Credit Cards (US)

CareCredit® card review: what you need to know before applying

Check out this CareCredit® card review article to understand how this card works and decide if it is suitable for you and your entire family, including pets.

CareCredit® card: access to health care for the whole family!

Did you know that it’s possible to have a credit card that also works as a loan for medical and health purposes? In this CareCredit® card review we’ll explain to you just how that works.

Everyone knows it can be challenging to pay for health and pet care in general, including labs, clinics, supplies, pharmacies, hospitals, dentistry, and everything related to it.

That is why credit cards specially designed for health care are being launched in the US. CareCredit is one of them.

But it doesn’t work like a credit card as we are already used to, and it is not a financial loan.

So, keep reading to learn everything about it before taking the next step of applying for one.

| Credit Score | Not disclosed |

| Annual Fee | None |

| Regular APR | It varies from 0% to 26.99% |

| Welcome bonus | None |

| Rewards | None |

How to apply for CareCredit®?

Learn how to apply for a CareCredit®, and have a powerful tool to help you with your medical bills!

How does the CareCredit® card work?

CareCredit is a card specially designed for those who want a helpful resource when it comes to health and pet care.

It seems like a credit card, but it works like a loan.

First of all, it includes animal & pet care, chiropractic, cosmetic treatments, dentistry, dermatology, fitness, access to health systems & hospitals, labs & diagnostics, pharmacies, personal care, clinics, and much more.

Secondly, you can use it to pay off medical bills that aren’t covered by your insurance. The thing is that it offers better financing options than traditional loans and other cards.

In summary, you can choose financing options. And the interest charged will imply considering the term you select and payments you make. So, you can pay off your bills through 6, 12, 18, or 24 months, and if you manage to make the minimum payment for purchases of at least $200, there won’t be interest charged.

Also, the card allows you to extend the term and financing options. But, higher interest will be applied.

Moreover, it is essential to remember that interests will be applied in case you won’t manage to pay off your debt in the period chosen, as happens with any other type of credit.

Carecredit offers you the possibility to prequalify with no hard inquiry. Furthermore, there is no activation fee associated with this card.

The issuer provides promotions on the website, as well as a payment calculator and mobile app.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

CareCredit® card benefits

CareCredit® is a tool for those who need help to pay off medical bills the insurance doesn’t cover. In case you don’t want to appeal for loans, this card might be a good alternative.

It offers flexible financing options with competitive rates.

In addition, the services covered include a full range of medical and vet treatments.

Plus, it provides resources and a mobile app for your convenience.

Pros

- It covers many services for the entire family;

- Also, it offers flexible financing options with competitive rates;

- It provides a mobile app and payment calculator;

- It offers prequalification.

Cons

- It doesn’t disclose all fees associated with the card;

- It doesn’t inform the credit score required.

Should you apply for CareCredit®?

If your insurance doesn’t cover all services related to health care, this card might be an excellent alternative for you since it works like a loan but with more competitive rates than those resources.

What credit score do you need for CareCredit®?

Unfortunately, it doesn’t disclose this information.

How to apply for a CareCredit® card?

If you need help to pay for your medical bills, find out how to apply for a CareCredit card below!

How to apply for CareCredit®?

Learn how to apply for a CareCredit®, and have a powerful tool to help you with your medical bills!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

TAB Bank Review: is it trustworthy?

Check out this TAB Bank Review article and learn how you can establish solid financial planning with its great full-service online banking.

Keep Reading

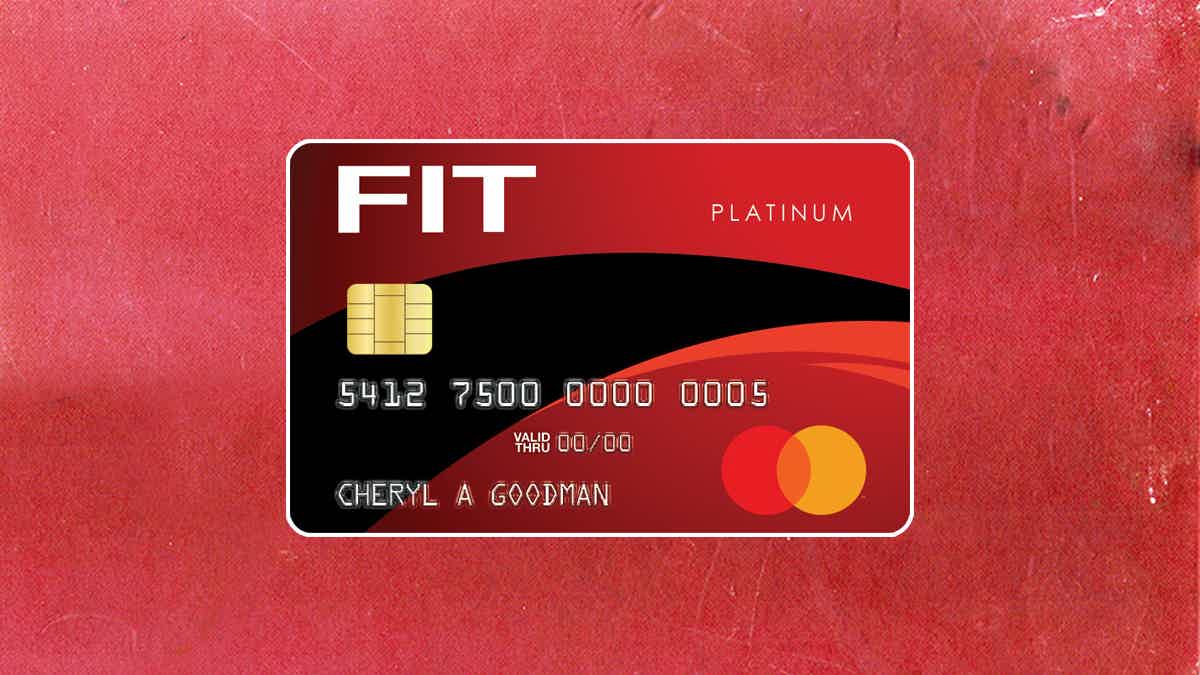

FIT® Platinum Mastercard® Card application

Do you need to reestablish your personal finances? The FIT® Platinum Mastercard® Card is a fantastic option! Learn how to apply for it.

Keep Reading

4 best crypto to buy on PayPal: read before buying!

Learn today the best crypto to buy on PayPal so you can invest in digital assets with the safety you need and the convenience you deserve.

Keep ReadingYou may also like

WWE Netspend® Prepaid Mastercard®: apply today

Apply for the WWE Netspend® Prepaid Mastercard® and simplify your finances - 0% APR and amazing benefits! Read on and learn more!

Keep Reading

Learn to apply easily for 100 Lenders personal loan

Do you need some money for an emergency or other personal matter? If so, read our post and learn how to apply for 100 Lenders personal loan!

Keep Reading

What is an emergency fund and why do you need one?

If you need to cover for a financial emergency today, are you prepared? What about facing unemployment? That's why you should have an emergency fund. We'll give you some easy tips to build one.

Keep Reading