Credit Cards (US)

The best cards if you have a low credit score

Don't let your past mistakes keep you from getting the purchasing power you want. Check out our list of some of the best credit cards for people with a low credit score.

Find out which are the best options to give you purchasing power and increasing your score!

If you are struggling with your current rating, it can be tough to find good cards for people with a low credit score that meets your needs.

You may feel like you’re stuck with high interest rates and few benefits. But there are actually some great credit cards out there for people with a low credit score.

In this article, we’ll review some of the best alternatives out there. We’ll compare features, rates and benefits so you can choose what makes sense to you financially.

So keep reading the content below to learn which are the best cards if you have a low credit score. Surely you’ll find one that fits your needs just right.

Discover it® Secured Credit Card

The Discover it® Secured Credit Card is one of the best cards for a low credit score for two simple reasons. One, it helps you repair your rating with responsible use.

And two, it provides rewards on purchases. So you’ll earn while improving your score.

The Discover it® Secured Credit Card offers a 2% return at gas stations and restaurants each quarter, with a maximum total consumption of $ 1,000 (after reaching the quarterly limit, 1%).

In addition, you will receive a 1% cashback on all other purchases. Discover’s Cashback Match feature will also match all cashback received by new cardholders at the end of the first year.

Even if the card requires a security deposit of at least $200, Discover will refund your deposit amount after eight months of possession of the card.

The annual fee for the card is $0, but you’ll have to pay a fee for foreign transactions. In other words, Discover is not accepted everywhere, so if you buy abroad, it is better to have a backup payment method.

How to get the Discover it® Secured Credit Card

Do you have a low credit score and need a credit card? The Discover it® Secured Credit Card can be a great fit for you! Read more to know how to apply!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

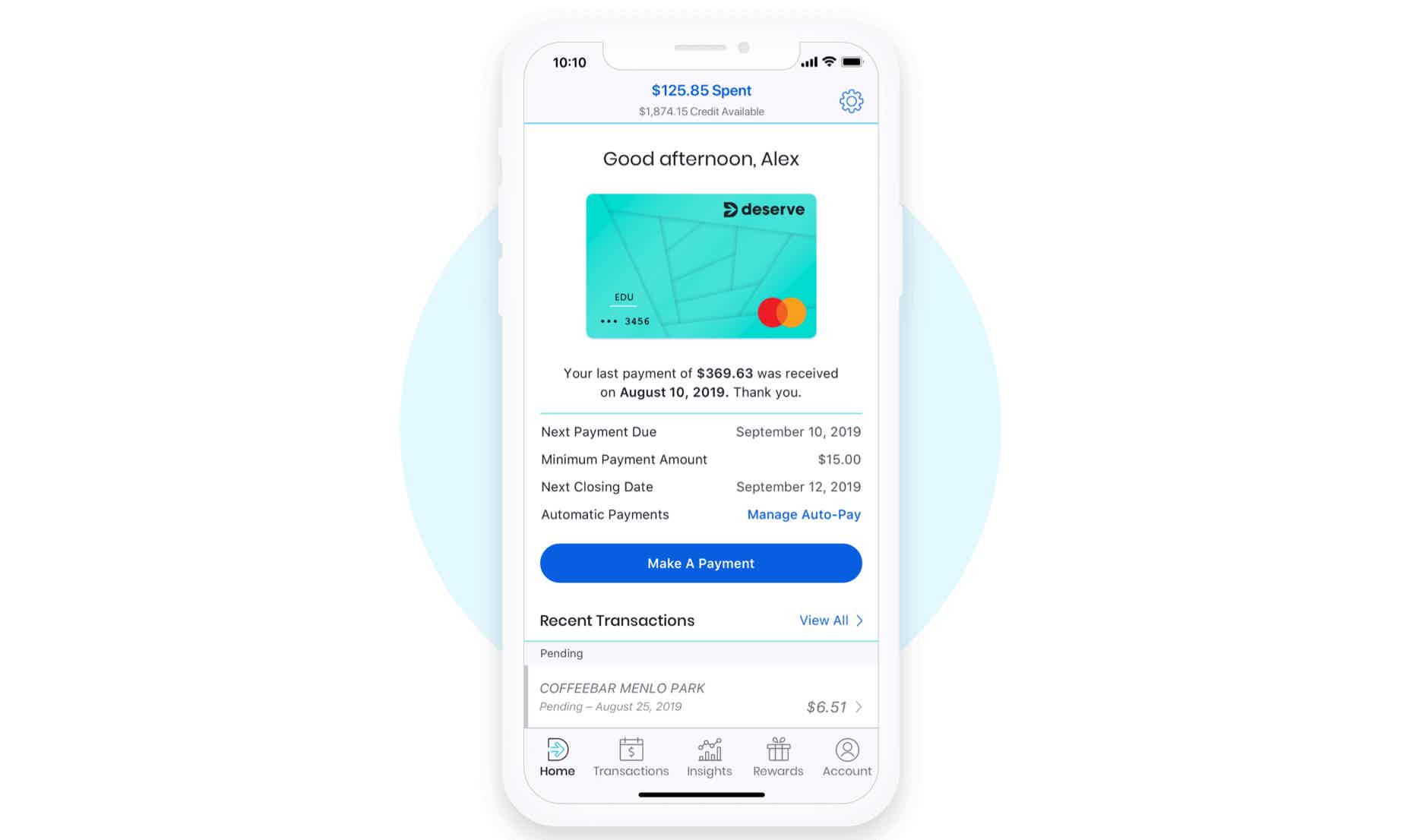

Deserve® EDU Mastercard for Students

One of the best cards if you have a low credit score is made especially for students. This card doesn’t require a credit history, and international students can apply as well.

If you are eligible to use the card, you can spend $500 on the first three charge cycles for using the card to get one year of free Amazon Prime student – a 1% refund for each purchase.

In addition, when using a card to pay a cell phone bill, if the cell phone is stolen or damaged, you will be covered for up to $600.

The annual fee is $0, you will receive all of that money, and there are no transaction fees abroad, if you plan to study abroad or return to another country, this will be a good choice.

How to get a Deserve EDU Mastercard for Students?

Deserve EDU Mastercard for Students credit card offers 1% cash back on all purchases. Check out how to apply for it!

Credit One Bank®Platinum Visa® Credit Card

You can also get access to unsecured cards even with a low credit score. One of the best in the business is the Credit One Bank®Platinum Visa® Credit Card.

Credit One Bank can easily check your pre-qualification – the pre-qualification process will not affect your credit. Knowing if you qualify before you sign up can avoid the trouble of unnecessarily questioning your credit score.

The card also undergoes regular reviews of the credit limit. If you are eligible for a higher credit limit and remain the same, it can help you increase credit by reducing usage.

In addition, you will receive a 1% cashback reward on eligible purchases. However it is important to note that there is a $39 annual fee.

Platinum Mastercard® from Capital One

The main reason the Platinum Mastercard® from Capital One features in this list is because it can help you repair your score, and has a $0 annual fee. That makes it a solid option amongst cards for a low credit score.

The card does not have many decorations – there is no reward program or membership bonus. However, if building credibility is your priority, you can expect better returns in the future.

After making your first six months of payment on time, the card may provide you with a larger credit line. When establishing credit, a higher credit limit can help you increase your credit utilization rate. The lower the utilization rate, the better.

There is also no charge for foreign transaction fees on the card. And because it is a Mastercard, you shouldn’t have to have a hard time finding a merchant abroad who accepts the card.

How to apply for a Capital One Platinum Secured?

The Capital One Platinum Secured card helps you rebuild your credit. Check out how easy it is to apply!

Petal® 2 “Cash Back, No Fees” Visa® Credit Card

The Petal® 2 “Cash Back, No Fees” Visa® Credit Card eliminates the Catch-22 in credit. Which means credit history is a prerequisite to obtaining credit approval, but you cannot establish a credit history without credit.

If you have never used a credit card before, the issuer will make a decision. This decision is based on your financial situation, making this card an excellent choice for your first credit card.

This is the main reason why this is one of the best cards if you have a low credit score.

So, when using Petal® 2 Visa® credit cards you can connect bank accounts to view your revenue, consumption, and savings methods.

If the issuer determines that it is appropriate based on how your funds are managed, you will be approved.

If you pass the exam, you will be eligible for a $500 to $10,000 credit line. And you will not have to pay any fees to use this card.

The Petal® 2 Visa® credit card application allows you to access your account from anywhere. Also, it shows the amount of interest you will have to pay for purchases if you do not pay your total balance each month.

This can assist you in managing your finances and building credibility in the process.

You can also use the Petal® 2 Visa® credit card to earn cashback rewards in the credit establishment process. After opening an account, the card will provide a 1% refund for all purchased goods.

And after paying 12 times a day, you can get a maximum return of 1.5%.

How to apply Petal® 2 "Cash Back, No Fees" Visa®?

Earn rewards and pay no fees with a Petal® 2 "Cash Back, No Fees" Visa® Credit Card! Check out how to apply for it!

Why did we choose these cards?

There are many cards for low credit scores, but some charge high fees or limit their use. Therefore, we focus on credit cards that can help you increase your credit without exploiting your portfolio.

More precisely, we look for cards with low or exempt annual fees. Also, the ones which offer unlimited rewards and have the ability to easily establish your credit history.

Take advantage of easy credit card approval features

These cards for low credit score are considerably easy to obtain. But after receiving the card, start using it to establish your credit history.

Make sure you pay on time every month and consider paying the full balance to avoid charging interest.

Also, try to keep your balance considerably low to maintain a good credit usage rate. You can use your card sparingly or make several payments per month.

After obtaining a reliable credit history and credit score, you can apply for an unsecured card.

So, how about learning the best way to pick the best credit card for you? And we are not talking only about bad credit cards but in general. Then, check out the easy tips we have for you next.

5 easy steps to pick the best credit card for you

Turn you credit card into your new ally! Learn here step by step which factors you should consider when choosing the best credit card for you, according to your lifestyle

Trending Topics

How to choose the best credit card to travel?

How to choose the best credit card to travel? Find out the best tips to look for the right card for your next destination, wherever you go!

Keep Reading

E*TRADE Investing full review

E*TRADE brokerage account features a robust online platform that will help you trading. So, check out the E*TRADE Investing full review!

Keep Reading

How to apply for the First National Bank Lifestyle checking account?

Learn how to open a First National Bank Lifestyle checking account so you can watch your money grow with flexibility and some other benefits.

Keep ReadingYou may also like

Learn to apply easily for 100 Lenders personal loan

Do you need some money for an emergency or other personal matter? If so, read our post and learn how to apply for 100 Lenders personal loan!

Keep Reading

What is APR in credit cards: understand how it works

Are you interested in learning more about the APR (annual percentage rate), its benefits and risks, as well as how to avoid it? Take a closer look at what this term means for you.

Keep Reading

CitiBusiness® / AAdvantage® Platinum Select® Mastercard® review

Read this post if you want to learn more about the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® review and why it's a must-have for frequent American Airlines travelers!

Keep Reading