Read on to learn about a card with travel and cashback perks!

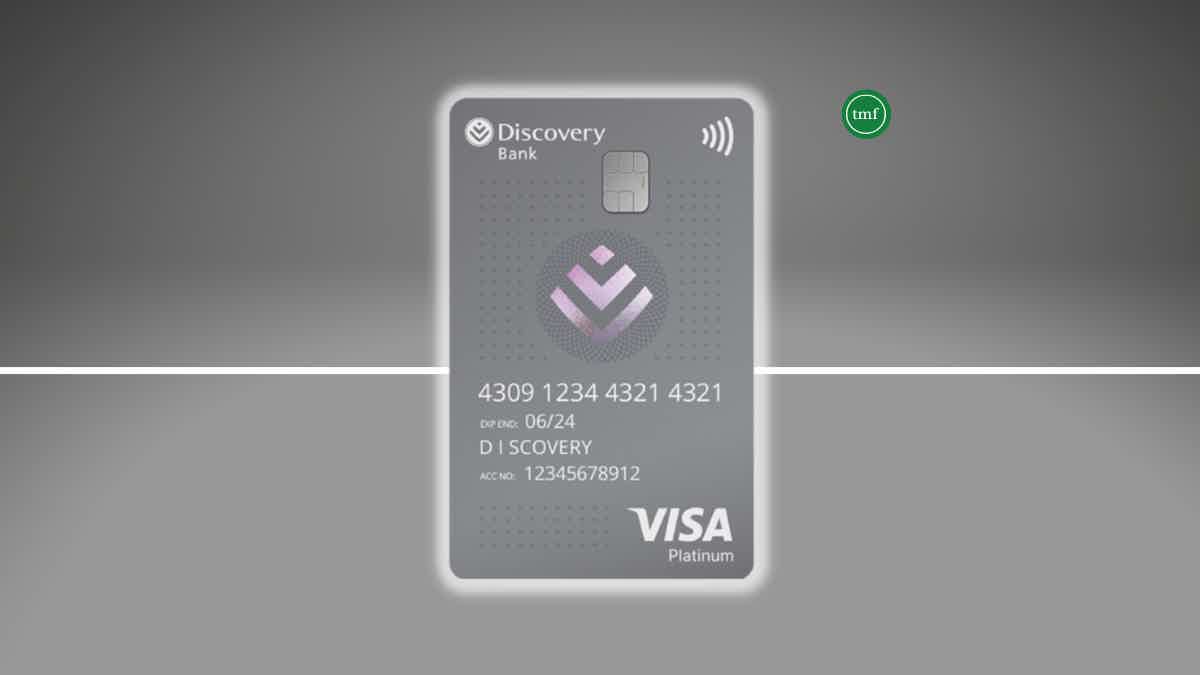

Discovery Bank Platinum Card, get rewards for Uber and other purchases!

With the Discovery Bank Platinum Card, you’ll be able to find travel discounts, such as up to 50% off for eligible local flights and more! Also, you’ll get cashback for HealthyFood, Uber, Shell, and other eligible purchases! Plus, this card allows you to access other incredible travel perks through Discovery Miles!

With the Discovery Bank Platinum Card, you’ll be able to find travel discounts, such as up to 50% off for eligible local flights and more! Also, you’ll get cashback for HealthyFood, Uber, Shell, and other eligible purchases! Plus, this card allows you to access other incredible travel perks through Discovery Miles!

See the main perks of the Discovery Bank Platinum Card!

You can earn incredible perks when using the Discovery Bank Platinum Card! For example, you can earn up to 50% cash back on HealthyFood, HealthyCare, and more! Plus, you can earn up to 15% cash back on Uber rides and fuel purchases at BP and Shell! Also, you’ll get access to travel perks, such as up to 50% off eligible local flights!

You’ll need to meet some requirements to qualify for the Discovery Bank Platinum Card, such as having an eligible income ranging from R350,000 to R850,000 per year. Plus, you’ll need to meet some other financial requirements and have a valid South African ID and address.

Even though you can get many perks with the Discovery Bank Platinum Card, you’ll also need to pay some fees. For example, there is an R145 total monthly fee, cash withdrawal fees for local and international ATMs, and many more common credit card and account fees.

Yes! You can find ways to spend with your card and use your account while making investments. For example, you can use Discovery PrimeFlex to invest and make the most of your money! Plus, you can earn DIscovery Miles when you invest!

Is the Discovery Bank Platinum Card what you’ve been looking for in a card and account? If so, you can learn how to apply for it in our application post below. Read on!

How to apply for the Discovery Bank Platinum Card?

If you need a card with rewards, travel discounts, and much more? Read on to apply for the Discovery Bank Platinum Card!

Are you not so sure about getting the Discovery Bank Platinum Card? If so, you can find a different Discovery card opinion, such as the Discovery Bank Gold Card!

With this card, you’ll earn incredible cashback and other perks similar to the Platinum card! And you may even pay a lower monthly fee!

Therefore, check out our post below to learn how this card’s application process works! Read on!

How to apply for the Discovery Bank Gold Card?

Looking for a card with cashback for everyday purchases and discounts? Read on to learn how to apply for the Discovery Bank Gold Card!

Trending Topics

How to apply for a Woolworths Gold Credit Card?

Check out how to apply for a Woolworths Gold Credit Card and earn 2% back in vouchers each quarter on all your favorite Woolies purchases.

Keep Reading

Discovery Bank Gold Card review: Earn cash back!

If you need a credit card to help you save on your everyday purchases, read our Discovery Bank Gold Card review to learn more!

Keep Reading

FNB Aspire Credit Card review: Travel and eBucks perks!

If you're looking for a card with incredible travel and eBucks perks, read our FNB Aspire Credit Card review to learn more!

Keep ReadingYou may also like

How to earn extra money online: your guide to getting started

Do you want to know how to earn money online? You're in luck. There are lots of different ways to earn money without leaving your home. So read on and see which method is the best fit for you!

Keep Reading

Sam´s Club Credit Plus Member Mastercard credit card review: is it worth it?

Find out if the Sam’s Club Credit Plus Member Mastercard credit card is right for you. This no-annual-fee option offers rewards on gas, dining, and select popular categories. Read this review to learn more!

Keep Reading

Application for the Luxury Gold card: how does it work?

If you need some extra luxury in your life, this card is for you. Consider applying for the Luxury Gold card and get the VIP experience you deserve. This article will show you how to get one.

Keep Reading