Financial Education (US)

How to increase your credit score

You may not know all the metrics related to the credit scoring system. You will know all the advantages, percentages, how to use it correctly and what you need to increase your credit score in the most efficient way possible.

Find the best way to increase your credit scores !

In this article, we will summarize all the information that is essential for obtaining your credit percentage. Analyze paragraph by paragraph and learn how to get a relevant and advantageous credit score. Have a great read and absorb as much data that will help you in the future!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

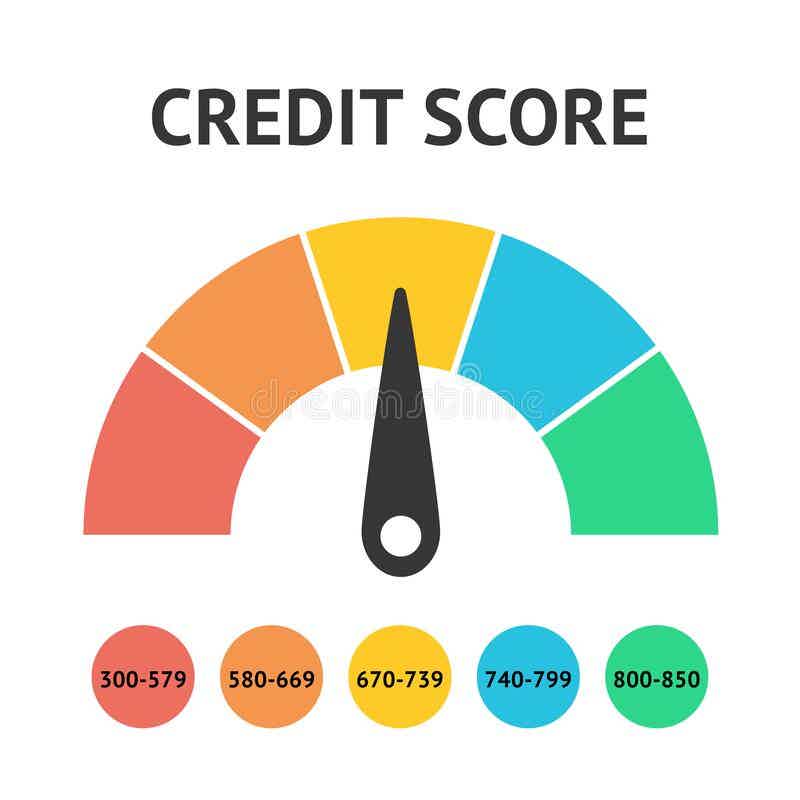

Know the score calculation

You can have dozens (if not hundreds) of credit scores. This is because the credit score is calculated by applying a mathematical algorithm to the information in one of the three credit reports, and not all creditors or other financial companies use a unified algorithm to calculate the credit score. (Some credit score models are very common, such as FICO®Score☉, which ranges from 300 to 850.)

However, you don’t have to worry about multiple scores, because the factors that cause the score to generally increase or decrease are similar in different scoring models. Consumer credit specialist Barry Paperno (Barry Paperno) said: “The reason the score goes up or down is always the same – it just depends on the grade.”

How to improve your score naturally

To improve your score, first check your credit score online. After obtaining the score, you will also receive information on which factors have the greatest impact on the score. These risk factors will help you understand the changes that you can start to improve your score. You need to take some time for creditors to report any changes made, which will be reflected in your credit score.

Obviously, certain credit score factors are generally more important than others. Among many credit score models, payment history and credit utilization are the most important. Together, they can represent up to 70% of the credit score, which means that they have an extremely high influence.

Focusing on the following actions will help to improve your credit score over time.

1. Watch your accounts

When creditors review your credit report and ask for a credit score, they are very interested in the reliability of your account payment. This is because the effect of previous payments is generally considered to be a good indicator of future results.

You can pay all bills on time according to the monthly contract, which positively affects this credit score factor. Delays in payment or account closure cost less than what you initially agreed to pay and can negatively affect your credit score.

You will want to pay all bills on time – not just credit card bills or any loans you may have (such as car loans or student loans), but also rent, utility bills, phone bills, etc.

2. By getting credit, you eliminate late payment for plans

If you have been making payments for utilities and mobile on time, there is a way to increase your credit score by counting those payments with a new free product called Experian Boost.

With this new optional product, consumers can allow Experian to connect to their bank account to identify payment history for utilities and telecommunications. After consumers verify the data and confirm that they want to add it to the Experian credit file, an updated FICO® score will be provided in real time.

Visit experian.com/boost to register now. When you sign up for free at Experian, you will immediately receive a free credit report and FICO® score.

3.The benefits when paying the bills

The credit utilization index is another important number when calculating credit scores. It is calculated by summing up all credit card balances at a given time and dividing by your total credit limit. For example, if you charge about $ 2,000 a month and the total credit limit for all cards is $ 10,000, the usage fee is 20%.

To find the average credit usage rate, check all credit card statements for the past 12 months. Add the balance of your monthly statement to all cards and divide by 12. This is the average credit limit you use each month.

Lenders generally prefer low interest rates of 30% or less, while those with the highest credit scores tend to have very low credit utilization. A low credit utilization rate tells lenders that you have not reached your credit card limit and that you know how to manage your credit well. You can positively affect your credit usage:

- Pay debts and keep your credit card balances low.

- Become an authorized user of someone else’s account (as long as you use credit responsibly).

4. New accounts, new benefits

It is not enough to open an account for a better credit portfolio – this may not improve your credit score.

Unnecessary credit can damage your credit score in many ways, from creating many difficult queries on your credit report to the temptation to spend too much and accumulate debt.

5. Analyze the validity of each card

Keep unused credit cards open – as long as they do not cost an annual fee, this is a smart strategy because closing accounts can increase credit card usage. Having the same amount, but having fewer accounts, will lower your credit score.

6. Review everything before making a request

Opening a new credit card may increase your overall credit limit, but the credit request will cause questions on your credit report. Many difficult queries will have a negative impact on your credit score, although that impact will disappear over time. Difficult queries will be kept on your credit report for two years.

7. Check each credit report

You should check the credit reports from all three credit reporting agencies (TransUnion, Equifax and Experian, editors of this article) for any inaccuracies. Incorrect information on the credit report can hurt your score. Check that the accounts listed in the report are correct. If you find an error, ask for information and correct it immediately. Regular monitoring of your credit status can help you identify errors before they cause damage.

How much is needed to redo each score?

If your credit report contains negative information, such as late payments, public record items (such as bankruptcy) or many inquiries, you must pay and wait. Time is your ally to improve your credit score. There is no quick way to resolve bad credit scores.

The time required to rebuild your credit history after a negative change depends on the reason behind the change. Most of the negative changes in credit scores are due to the addition of negative elements to the credit report, such as defaults or collections. These new elements will continue to affect your credit score until you reach a certain age.

- The default will be maintained on your credit report for seven years.

- Most publicly recorded items are kept on your credit report for 7 years, although some bankruptcies can be maintained for 10 years.

- These issues will remain in your report for two years.

It takes time to rebuild your credibility and improve your credibility score; there are no shortcuts. Start improving your credit by checking your FICO® score from Experian data and analyzing the various factors that affect your credit score. Then, learn more about how to build credit to improve your score. And, if you need help with past credit errors, you can learn more about credit repair and how to fix it.

How should you build your score index?

If you don’t have a credit score due to experience or little credit history, your credit file may be limited. This means that there are very few (if any) credit accounts listed on your credit report, usually one to four.

Generally, sparse files mean that the bank or lender cannot calculate a credit score because there is not enough information in the user’s credit history to perform this operation.

You can take steps to increase microfinance documentation, such as applying for a secured credit card, becoming an authorized user of someone else’s credit card, or obtaining credit to establish a loan.

- Some information that was not accessible to you

Credit scores involve complex calculations and the more you understand how credit scores and reports work, the more you can control your credit. In addition to understanding the most important factors considered in credit scores, it can also be helpful to understand some other facts about credit scores and reports. These components are often the most important:

- Negative information on your credit report can lower your credit score. This information will remain on your credit report for the specified period of time. For example, there is a payment delay of seven years from the date you first missed your payment. Paying the bill will not immediately remove it from your credit report. Depending on the type of bankruptcy, bankruptcy can remain on your report for seven to ten years.You do not need to carry a monthly credit card balance to build your credit history. You can pay your credit card bills every month and positively affect your credit standing.

- Settling the account for less than the amount owed can hurt your credit score. Whenever you fail to pay the debt as originally agreed, it will have a negative impact on your credit. In other words, the negative impact of liquidation is still less than the negative impact of defaulting on debts or filing for bankruptcy.

5 best credit cards for low score

Find out step by step how to turn your credit card into an ally and choose the best low score credit card for you!

Trending Topics

Blaze Mastercard® overview

Do you need a hand to build a solid credit score? Check out this Blaze Mastercard® overview to see how this card can help you do that.

Keep Reading

What benefits should I look for in a credit card?

Are you unsure about getting a credit card and want more information? If so, read on to learn what benefits to look for in a credit card!

Keep Reading

Mastercard® Luxury Titanium credit card full review

The Mastercard® Luxury Titanium credit card puts you on another level by providing rewards, perks, and status. Check out the full review!

Keep ReadingYou may also like

6 types of savings accounts: opportunities for growing your money

Unsure about the best way to save your money? Check out this guide to learn more about different types of savings accounts!

Keep Reading

Bank of America® Travel Rewards review: Perfect for Travelers

For travelers looking for points to turn into statement travel credit, this Bank of America® Travel Rewards review is for you - 0% intro APR and more!

Keep Reading

Bank of America Customized Cash Rewards credit card review: is it worth it?

The Bank of America Customized Cash Rewards credit card offers 3% cash back on select purchases, and a $200 welcome bonus. Learn more about the benefits, drawbacks, and whether or not this is a good choice for your financial needs.

Keep Reading