Loans (US)

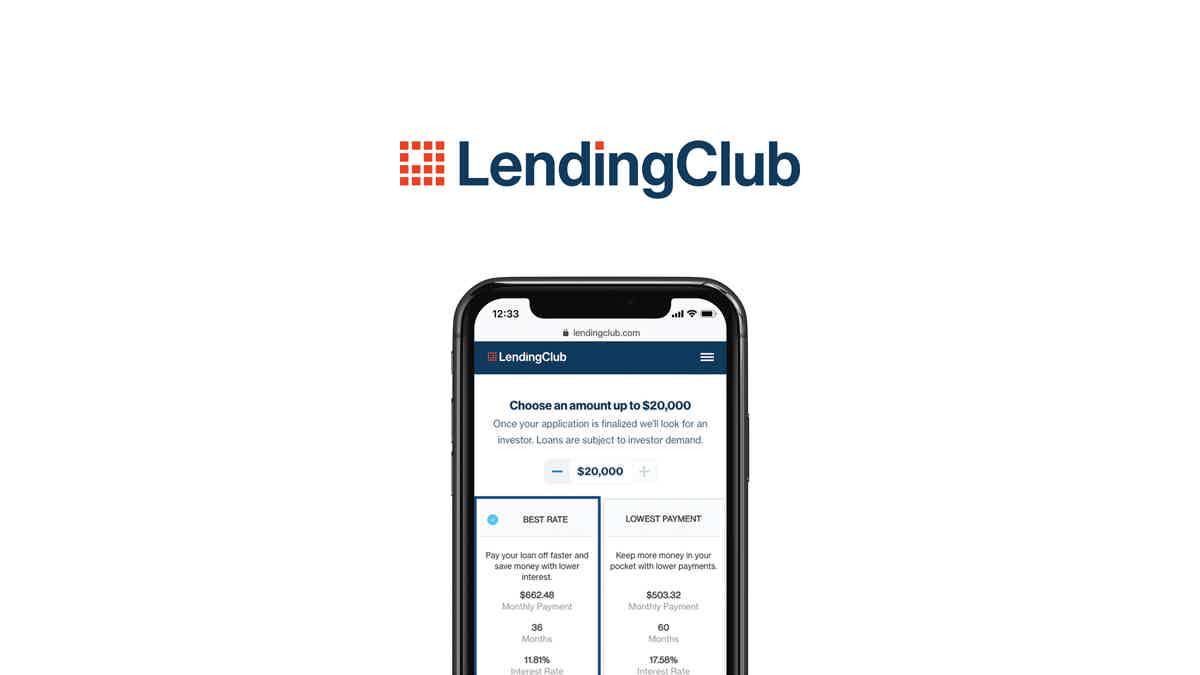

LendingClub Personal Loan review

Looking for a personal loan? Check out our review of LendingClub, one of the largest online lender in the country. We cover the pros and cons of their loans, as well as how to apply.

LendingClub Personal Loan: Competitive rates and good amount range!

If you need to make a personal loan to help pay down debt or any other type of emergency, the LendingClub Personal Loan can help you!

This lender offers great features for those with not-so-good credit scores, and you can get high loan amounts, depending on your context.

So, if you want to know more about this personal loan, keep reading our full review!

| APR | The APR ranges between 8.30% – 36.00%. |

| LOAN PURPOSE | You can use this personal loan to pay down debt or to use it for any other emergency. |

| LOAN AMOUNTS | The loan amounts you can get with this lender range from $1,000 to $4,000. |

| CREDIT NEEDED | We recommend a minimum credit score of 600 points. |

| TERMS | The terms range from three to five years. |

| ORIGINATION FEE | The origination fee charged ranges from 1% to 6%. |

| LATE FEE | The late payment fee is either 5% of payment or $15 after the 15-day grace period. |

| EARLY PAYOFF PENALTY | There are no early payoff penalties with this lender. |

How to apply for the LendingClub Personal Loan?

Do you need a loan to help you pay down debt and pay for other emergencies? Then, read more to know how to apply for the LendingClub Personal Loan!

How does the LendingClub loan work?

Once you get your loan application approved by this lender, you can have a loan term that ranges from three to five years.

Also, the loan amount you can make ranges from $1,000 to $40,000. You can get your loan fund within a week of applying.

Also, if something happens and you cannot make your repayment on time, you can change the payment due date.

In addition, this lender offers the feature of a member center. The LendingClub Member Center is available to help its clients manage and control their money in the best way possible.

You can track your credit use, credit score, and more.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

LendingClub Personal Loan benefits

Pros

- You can get the option of making joint loans.

- This lender only does a soft credit check that will not have a hard impact on your credit score.

- You can choose your payment date and change it later.

Cons

- This lender charges a relatively high origination fee. And other lenders do not even charge this kind of fee.

- You cannot make a loan with this lender to refinance another personal loan you might have.

Should you apply for the LendingClub Personal Loan?

Some people need to make loans to pay for some emergency or consolidate debt. If this is your case, you can apply for a loan with this lender.

However, you need to make sure that you can pay for the fees charged by this lender. Also, you need to know that you have the minimum score required to qualify.

Can anyone apply for a loan at LendingClub?

This personal loan is for those who have not-so-high credit scored and want to pay down debt or use the loan for other emergencies.

So, if you have the minimum credit score need and can pay the fees, you can apply for a loan with this lender.

What credit score do you need for LendingClub?

If you have a credit score of at least 600 points, you can have a chance of getting your loan application approved.

However, if you have a very bad credit score or no score at all, you might not be able to get approved for a loan with this lender.

How to apply for a LendingClub loan?

It can be easy to apply for a loan with this lender, and you can do it all online.

So, if you know you fit the profile to qualify for a loan application with this lender, read our post below to know more about the application process!

How to apply for the LendingClub Personal Loan?

Do you need a loan to help you pay down debt and pay for other emergencies? Then, read more to know how to apply for the LendingClub Personal Loan!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

X1 Credit Card full review: High rewards rate!

Do you need a card with incredible and different perks to earn rewards on everyday purchases? If so, read our X1 Credit Card review!

Keep Reading

Find the Best Visa Credit Cards and enjoy benefits!

Check our Best Visa Credit Cards; Visa credit card reviews and pick your next globally accepted credit card today with reliable information!

Keep Reading

How to apply for the U.S. Bank Cash+® Visa Signature® credit card?

The U.S. Bank Cash+® Visa Signature® credit card is a good choice if you want a variable reward program with no annual fee. See how to apply!

Keep ReadingYou may also like

Delta SkyMiles® Platinum American Express Card application

If you are looking for a travel credit card with benefits for travel and more, read our post to learn about the Delta SkyMiles® Platinum American Express Card application!

Keep Reading

First Access Visa® Card application: how does it work?

Want to know more about the First Access Visa® Card? We break down the application process, eligibility requirements, and more. Read on!

Keep Reading

How to buy cheap Frontier Airlines flights

Do you want to fly with affordable fares? Buy cheap Frontier Airlines with these tips. Find several discounts and save a lot. Learn how below!

Keep Reading