Reviews (US)

Aspiration Spend & Save™ account full review

If you search for financial planning and conscience, you should look at accounts that provide checking and saving at the same place. Then, check out our Aspiration Spend & Save™ Account review!

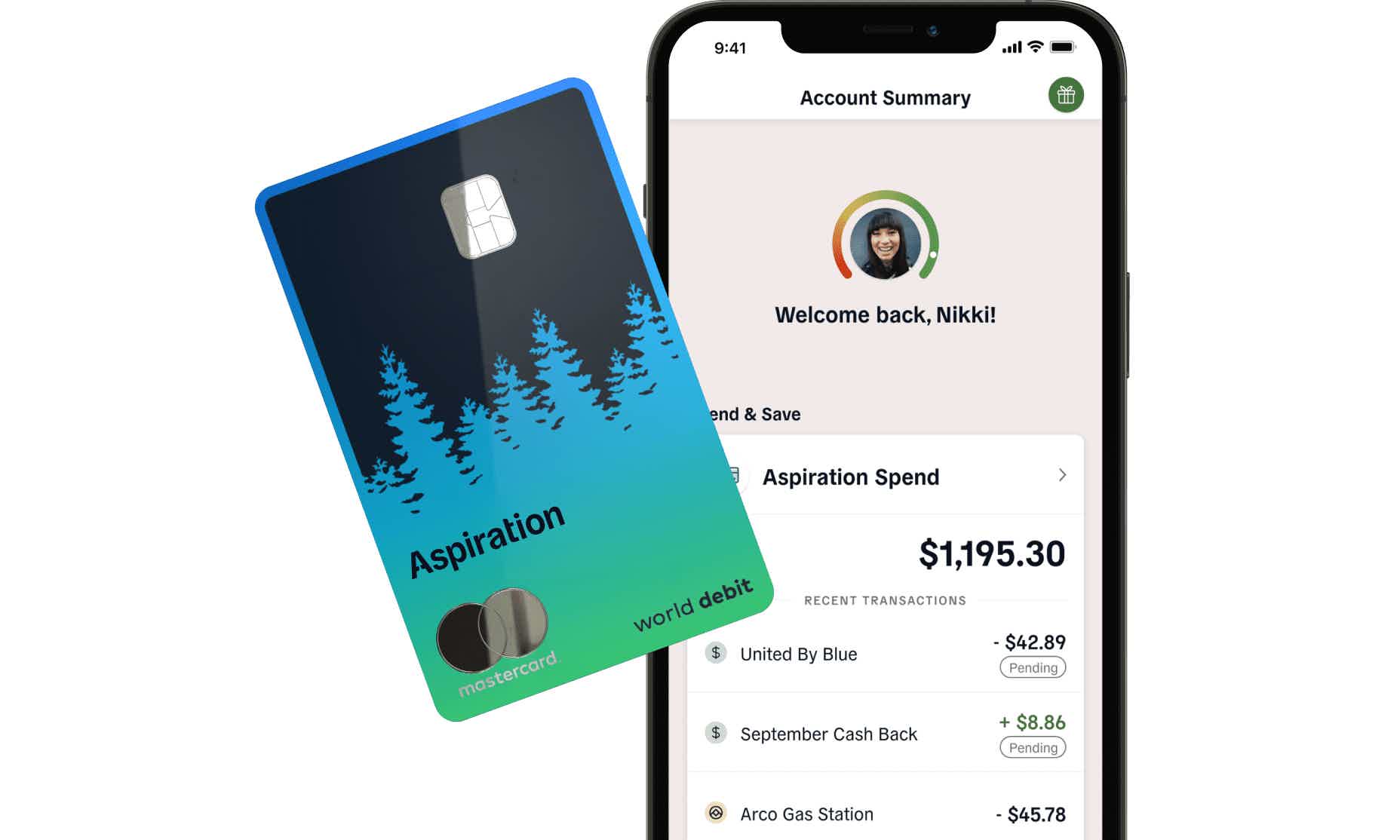

Meet the Aspiration Spend & Save™ Account

The Aspiration Spend & Save™ account is a hybrid of checking and saving. But, it offers more than just information and money yielding in the same place.

This account features cash back, FDIC insurance in case of bank failure, AIM score for knowing purchases impact in the world, and $0 out-of-network ATM.

So, keep reading our Aspiration Spend & Save™ Account review to learn more about it.

| Intro Balance Transfer APR | N/A |

| Regular Balance Transfer APR | N/A |

| Balance Transfer Fee | N/A |

How to apply for Aspiration Spend & Save™ Account?

The Aspiration Spend & Save™ Account is a hybrid account with perks and environmental conscience. Learn how to apply for it!

Check out all about the Aspiration Spend & Save™ Account

This account provides something very important these days: environmental protection and conscience. So, it is not only about growing money after all.

That is because it offers the AIM, a sustainability score that helps you find out how much your purchases and spending impacts the world.

Also, the Aspiration doesn’t fund fossil fuel projects, as well as it doesn’t support political campaigns of any kind.

Plus, it offers a mobile app and an online platform that makes it easy to manage all your financial information.

Firstly, you need to deposit $10 to start after opening the account. Then, it does not charge annual or monthly maintenance fees.

But, if you decide to join the Plus members club, you will pay $7.99 or $5.99 each month if you pay it annually.

The Basic account features up to 3% APY. On the other hand, the Plus account features up to 5% APY.

Moreover, it is the same for cash back rewards. With the Basic one, you can earn from 3% to 5% every time you make a purchase at a Conscience Coalition business, such as Cloud Paper, United by Blue, Lola, and many others! And with the Plus one, you can earn 10% cash back buying products from those brands using your Aspiration debit card.

Both types of accounts give you a debit card, but only the Plus gives you a recycled plastic card.

Finally, the two of them also provide unlimited and free transactions at Allpoint ATMs. However, only the Plus account offers one $0 out-of-network ATM fee.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Aspiration Spend & Save™ Account benefits and more

With this hybrid account, making a difference in the world will be as easy as managing your financial activity through its mobile app.

Also, you can get a welcome bonus of $200, with no monthly fees for the Basic account.

But, note that for a higher APY, you need to sign up for the Plus account.

Check out all the pros and cons before applying for it.

Pros

- Hybrid account

- No annual or monthly fee for the Basic account

- Environmental conscience

- Up to 5 transactions a day at ATMs (at Allpoint is for free and unlimited); Plus members get one $0 out-of-network ATM fee a month

- FDIC insurance

- Cash back rewards

- Mobile app

- Welcome bonus

Cons

- Minimum deposit of $10 to open the account

- Average APY offered is quite low if compared to other similar accounts

- If you want to get more rewards, you need to sign up to the Plus account

- Foreign transaction fees

Credit score recommended

The only thing required for the application process is a U.S. bank or credit union saving or checking account to fund the initial $10 deposit.

Learn how to apply for an Aspiration Spend & Save™ Account

If you are looking for a hybrid account with perks, no hidden fees, and an environmental commitment, learn how to apply for the Aspiration Spend & Save™ account on the link below!

How to apply for Aspiration Spend & Save™ Account?

The Aspiration Spend & Save™ Account is a hybrid account with perks and environmental conscience. Learn how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

What are Vocational training programs?

Have you wondered what are Vocational training programs? If so, we can help you understand what they mean and how to join. So, read on!

Keep Reading

Can you open a UK bank account from abroad?

Are you looking for ways to open a UK account from abroad with your favorite bank? If so, you can read our post to learn more!

Keep Reading

Learn to get medical assistance from the government!

You can learn if you can get medical assistance from the government! Read our post to find out if you qualify!

Keep ReadingYou may also like

How to open an Axos High Yield Savings Account easily

If you're looking for an online savings account, the Axos High-Yield Savings account is a good place to start. Learn about its features and application process here!

Keep ReadingHoly Bible App: Listen online, download now!

Find the best Holy Bible app for listening or reading on your phone, with audio in English or Spanish. With Bluetooth and headphone options, you won't ever have to leave home without it!

Keep Reading

How much should you save to move out: is $5000 enough?

If you're wondering how much money you need to save to live independently, this is the guide for you. Figure it out here!

Keep Reading