Credit Cards (US)

How to apply for the Credit One Bank® Platinum Visa credit card?

The Credit One Bank® Platinum Visa card is full of benefits, such as cash back, Visa security features, and much more. Check out how the application process works, and start earning rewards on your everyday purchases!

Credit One Bank® Platinum Visa credit card application: earn rewards on day-to-day purchases!

If you’re looking for a credit card with a low annual fee and many perks, you should learn more about the Credit One Bank® Platinum Visa credit card application.

This card offers unlimited 1% cash back on eligible purchases, such as gas, groceries, mobile, internet, satellite TV, and cable services. The rewards are automatically redeemed as statement credit into your account.

Although it charges an annual fee, it provides you with all the Visa benefits like Zero Fraud Liability, travels accident insurance, auto rental collision damage waiver coverage, and 24/7 roadside assistance.

Plus, you can get extra rewards if joining some perks programs featured by Credit One and Visa.

Check out how to apply for it today!

Apply online

The first step to apply for this card is to access Credit One Bank®’s website to find out if you’re pre-qualified. This process doesn’t harm your credit score!

Then, choose the Platinum Visa on the credit cards tab.

Once you’ve selected your card, fill in the forms with personal and contact information. Note that you’ll need an account at the bank in order to apply for the credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After getting approved, download the Credit One mobile app to manage all your financial information.

Credit One Bank® Platinum Visa credit card vs. Bank of America Customized Cash Rewards credit card

However, if you are still unsure if this Credit One Bank® card is the best option for you, don’t worry. There are other interesting alternatives available on the market.

So, check out our comparison table below to learn more about the Bank of America Customized Cash Rewards credit card!

| Credit One Bank® Platinum Visa credit Card | Bank of America Customized Cash Rewards credit card | |

| Credit Score | Good | Good |

| Annual Fee | $39 | $0 |

| Regular APR | Variable 23.99% | From 13.99% to 23.99% (variable) |

| Welcome bonus | None | $200 online cash rewards plus 3% cash back in the category of your choice |

| Rewards | Unlimited 1% cash back on eligible purchases | 3% cash back in the category of your choice, 2% cash back at grocery stores and wholesale clubs, and 1% cash back on all other purchases |

How to apply for Bank of America Customized card?

The Bank of America Customized Cash Rewards Secured card has no annual fee and can help you build credit. Read more to know how to apply!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Acorns Visa™ Debit card review: Start investing!

Do you want to know how an incredible debit card with investment perks works? Then, read our Acorns Visa™ Debit card review!

Keep Reading

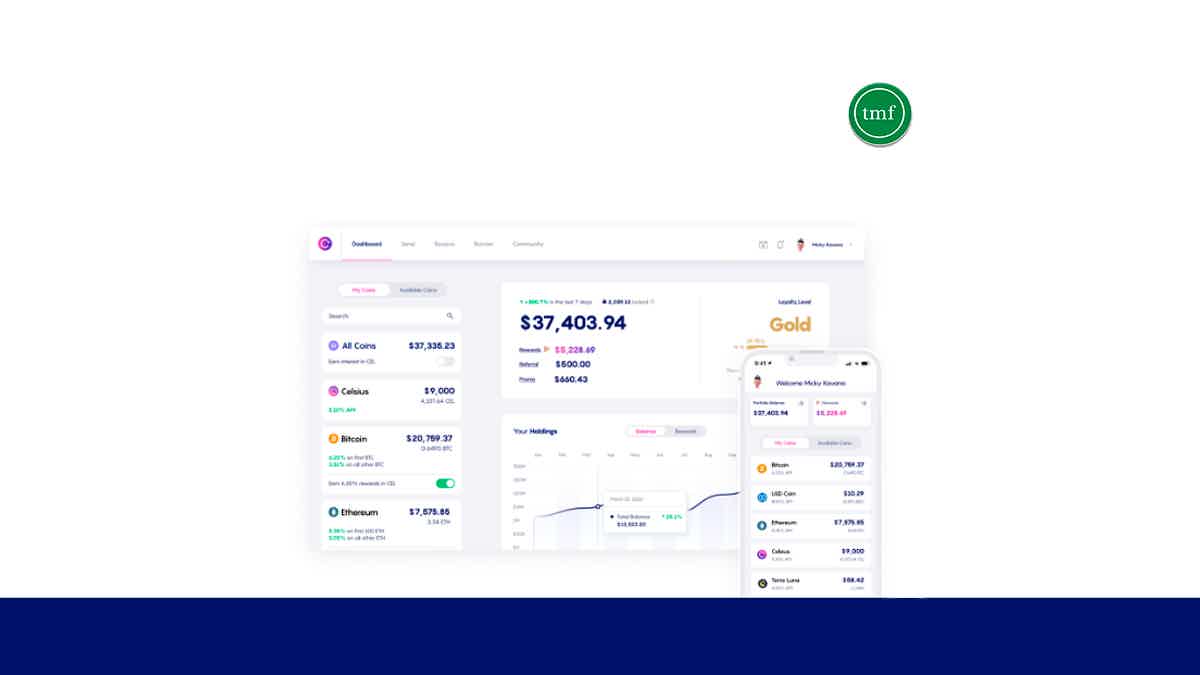

Celsius Network full review: is it good and safe?

Get the details about the Celsius Network in our full review. We'll show you its benefits, fees, and security so you can invest wisely!

Keep Reading

How do you get the Amazon Rewards Card?

Learn an easy step-by-step guide on how you can easily apply for the Amazon Rewards Card and earn rewards on all your purchases!

Keep ReadingYou may also like

Accepted Account application: how does it work?

If you are on the market for a credit line that you can use at an exclusive outlet, look no further than Accepted Account. Here you'll learn everything about the application process. Read on!

Keep Reading

First Phase Visa® Card application: how does it work?

Applying for a First Phase Visa® Card is straightforward! Learn how to get credit for the things you already do and make your everyday life a little bit easier. Read on!

Keep Reading

Chase Sapphire Preferred® Card review

Customers love The Chase Sapphire Preferred® card because of its lucrative sign-up bonus, big rewards, and flexible redemption options. Read this review to see if it's a good fit for you.

Keep Reading