Earn a 2% APY on savings!

Walmart MoneyCard, maximize your cash back rewards at Walmart stores!

The Walmart MoneyCard is a reloadable debit card full of benefits. First, you earn cash back on purchases at Walmart. Second, you can get a 2% interest rate on savings. Third, you get an ASAP direct deposit with overdraft protection, and you can add members for free accounts. Plus, you can also use the card anywhere Visa or Mastercard is accepted.

The Walmart MoneyCard is a reloadable debit card full of benefits. First, you earn cash back on purchases at Walmart. Second, you can get a 2% interest rate on savings. Third, you get an ASAP direct deposit with overdraft protection, and you can add members for free accounts. Plus, you can also use the card anywhere Visa or Mastercard is accepted.

The Walmart MoneyCard is a reloadable prepaid Visa card that gives you convenient and easy access to your money. It's perfect for everyday expenses and emergencies. Check some of its benefits below!

The maximum amount you can reload on a Walmart MoneyCard is $2,999. It’s important to note that this also applies to the maximum in-store reload limit, and you cannot load more money into the card once it hits the maximum.

You can easily add money to your Walmart MoneyCard with cash at any participating Walmart store, by performing an online bank transfer after enrolling in direct deposit, or using the Walmart MoneyCard® mobile app to request a check deposit.

You can use this card anywhere Visa and Mastercard are accepted, but you’ll only earn cash back rewards by shopping at Walmart. By making purchases with your Walmart MoneyCard, you’ll get 3% back at Walmart.com, 2% back at Walmart fuel stations and 1% at Walmart stores. The spending caps is $75 per year.

If you’re a frequent Walmart shopper, you can benefit greatly from the Walmart MoneyCard. Check the link below to learn how you can apply for it.

How to apply for a Walmart MoneyCard debit card?

Earn cash back while shopping at Walmart with a Walmart MoneyCard! Check out how to apply for it!

But if you’re not a frequent Walmart shopper, there’s still a prepaid card with cash back rewards for you! With the Sable debit card, you’ll get 1% back on all your purchases, plus a ton of other benefits. Check the link below to learn more and how you can apply for it.

How to apply for a Sable Debit Card?

A Sable Debit Mastercard® card doesn’t require a social security number or credit history to apply for it. Learn now how you can get this card!

Trending Topics

12 best online broker accounts: start trading in 2022!

This article will show you what the best online broker accounts are so you can start planning your long-term investing today! Check it out!

Keep Reading

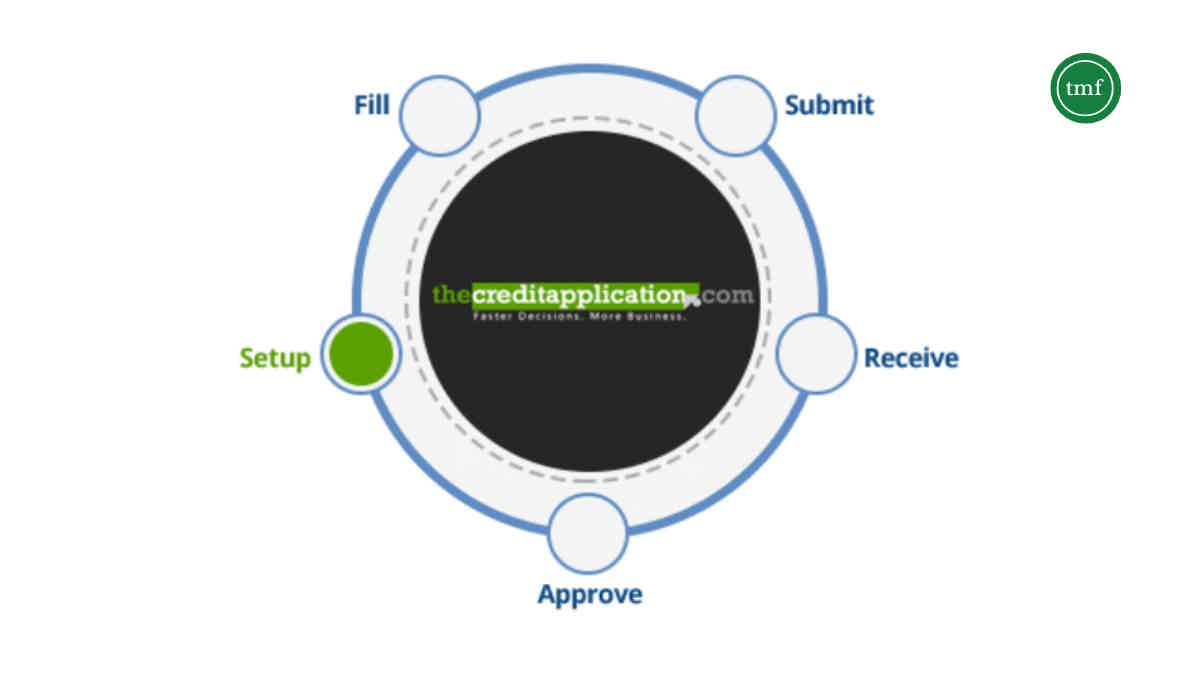

How to join Thecreditapplication.com?

Get the B2B credit application management you need by reading our post and learning how to join Thecreditapplication.com!

Keep Reading

How to apply for the Axos Personal Loans?

Check out how the Axos Personal Loans application works and how to borrow up to $50,000 with flexible terms and conditions, and fixed rates.

Keep ReadingYou may also like

What is overdraft: the invisible transaction cost

What is overdraft? Find the answer here. Learn how it works and how to avoid it, so you don't get hit with hidden fees. Check it out!

Keep Reading

First Citizens Bank Secured Cash Back Credit Card application: how does it work?

Find out if you can apply for the First Citizens Bank Secured Cash Back Credit Card. Earn unlimited 1% cash back at eligible purchases!

Keep Reading

The best free offline GPS: Never get lost again with these apps!

If you ever find yourself without an internet connection and in need of navigation, check out this list of the best free offline GPS apps for both iOS and Android devices.

Keep Reading