Credit Cards (US)

How to apply for the Credit One Bank NASCAR® Visa credit card?

The Credit One Bank NASCAR® Visa credit card offers you the opportunity to rebuild your credit score while purchasing things you love at NASCAR Shop. See how to apply for it!

Credit One Bank NASCAR® Visa credit card application process

Even though the Credit One Bank NASCAR® Visa card charges annual and foreign transaction fees, it can help you with your credit score increase.

Also, it offers cash back on some purchases at NASCAR and discounts.

Plus, this card provides you with protection against fraud and ID theft, so you can relax knowing that you won’t be charged if unauthorized purchases happen.

Finally, you can access for free your Experian credit score while rebuilding it.

Therefore, if you are an automotive fan and looking for rebuild credit, the credit card might be perfect for you.

So, check out how to apply for it now!

This offer is currently inactive. Meanwhile, check how you can apply to a similar offer below.

How to get a Credit One Bank® Platinum Visa card?

Enjoy cash back on everyday purchases and Zero Fraud Liability with Credit One Bank® Platinum Visa! Learn how to apply for it.

Apply online

So, if you want to apply for the Credit One Bank NASCAR® Visa credit card, you just need to follow some simple steps!

First, access the website https://www.creditonebank.com/pre-qualification, so you can fill in the information to pre-qualify without impacting your credit score.

It is fast and easy, according to some clients.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Unfortunately, there is no mobile app dedicated to this card. But, you can download the Credit One Bank mobile app, after opening an account, to manage your finances.

Which is the best: Credit One Bank NASCAR® Visa card and HSBC Cash Rewards Mastercard® card comparison

The Credit One Bank NASCAR® Visa card has benefits that increase your credit score while purchasing automotive items. But, if you don’t think this card fits your needs, we present to you another great option available on the market, the HSBC Cash Rewards Mastercard® credit card.

| Credit One Bank NASCAR® Visa card | HSBC Cash Rewards Mastercard® card | |

| Credit Score | Bad – Fair | Good – Excellent |

| Annual Fee | From $39 to $99 | $0 |

| Regular APR | 23.99% variable APR | From 12.99% to 22.99% |

| Welcome bonus | N/A | 3% cash back on all purchases in the first year, up to $10,000 spent |

| Rewards | From 1% to 2% cash back on eligible purchases | 1.5% cash back on all purchases |

How to apply HSBC Cash Rewards Mastercard® card

The HSBC Cash Rewards Mastercard® credit card provides you with cash back and more. Check out how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

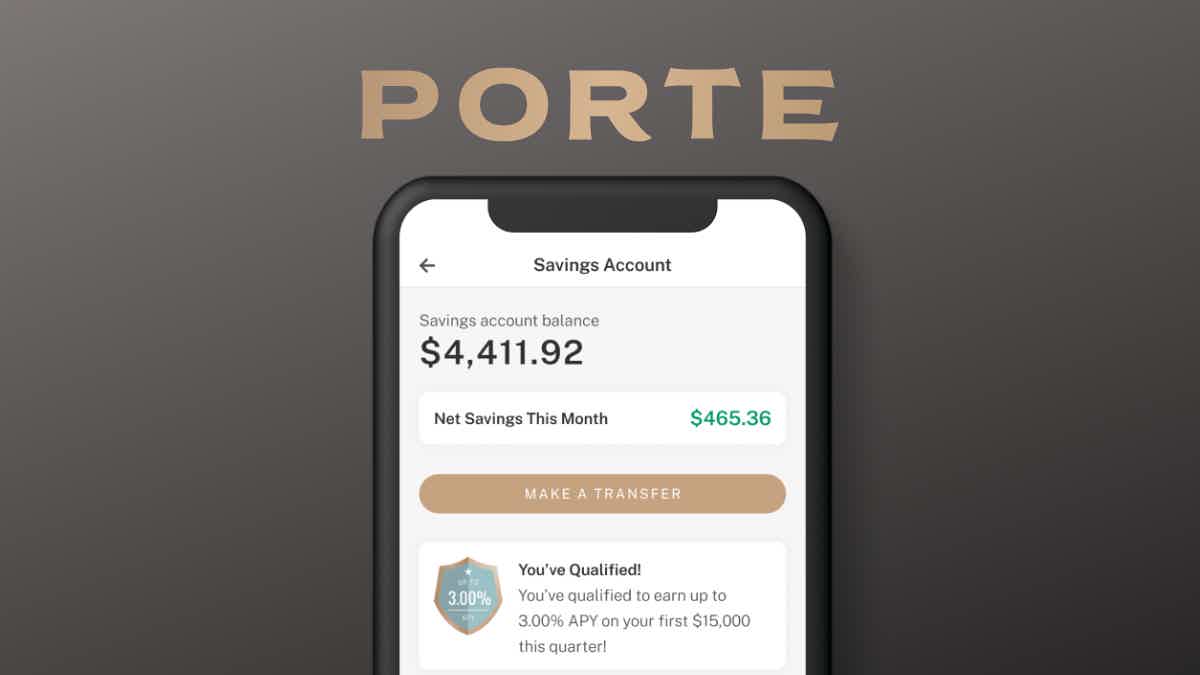

How to apply for the Porte Savings Account?

Find out how easy it is to apply for a Porte Savings Account and start earning up to 3.00% APY at no monthly service fees (conditions apply).

Keep Reading

SpeedyNetLoan review: what you need to know before applying

Check out the SpeedyNetLoan review article to find out how it works, its benefits, and more, so you can get the money you need right away!

Keep Reading

Find the best cards even if you have poor credit

Check our list of the very best cards for those with poor credit scores, a selection of solid choices to get you back into the credit scene!

Keep ReadingYou may also like

Cheap Frontier Airlines flights: Book flights for $19

Want to score a cheap flight on Frontier Airlines? Here's what you need to know about how their pricing system works. Find the best deals. Keep reading!

Keep Reading

GO2bank™ Secured Visa® Credit Card review: no annual fee

Keep reading to find out if the GO2bank™ Secured Visa® Card is what you need. You can do everything online. Check it out!

Keep Reading

Reflex® Platinum Mastercard® credit card review: is it worth it?

If you have bad credit, you know that it can be hard to find a card that is right for you. But don't worry, Reflex® Platinum Mastercard® can help you! Check out this review and learn how to use this product to rebuild your credit today.

Keep Reading