Credit Cards (US)

What stores give credit easily?

Which stores give you credit easily? Find out the main stores that offer simple eligibility requirements so you can access credit with ease.

Credit: easy access to store credit cards

Accessing credit might be challenging for many reasons. But some stores give credit easily with only a few eligibility requirements.

And for many reasons, it usually means people with bad or no credit history at all may face difficulties when applying for credit solutions, especially regarding traditional credit cards.

On the other hand, stores may give credit easily, even for poor-credit applicants.

However, it is important to do extensive research before deciding which store is the best, especially because getting credit requires attention and control of finances.

Fortunately, the list below will help you cut the path short. Then, take a look at it if you need to access credit easily.

7 best cards for electronic stores

Are you looking for the perfect card for rewards when shopping at your favorite electronic store? Read on to see the best cards for electronic stores!

What is a store credit card, and why is it easier to get?

A store card works just like a credit card. However, it usually does not allow you to use it outside of the particular store or chain of stores that issues it.

On the other hand, nowadays, many store cards are already available for purchases outside of the brand. Also, they come with rewards, although you may watch out for the fees and interest rates associated with them.

Of course, if you are already a specific store client, it is worth considering applying for the particular store card.

Applying for a store card regularly doesn’t demand hard and several eligibility requirements. Thus, the stores may give you credit easily, even if you don’t have a perfect credit score and history.

In addition, you may be able to get good discounts as well as great bonuses when purchasing from a specific brand.

Not to mention that you will be able to build credit while using the card in a responsible way.

On the contrary, these cards frequently have membership fees, which makes them a little more expensive than traditional credit cards.

In essence, it is crucial to understand all costs associated with a store card if you are considering applying for one. If you can handle it, you will definitely find it useful to get one since some stores give credit way more easily than banks.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Which stores give access to credit easily?

Many stores give easy access to credit. But you must be careful because it is easy to sink into debt, too, especially if you don’t have control of your finances.

Also, accessing credit means you will get a store card. And store cards are usually more expensive than traditional credit cards.

To sum up, it is essential to find the best deals. Fortunately, the list below considers great and reliable stores that give you credit easily with reasonable costs. Check it out!

1. Walmart® Store Card

Walmart features an easy way to get credit through its store card. The card accepts fair credit scores, and it features rewards as well as bonuses, including a welcome offer of five points per dollar spent on in-store purchases via Walmart Pay for the first 12 months.

In addition, the card offers from five to two points per dollar spent on purchases at Walmart stores and related brands.

Although you may watch out for the APRs, there is no annual fee or membership fee associated with a Walmart® Store Card.

2. Target Credit Card

Target Credit Card also accepts less-than-perfect credit scores.

Even though the regular APR is quite high, there are no membership or annual fees.

Plus, you will access valuable rewards and discounts, such as:

- 5% discount when purchasing at Target and related brands and partners;

- $40 discount on an eligible purchase when approved for credit;

- Special offers throughout membership;

- Free shipping days;

- Extended returns.

Then, if you regularly buy at Target, you will find this card useful.

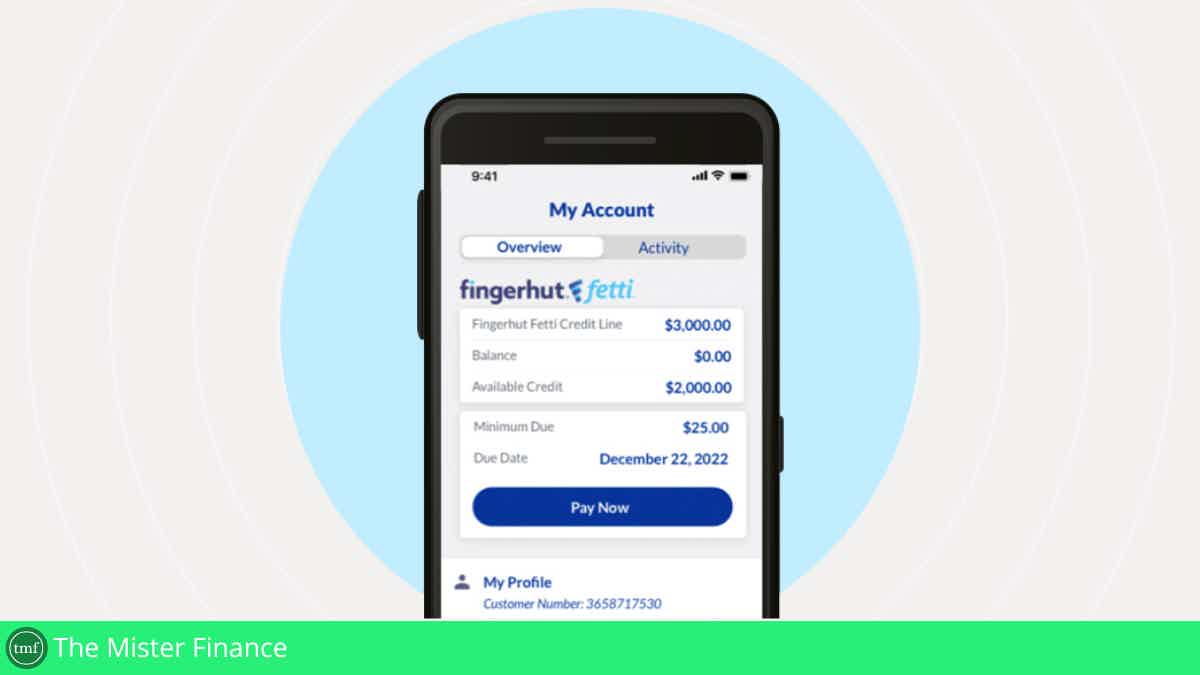

3. Fingerhut Credit Account

On the other hand, suppose you have bad credit; Fingerhut offers one of the easiest ways to access credit with ease.

Its account has no fees, although the APR is high. But it does not require a security deposit.

So, it is one very fair way to get credit with confidence.

How to apply for the WebBank/Fingerhut account

Do you need to purchase at your favorite brands with no hidden fees? Read on to learn how to apply for the WebBank/Fingerhut Credit Account!

4. Kohl’s Credit Card

Now, if you frequently purchase at Kohl’s, a Kohl’s Credit Card is definitely worth considering. Luckly, Kohl’s is one of the stores that give credit easily to its customers.

In summary, the card has no annual or membership fees. And it gathers many good deals, including:

- 35% discount on your first purchase made within 14 days from credit approval;

- 7.5% back in rewards on eligible purchases;

- Special anniversary offer;

- Many discounts throughout the year;

- Promotional events throughout the year;

- Free shipping events and more (conditions apply).

Of course, the APR is quite high, as it happens to several store cards.

But you can access credit easily at a very low cost.

How to apply for Kohl’s Card?

Looking for a card that can give your discounts and more with no annual fee? If so, you can read on to learn how to apply for Kohl’s Card!

5. Amazon.com Store Card

Lastly, a card for frequent Amazon clients.

Contrarily to the other cards mentioned above, this one offers an introductory APR of 0% for six to 24 months. Then, the APR is competitive.

Moreover, there are no membership or annual fees.

Also, you will get amazing offers, including 5% back on Amazon.com purchases and a welcome bonus of $60 as a gift card (loaded automatically into your account once you are approved in an application).

Recommendation: what is a store card? A complete guide to using it

Now you know the best stores that give you credit easily.

However, it is essential to learn how a store card works. Usually, those cards are more expensive than traditional credit cards, even though you will be able to access them more simply than regular bank cards.

Thus, it is crucial to find out the advantages and disadvantages of holding a store card instead of a credit card.

Read the complete guide prepared in the following article before deciding to proceed with a store card application, then.

What is a store card? A complete guide

What is a store card? Does it work like a traditional credit card? What are the differences? Learn all about it on this complete guide on how to use it.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for an Athleta Rewards Mastercard®?

If you are an Athleta client or even if not but love buying premium versatile clothes, learn how to apply for an Athleta Rewards Mastercard®!

Keep Reading

What are digital nomads and where can you get a digital nomad visa?

Learn what a digital nomads is and where you can get a digital nomad visa to travel worldwide while working and living amazing experiences.

Keep Reading

Aspiration Spend & Save™ account full review

Check out our Aspiration Spend & Save™ Account review to find out more about this hybrid checking and saving account, and its benefits!

Keep ReadingYou may also like

Application for the Sam’s Club Credit Plus Member Mastercard card: how does it work?

If you're looking for a credit card that offers great rewards, then the Sam’s Club Credit Plus Member Mastercard is a great option. You can earn cash back on your purchases, and there are no annual fees. So how do you apply? Keep reading to find out.

Keep Reading

Discover it® Balance Transfer Credit Card application: how does it work?

Learn how to easily apply for the Discover it® Balance Transfer Credit Card today! Get 0% intro APR and other additional benefits! Keep reading!

Keep Reading

401 (k) plan: what is it and how does it work?

Retirement seems so far away when you're young. But when you notice, it is already time, and you're not prepared. Don't let that happen. This article will show you how to be ready with a 401(k) plan.

Keep Reading