Credit Card (UK)

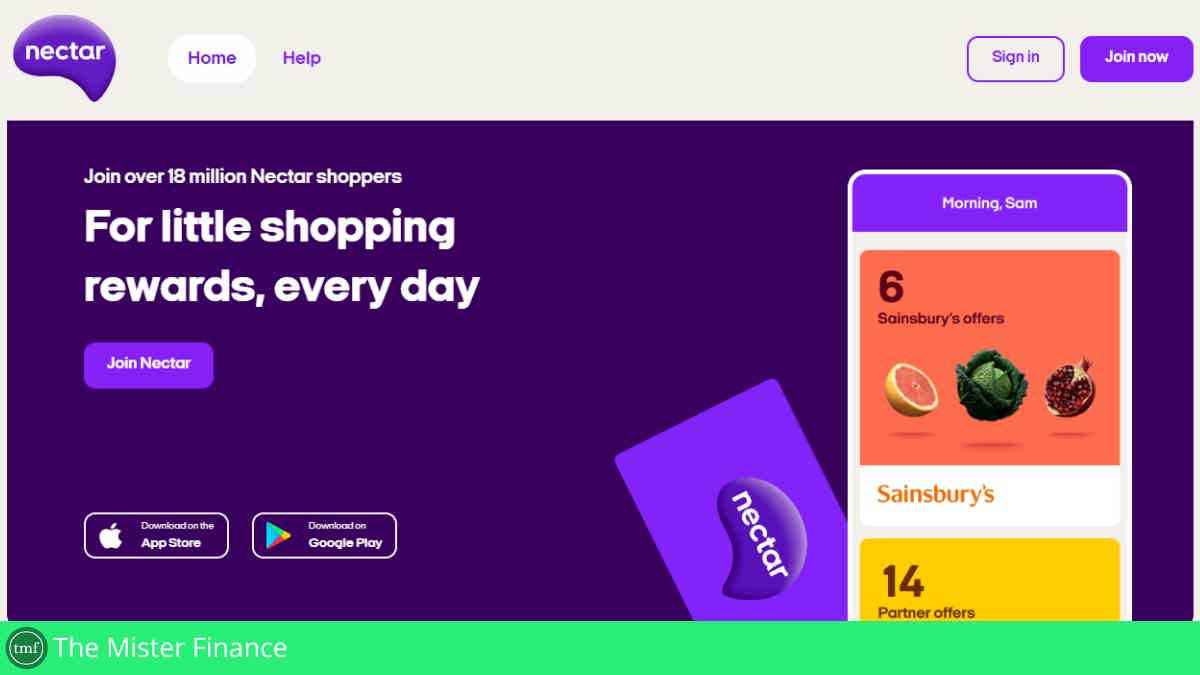

Nectar Credit Card review: earn points on all purchases

Are you looking for a card that gives you points on all purchases? Then, read this Nectar Credit Card review to find out how this AMEX works.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

Nectar Credit Card: up to 3X points on purchases

An AMEX is always a good choice, but you will see on this Nectar Credit Card review if this particular AMEX is worth considering.

How to apply for the Nectar Credit Card?

Check out how to apply for a Nectar Credit Card and start earning up to 3X points on eligible purchases at no annual fee in the first year.

First of all, the card waives its annual fee in the first year. Then, the benefits compensate for the fee charged.

| Credit Score | Good – Excellent |

| APR | 34.3% (representative and variable);28.8% on purchases (variable) Rates & Fees |

| Annual Fee | £25 (£0 in the first year) Rates & Fees |

| Fees | Cash advance: 3% (£3 minimum) Balance and money transferFee: 3% of the amount of the transfer Copy statement fee: £2 for each additional copy Foreign usage: non-sterling transaction fee – 2.99% Late Payment: £12 Returned Payment: £12 Rates & Fees |

| Welcome bonus | 20,000 bonus Nectar points after spending £2,000 within three months *Terms Apply |

| Rewards | 3X Points for each £1 spent on spending at Nectar partners; 2X Points for each £1 spent on purchases *Terms Apply |

Furthermore, you will earn up to 3X points on eligible purchases, besides the generous welcome bonus.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How does the Nectar Credit Card work?

American Express is always a good choice when it comes to credit cards. The many options available make it hard to choose the best, though.

So, today, on this Nectar Credit Card review, you will find out about a reasonable option if you are looking for rewards, a welcome bonus, and competitive rates and fees.

Firstly, Nectar features an introductory bonus of 20,000 points once you spend £2,000 in the first three months of Cardmembership.

Also, you will earn the following:

- 3X Points for each £1 spent on spending at Nectar partners;

- 2X Points for each £1 spent on other purchases.

In addition, you may earn 5,000 points after inviting a friend if they are approved.

The redemption program is flexible, and you get other advantages as follows:

- Purchase and Refund Protection;

- American Express Offers and Experiences;

- Global Assist®;

- Fraud Guarantee.

On the other hand, you may watch out for the fees and rates, although they are competitive compared to other similar cards.

Lastly, to be eligible, you must be at the age of majority and living in the UK. Plus, it is important not to have a history of bad debt.

Nectar Credit Card benefits

Even though the card comes with an annual fee, the advantages offered overcome possible costs.

Additionally, the fee is waived in the first year.

Pros

- The card offers up to 3X points on eligible purchases;

- It features a generous welcome bonus;

- The annual fee is waived in the first year;

- The card gathers travel perks, assistance, fraud protection, and more.

Cons

- There is an annual fee after the second year;

- The higher tier of rewards is limited to eligible purchases.

How good does your credit score need to be?

Although the information is not fully disclosed, American Express usually requires good creditworthiness in the application.

Moreover, it is crucial to check the eligibility requirements before applying.

How to apply for a Nectar Credit Card?

If you want to accumulate points to redeem at the Nectar partners, learn how to apply for a Nectar Credit Card.

How to apply for the Nectar Credit Card?

Check out how to apply for a Nectar Credit Card and start earning up to 3X points on eligible purchases at no annual fee in the first year.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

TOP 10 crypto millionaires of the world: who are they?

Check out who the greatest crypto millionaires are and how they got there so you can start planning your investments to achieve wealth too!

Keep Reading

How to apply for the Credit One Bank NASCAR® Visa credit card?

The Credit One Bank NASCAR® Visa credit card is a good choice if you love NASCAR and want to rebuild your credit score. See how to apply!

Keep Reading

CareCredit® card review: what you need to know before applying

Learn how a credit card designed for health care works with this CareCredit® card review post! Decide now if it fits your needs and budget!

Keep ReadingYou may also like

Get financial fitness with 7 steps: put your finances in shape!

When you hear the word "fitness," do you think about going to the gym to work out? You can get fit on your finances too. This article will tell you some easy steps to accomplish this.

Keep Reading

Is the U.S. headed for a housing crisis?

The housing market has been booming for years, but there are signs that a crash could be on the horizon. Find out what's causing it and what you can do to prepare.

Keep Reading

How to buy cheap flights on Kayak

Buy cheap flights on Kayak! Learn how to use this popular travel search engine's tools to get low-cost tickets from $29.99! Read on!

Keep Reading