SA

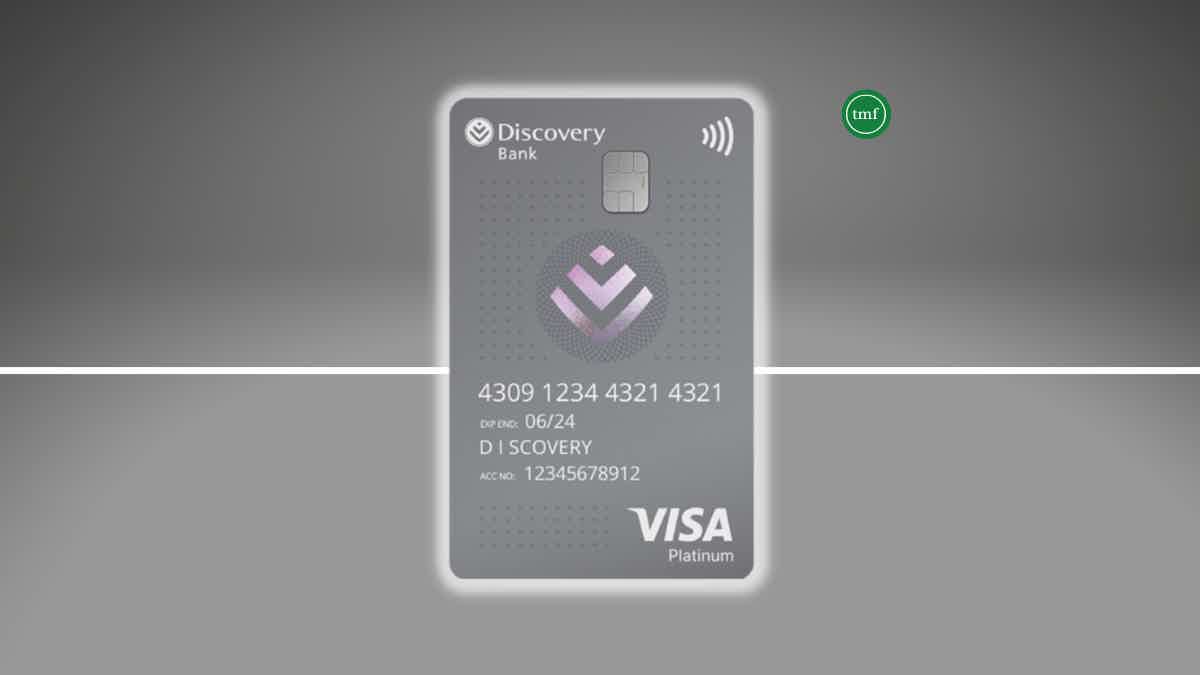

Discovery Bank Platinum Card review: Earn rewards!

If you need a card with travel discounts and other perks, read our Discovery Bank Platinum Card review to see its pros and cons!

Discovery Bank Platinum Card: Cashback on Uber and HealthyCare!

Are you looking for a card with great travel and cashback rewards? Look no further! You can read our Discovery Bank Platinum Card review to learn more about this card that gives South Africans fantastic benefits!

How to apply for the Discovery Bank Platinum Card?

If you need a card with rewards, travel discounts, and much more? Read on to apply for the Discovery Bank Platinum Card!

| Requirements | To get your card, you’ll need to earn an income ranging from R350,000 to R850,000 per year. |

| Initiation Fee | N/A. |

| Monthly Fee | R145 total monthly account fee. |

| Fees* | 55 days interest-free; You can pay up to 4% less on your borrowing rates; Cash withdrawals at local ATMs: R5 +2.25% of withdrawals amount; International ATM cash withdrawals: R80; There could be more card and account fees. *Terms apply. |

| Rewards* | Up to 50% cash back on HealthyFood-eligible purchases; Get up to 50% off eligible local flights; Up to 15% cash back eligible Uber rides; Get up to 15% cash back on eligible fuel purchases at BP and Shell; Earn Discovery Miles to find more ways to spend and get rewards! *Terms apply. |

Also, this card has incredible benefits, including Uber cash back, HealthyCare and HealthyFood discounts, airport lounge access, cell phone insurance, and more!

Moreover, in this blog post, we’ll take an in-depth look at the features of this card to help you decide if it’s the right choice for your lifestyle!

Keep reading this review to discover why the Discovery Bank Platinum Card might be just what you need when planning your travels or seeking quality healthcare products and services!

How does the Discovery Bank Platinum Card work?

The Discovery Bank Platinum Card provides points on your travels and gives customers various cashback features such as Uber rides and HealthyCare rewards!

Also, it’s the perfect way to pay for your daily needs without getting overwhelmed by high-interest payments.

Moreover, you can find ways to pay up to 4% less on your borrowing rate. And you can get up to 50% off eligible local flight deals!

You will be redirected to another website

Discovery Bank Platinum Card benefits

As we mentioned, this card offers incredible benefits to its users. For example, you can even find cashback when buying the latest iPhone and other items!

However, this card also has some cons to it. So, read our pros and cons list below to learn more about it!

Pros

- You can get flight discounts and pay less on your borrowing rate;

- There is up to 50% cashback on eligible purchases;

- You’ll find travel perks and discounts;

- Get access to Discovery Miles rewards and perks.

Cons

- The monthly fee can be high compared to similar cards;

- The rewards are not so simple to understand.

How good does your credit score need to be?

There is not much information about the credit score required to get this card. However, you’ll need to meet other requirements, such as having an income from R350,000 to R850,000 per year.

How to apply for the Discovery Bank Platinum Card?

You can easily apply for this card online through the official website. Also, you’ll only need to provide your personal information and check the requirements to complete the application!

How to apply for the Discovery Bank Platinum Card?

If you need a card with rewards, travel discounts, and much more? Read on to apply for the Discovery Bank Platinum Card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Savvy Bundle Platinum Account?

Looking for an account with travel features and other platinum perks? If so, read on to apply for the Savvy Bundle Platinum Account!

Keep Reading

FNB Petro Credit Card review: Roadside assistance!

If you need a card with free emergency roadside assistance, you'll need to read our FNB Petro Credit Card review to learn more!

Keep Reading

How to apply for the Sanlam Personal Loans?

Learn how easy it is to apply for Sanlam Personal Loans and borrow up to R300,000 to repay in up to 6 years with personalized fees and rates.

Keep ReadingYou may also like

Apply for the Southwest Rapid Rewards® Premier Credit Card

Our guide provides simple steps to apply for Southwest Rapid Rewards® Premier Credit Card. Earn up to 3 points per $1 spent and enjoy exclusive perks!

Keep Reading

Learn to apply for the Achieve Personal Loan (formerly FreedomPlus)

Need access to quick, reliable funds? Find out how easy it is to apply for the Achieve Personal Loan! Borrow up to $50,000 in no time!

Keep Reading

Chase Freedom Flex℠ review: is it worth it?

A good credit card is not just for spending money but to get valuable benefits. Chase Freedom Flex℠ is an excellent credit card. We'll tell you more about it in this review.

Keep Reading