US

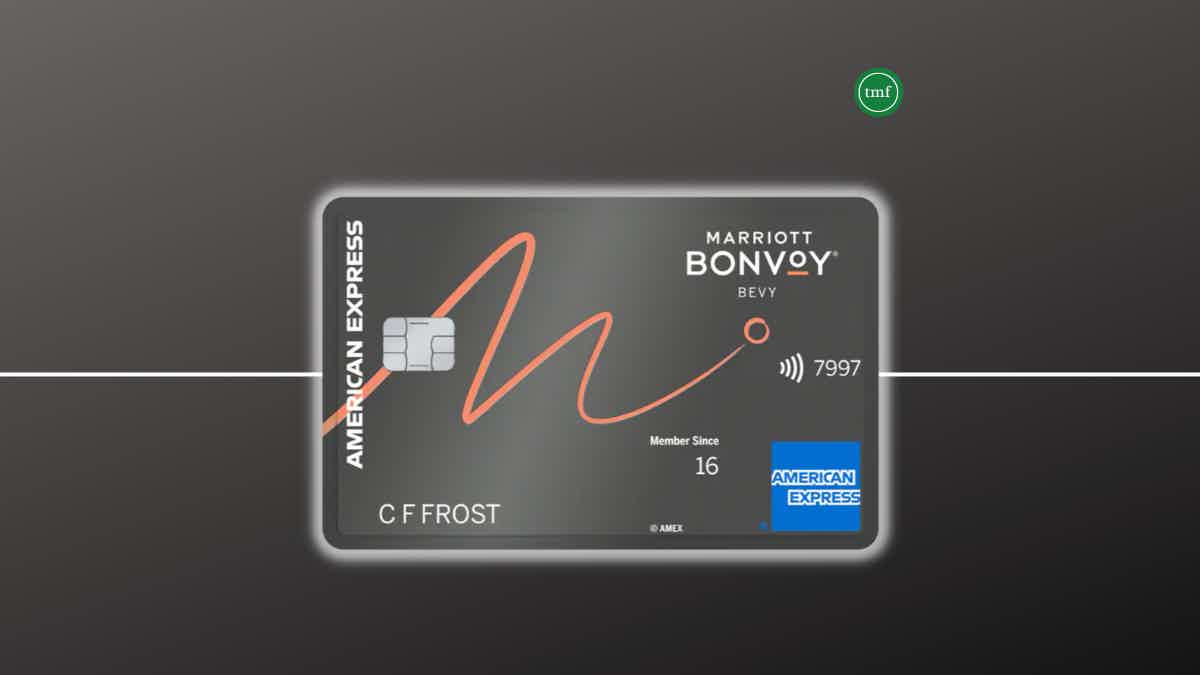

Marriott Bonvoy Bevy™ American Express® Card full review

Read on this Marriott Bonvoy Bevy™ American Express® Card review to learn how valuable this credit card might be for you that travel on a regular basis.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

Marriott Bonvoy Bevy™ American Express® Card: up to 6X points on eligible travel purchases

On this Marriott Bonvoy Bevy™ American Express® Card review, you will learn how this AMEX works as well as how valuable and how much it costs.

How to apply for the Marriott Bonvoy Bevy™ card?

Learn how to apply for Marriott Bonvoy Bevy™ American Express® Card and enjoy earning 125,000 Marriott Bonvoy® Bonus Points within 3 months.

As can be seen below, the Marriott Bonvoy Bevy card offers great rewards but comes with a high price.

| Credit Score | Good – Excellent |

| APR | 20.49%-29.49% for purchases 29.99% for cash advances APR is based on creditworthiness and varies according to the Prime Rate Rates & Fees |

| Annual Fee | $250 Rates & Fees |

| Fees | Cash advance: $10 or 5% of the amount of each transaction, whichever is greater Foreign Transaction: $0 Late Payment: up to $40 Overlimit: $0 Returned Payment: $40 Rates & Fees |

| Welcome bonus | 85,000 Marriott Bonvoy® Bonus Points after purchasing $4,000 within three months of card membership *Terms Apply |

| Rewards | 6X points on eligible purchases at participating Marriott Bonvoy® hotels; 4X points on dining (restaurants worldwide, plus delivery and take-out in the U.S.), up to $15,000 on purchases – then, 2X points; 4X points on groceries (at supermarkets in the U.S., up to $15,000 on purchases – then, 2X points); 2X points on other eligible purchases *Terms Apply |

Before making up your mind about this AMEX, keep reading to find out how it works and the details about it.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

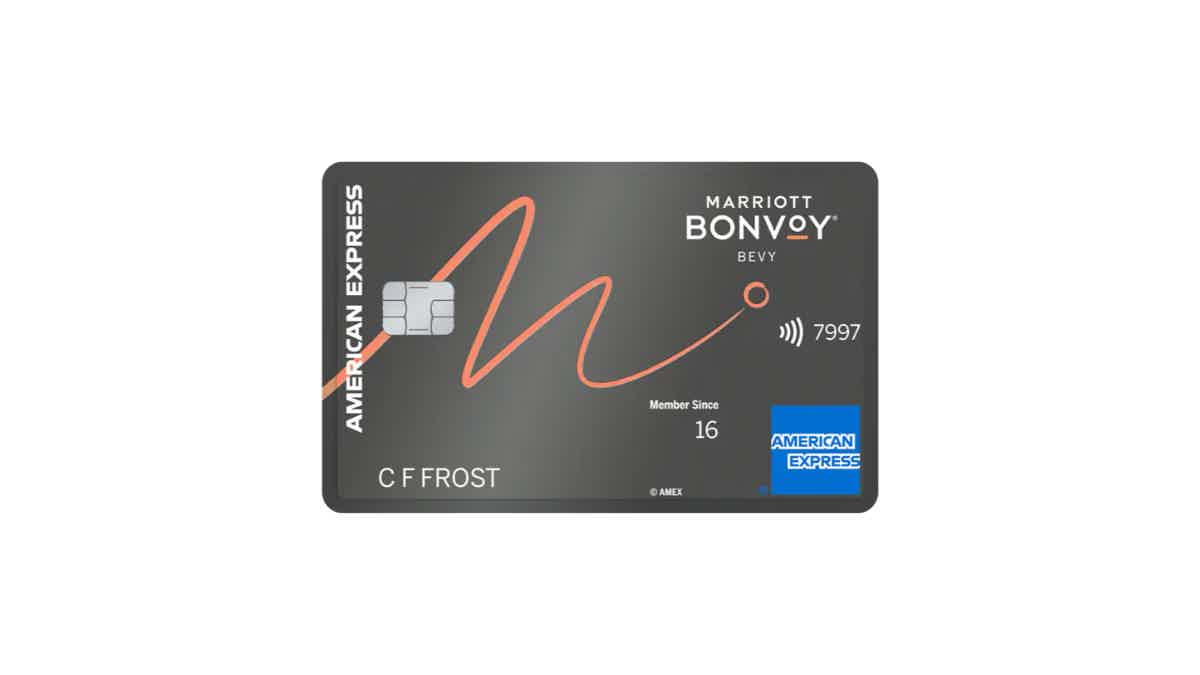

How does the Marriott Bonvoy Bevy™ American Express® Card work?

The Marriott Bonvoy Bevy™ American Express® Card might be seen as an amazing option for travelers. However, you must watch out for the fees.

On the other hand, if you usually stay at Marriott Bonvoy® hotels when traveling abroad, this credit card might take you to the next level when it comes to experiences and rewards.

Firstly, it offers 6X points on eligible purchases at participating Marriott Bonvoy® hotels, 4X points on dining, 4X points on groceries, and 2X on other eligible purchases.

Likewise, it features some perks for Marriott Bonvoy® stays, such as:

- A Free Night Award after purchasing $15,000 in a year;

- 1,000 Marriott Bonvoy® bonus points per eligible paid stay in participating hotels;

- 2.5X points on eligible hotel purchases.

However, it is important to mention that some reward rates come with a limit. For instance, both 4X-point rates have a cap of $15,000 in combined purchases. After achieving it, the rate decreases to 2X-point.

Of course, this AMEX provides some other traditional benefits you may love, as follows:

- No foreign transaction fees;

- Premium internet access in-room for free;

- Car Rental Loss & Damage Insurance;

- Trip Delay Insurance;

- American Express Experiences full of ticket presales and more;

- Purchase Protection & Extended Warranty.

Lastly, the card offers a generous welcome bonus of 85,000 Marriott Bonvoy® Points on the condition that you purchase at least $4,000 within three months of membership.

Summing up this Marriott Bonvoy Bevy™ American Express® Card review, this particular AMEX gathers fantastic perks for its cardholders.

However, it costs $250 per year. So, it is worth it if you usually travel and regularly stay at Marriott Bonvoy hotels. Otherwise, you may enjoy finding out about an alternative card in the next post!

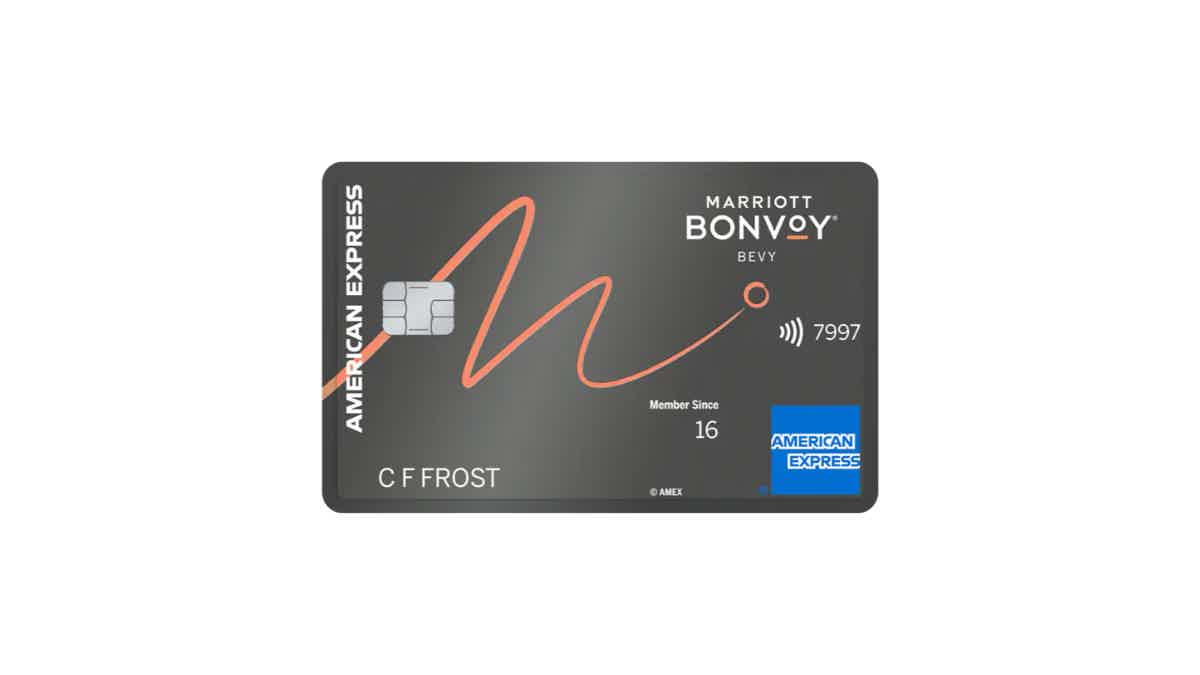

Marriott Bonvoy Bevy™ American Express® Card benefits

As shown above, in this review, the Marriott Bonvoy Bevy™ American Express® Card features a good reward rate in addition to a variety of perks specially designed for travelers who usually stay at Marriott Bonvoy hotels.

But it is crucial to watch out for the fees.

Before applying, check out the list of pros and cons!

Pros

- It offers up to 6X points on eligible purchases on hotels;

- 4X points at restaurants worldwide (up to $15.000);

- It features a generous welcome bonus;

- It provides you with a package of exclusive perks featured by American Express;

- It offers extra benefits like a Free Night Award and complimentary Marriott Bonvoy® Gold Elite status.

Cons

- Some reward rates come with a limit on spending;

- It charges an annual fee;

- APRs are quite high.

How good does your credit score need to be?

Of course, an elite card requires at least a good credit score. So, it is recommended that you apply for this credit card only if you have high creditworthiness.

How to apply for a Marriott Bonvoy Bevy™ American Express® Card?

Now, if you are interested in getting a Marriott Bonvoy Bevy card, check out how easy it is to apply for it by reading the step-by-step in the following post!

How to apply for the Marriott Bonvoy Bevy™ card?

Learn how to apply for Marriott Bonvoy Bevy™ American Express® Card and enjoy earning 125,000 Marriott Bonvoy® Bonus Points within 3 months.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more

Partner Offer through CreditCards.com

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Sable One Secured Credit Card review

If you want to earn rewards that really matter while you build your score, the Sable One Secured Credit Card is the answer to your prayers.

Keep Reading

20 real estate investing books for beginners: the best and essential ones

Do you want to start investing in real estate? Read more to see a list of 20 essential real estate investing books for beginners!

Keep Reading

How to apply for Equifax?

Find out how easy it is to apply for Equifax and get the right plan for you to stay aware of your credit & report monitoring and protection.

Keep ReadingYou may also like

GO2bank™ Secured Visa® Credit Card application: how does it work?

Find out if you are eligible for GO2bank™ Secured Visa® Card and learn the step-by-step to make your application today and have access to your account anytime and anywhere!

Keep Reading

What is a balance transfer credit card: is it a good idea?

Are you looking for a way to reduce your credit card debt? You may want to consider a balance transfer credit card. This product allows you to move your outstanding balance from one card to another, typically with a lower interest rate. Keep reading if you want to learn more!

Keep Reading

Juno Debit Card application: how does it work?

Apply for a Juno Debit Card and get all the benefits of a traditional banking account without visiting a physical branch. Read on!

Keep Reading