that gives you travel rewards, can be the best option for you.

On the other hand, if you are new to the credit card world or need to rebuild damaged credit and improve your score, perhaps the best option for you might be a student credit card or a secured credit card since they usually have less bureaucratic approval processes.

3. Search around for best credit card offers

As we said before, the banking industry has been changing dramatically, especially thanks to the rise of fintech companies. This means that your money has never been more valuable! With financial institutions fighting for your attention, finding the best credit card offers has never been easier.

So be sure to take advantage of this moment. The time of endless hidden fees on credit card bills is behind us, and now there are card issuers that even pay you every time you make a purchase — yes, we are talking about cash-back.

Once you have narrowed down your options to just a few credit cards, try to make a detailed comparison of what each credit card offers.

4. Look closely for differences

When comparing the cards that seem to best fit your lifestyle, be sure to consider what is already trending in the industry today. Keep an eye on the innovations coming along with fintechs, which are making us question traditional banking practices.

Turn technology to your advantage: choose a credit card that has a user-friendly mobile app and allows you to buy with a virtual card, as well as notifies you every time you make a purchase. This can give you more security and control over your finances.

Stop giving money to your card and start letting it pay you for using it: just by the

fact that you do not have to pay credit card annual fees, you already have a great benefit, and many banks can give you this benefit.

Also, you can find options that turn what you spend into cash (cash-back) or rewards. There even are options that give discounts when you anticipate installments, for example.

Finally, do not decide before considering the banks’ customer service. There is nothing worse than, in an emergency or while trying to solve a problem, not being able to reach the company that you hired.

5. Use your card the right way

After following all these steps, and choosing the best credit card with the best benefits, according to your lifestyle, do not forget that turning your new credit card into an ally during your daily life will depend only on you

It is important that you try to adopt smart and healthy financial habits. If you find it hard to go out of the red, still have money at the end of the month, or not get carried away with unbridled consumerism, here are a few more tips for you:

Buy on credit only what you could already buy in cash.

Anticipate future installments in case the credit card brand offers you a

discount.

Adjust your credit card limit to an amount that is below your household income and write down all your expenses, so you do not lose control.

Sometimes a mobile app where you can write down your expenses, put them into categories, and create charts may come in handy. Some apps even have the option to get your data directly from your bank account, saving you a lot of time.

Finally, as you may have realized by now, there is no right answer, only the right questions we can ask to identify each person’s lifestyle and needs. Self-knowledge is a great ally towards smart financial planning.

Picking the best credit card is just one of the pieces of good personal financial planning. If you are looking for habits that can make you wealthier, take a look at our recommended article next:

How to save money in 2021: 14 super easy tips!

In 2021, we are looking for solid ways to save money when buying and when spending. So check out these 14 easy tips and start now!

Trending Topics

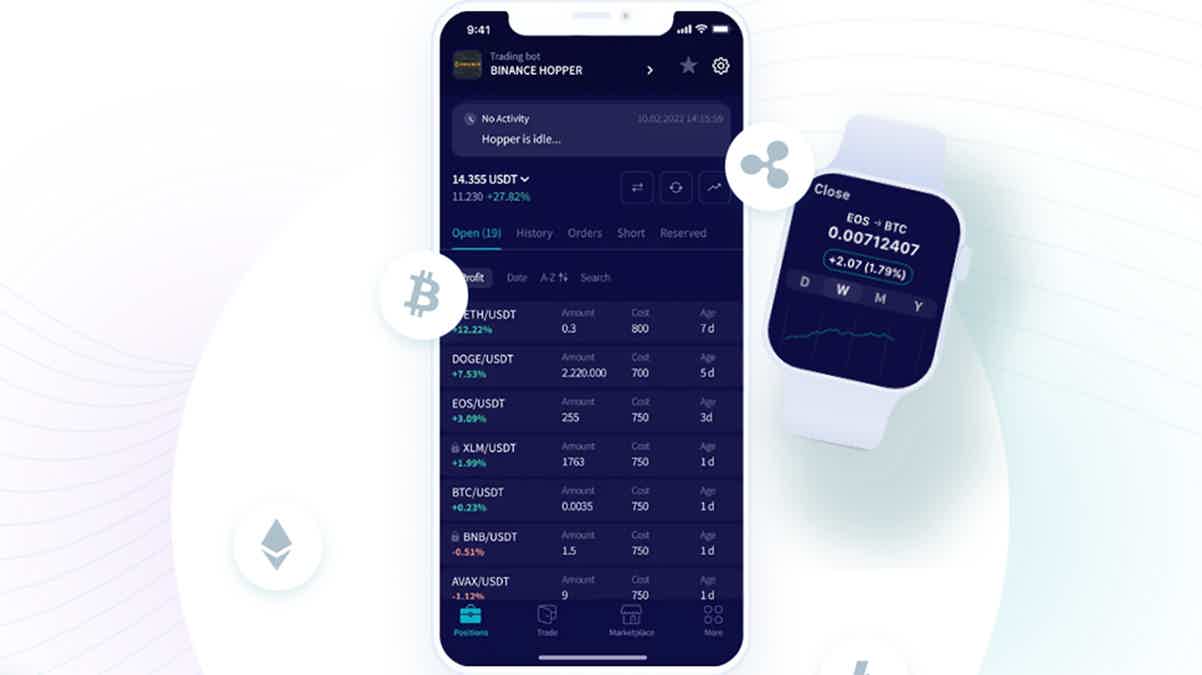

Cryptohopper review: The Most Powerful Crypto Trading Bot

Check out Cryptohopper review. Learn how the most powerful crypto trading bot works and start investing in digital coins with less effort.

Keep Reading

4 best secured cards for raising your score!

If you need a secured card to help you boost your score, check out our post with a list of the best secured cards for raising your score!

Keep Reading

First Latitude Platinum Mastercard® Secured Credit Card review

Check out the First Latitude Platinum Mastercard® Secured Credit Card review post and learn how to build your credit with as little as $100.

Keep ReadingYou may also like

The Business Platinum Card® from American Express application

The Business Platinum Card® from American Express offers online management and credit statements for many top brands that will help you boost your company. Read on to learn how to apply!

Keep Reading

Gold benefits: American Express® Business Gold Card review

Looking for a card to help manage your business expenses? Here's the American Express® Business Gold Card! Earn points on every purchase and more!

Keep Reading

Learn how to download the Capitec Bank App

Need help with the Capitec Bank App download? This quick guide will show you how! Keep reading!

Keep Reading