Credit Cards (US)

How to choose the best credit card to travel?

Do you know how to choose the best credit card to travel to? Follow the right tips to look for a card that gives you all on your next destination!

Credit Card to travel: earn miles to plan your next trip

Certainly, the best credit card to travel is one that gives you miles on every purchase you make. However, it is important to look for something else.

For instance, imagine that you are in the middle of a trip, and an emergency happens. In this case, if you don’t have insurance, you might face the worst scenario.

But, a few credit cards offer travel insurance and world-class assistance so you can feel peace of mind wherever you are.

Therefore, seeking a complete package of benefits designed for frequent travelers is crucial.

But, before telling you more about it, take a look at the basics: how a mileage program works!

Transfer Marriott points to American Airlines

Dreaming of an amazing getaway but don’t have the points to make it happen? You can read on to learn how to transfer Marriott points to American Airlines!

What is a mileage program?

Firstly, to choose the best credit card to travel, it is essential to learn what a mileage program is.

Not all cards offer miles as rewards. Since it has been considered a travel card, it is worthwhile to look for a card that gives you miles, although other cards may allow you to earn other types of rewards to redeem them for travel perks.

However, the best way to maximize travel benefits is to seek miles.

So, a mileage program is a package of miles earned when you use your credit card. Each card features a mile rate.

For example, you can earn 1X mile per dollar spent on fuel using the card.

It is important to consider the categories, as well. Then, imagine that you spend a lot on groceries. Therefore, a card that offers a higher rate for mile earnings in this category is worth considering.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How does a mileage program work when you have a credit card to travel?

Secondly, as mentioned above, a mileage program is a way to maximize your travel experiences since you can earn miles through purchases and then redeem them for airline tickets and to cover other travel expenses.

Basically, each dollar spent on something delivers a mile for you. In the end, you can accumulate enough miles to exchange for travel charges.

Also, it is important to mention that not all mileage programs are flexible. Many don’t cover all airline ticket costs, for example.

Thus, the best way to find the best credit card to travel with is to take note of your goals and needs.

How to choose the best credit card to travel?

Now, it is time to learn the best tips to choose your next card to travel abroad.

The list below gathers the main recommendations for you. But you may consider planning and defining your own goals, needs, budget, and profile before applying for a credit card.

1. Analyze costs

In the first place, analyze the costs associated with a credit card. Even if the card charges fees, the benefits must overcome the package of charges.

Moreover, there are many cards that don’t charge annual or monthly service fees. But they might not be the best for frequent travelers.

Although they are worth considering, it is important to seek to balance how much you will pay versus how much you will gain.

Additionally, choose a card that doesn’t charge foreign transaction fees.

2. Consider cards with good welcome bonuses

In the second place, consider choosing a credit card that offers welcome bonuses.

Many cards feature a reasonable welcome bonus in the form of miles.

Also, there are some cards that offer bonuses with flexible redemption so that you can redeem the bonuses earned for travel perks.

3. Explore rewards

You don’t need only to consider cards that offer mileage programs because many cards feature flexible reward programs with convenient redemption plans.

For example, you can earn points to redeem for airline tickets—or even cashback to pay for other travel expenses.

Thus, it is essential to consider all reward programs offered by credit cards because the best for you will be the one that provides you with a good reward rate along with flexibility and convenience.

4. Look for the international protection

As shown, when you travel, the most important thing is to feel safe and be assisted. Besides global acceptance, it is crucial to consider applying for a credit card that offers international protection.

Usually, the top-tier cards available on the market come with automatic global travel insurance. But you may find other less expensive cards with international coverage.

Also, it is crucial to look for cards that offer good assistance in case you are traveling abroad and need to speak with someone to help you out.

Don’t forget to consider choosing a card that features car rental perks, medical coverage, accident support, and other protection features.

5. Get the extra

Of course, getting a card with extra perks is just something more than essential when looking for a credit card to travel.

But it may help you with your next trip.

For instance, some cards offer hotel benefits, priority boarding passes, concierge services, lost baggage protection, upgrades, free checked bags, discounts on travel expenses, and more.

So, although it might seem irrelevant, you may save some time and money when choosing a card with the extra.

Recommendation: How to use American Airlines flight credit?

Now, learn how to use American Airlines flight credit to book your next trip in case you have canceled or not used your current flight ticket.

To sum up, American Airlines offers travel credits that are valid for a year from the issuance date. But you need to follow some steps to use the credit you have in your account.

So, take a look at how easy it is to access and add your travel ticket credit.

How to use an American Airlines flight credit?

American Airlines allows you to get credit if you have canceled or even not used your flight ticket. So, learn how easy it is to use an American Airlines flight credit.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

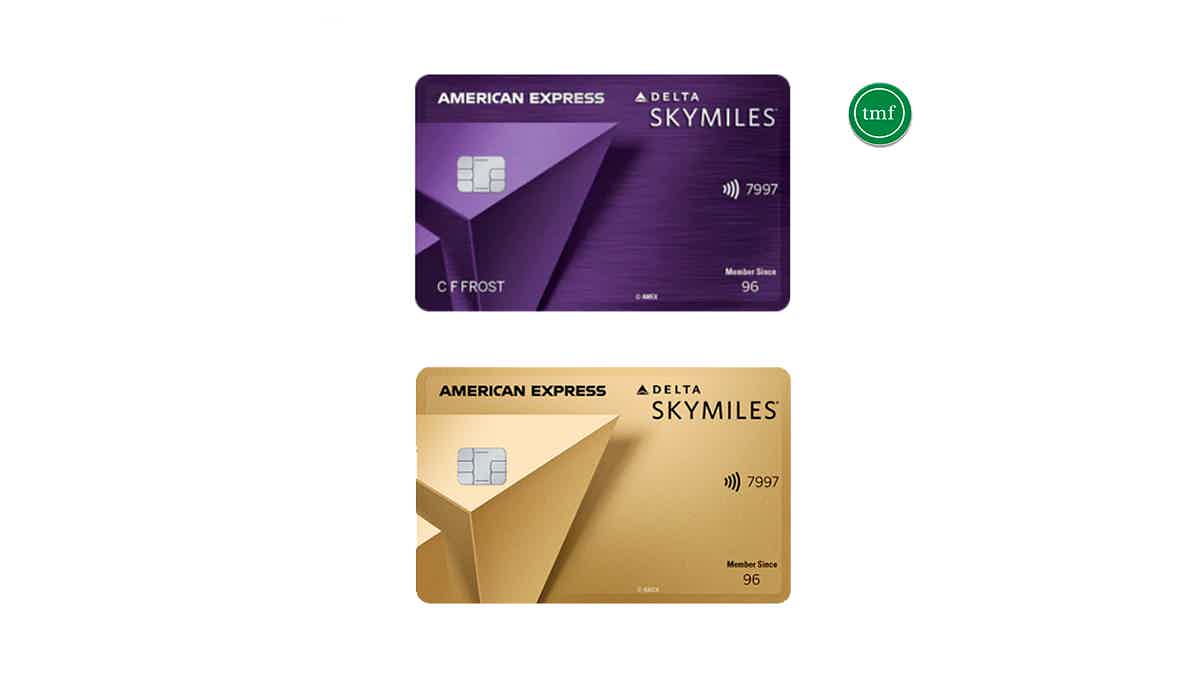

Delta SkyMiles® Gold American Express Card vs Delta SkyMiles Reserve: card comparison

Which is the best for you: Delta SkyMiles® Gold American Express card or Delta SkyMiles Reserve? Check out the comparison and decide today!

Keep Reading

Bluebird® American Express® Prepaid Debit Card review

Do you need a debit card with no monthly fees and Amex benefits? If so, read our Bluebird® American Express® Prepaid Debit Card review!

Keep Reading

Medicaid review: Health insurance program!

Do you need help finding health insurance or welfare programs? If so, you can read our Medicaid review to learn about this program!

Keep ReadingYou may also like

Affordable Connectivity Program (ACP): see how to apply

Access to the internet is a basic human right in today's world. Learn how to apply for The Affordable Connectivity Program, which provides low-cost broadband and Wi-Fi access to people who need it most.

Keep Reading

Luxury Gold credit card review: is it worth it?

The Luxury Gold credit card comes with heavy benefits - including its 22g metal card with 24k gold on it. The Mad Capitalist will show you everything about this premium travel card.

Keep Reading

Delta SkyMiles® Platinum Business American Express Card application

Using the Delta SkyMiles® Platinum Business American Express Card it's the perfect way to upgrade any trip, no matter how far you're going. Read on to learn how to apply!

Keep Reading