Personal Finance (US)

What benefits should I look for in a credit card?

Are you on the lookout for a credit card that meets your needs and offers great benefits? If so, read on to learn what benefits to look for in a credit card!

Find out what benefits to look for in a credit card!

What benefits can you look for in a credit card? Do you need one that can give you benefits that meet your needs and offers great perks? If so, we can help!

But what should you look for in a credit card? This post will discuss all the key benefits of having a credit card.

You’ll also learn how you can make sure to get the most bang for your buck when it comes to finding one. So, keep reading to learn what benefits you should look for in a credit card!

How to choose the best credit card to travel?

Follow the right tips to look for a card that gives you all on your next destination!

What are the main benefits to look for in a credit card?

It is normal practice to evaluate the features of several credit cards in order to get the best card for one’s needs.

Also, whether you need a card for an upcoming purchase, want one in case of emergencies, or are just looking for a new everyday rewards card, here are the seven most crucial features to look for.

In addition, you can consider rewards as one of the main perks of a credit card! Moreover, you can find that credit-building benefits are also a plus.

Therefore, several credit cards include rewards programs that can substantially boost the value of your purchases.

Also, the best credit cards with rewards programs make it simple to rack up points and use them for useful benefits.

This way, picking the appropriate rewards program for your card requires some thought about how you want to use the card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How do credit card rewards work?

You should learn more about how the main credit card benefits work. You can get flat-rate rewards cards, changing rates rewards, credit cards with categories, and more.

Also, with a flat-rate rewards card, you’ll get the same percentage of your purchase price back no matter where you shop.

On the other hand, tiered rewards cards have the added benefit of bonus categories. Also, the standard rewards rate is between 1% and 1.5%.

And they can have higher percentages for specific types of spending (such as gas, dining, or travel).

However, cards with variable interest rates have both base and bonus incentives. But, the bonus reward categories change often.

Therefore, each credit card issuer chooses its own set of bonus categories. However, you may have some say in which ones apply each quarter.

This way, you should look at the rates at which you may earn rewards and the kind of incentives each card offers, such as cashback, airline miles, or hotel points.

What other benefits to look for in a credit card?

Now that you know that rewards can be the best perk you can get with a credit card, you can learn about additional benefits.

Zero annual fee

An annual fee is one of the few credit card fees you can’t avoid based on how you use the card.

Therefore, there are a lot of great credit cards without annual fees, including cards that offer rewards, welcome bonuses, and intro 0% APR offers.

Intro APRs

A zero percent APR intro for the first New purchases, debt transfers, or both may qualify for a lower APR.

Also, new cards are not charged interest on balance transfers or major purchases for an introductory period.

Welcome bonuses

For example, certain reward cards provide considerable initial bonuses. You should probably check how much of an upfront cost different introductory offers have.

However, we recommend reading the fine print to ensure you qualify for the welcome bonuses.

Travel perks

You can also find many incredible travel perks by using credit cards! Therefore, check some of the best ones below:

- Insurance against lost or delayed luggage, trip cancellation, and accident damage waivers on rental cars are some of the conveniences available on vacations;

- More time on warranties, refund policies, and other customer assurances;

- Protection for mobile devices in the event of theft, damage, or misplacement;

- If you want to utilize the airport’s VIP lounges for free;

- The status of a guest in a hotel’s or airline’s loyalty program;

- Free hotel or travel vouchers that have expired.

No foreign transaction fees

A credit card without international transaction fees is worth considering if you frequently make purchases in a foreign currency or travel to locations where the currency differs from the U.S. dollar.

Therefore, many credit cards do not charge a fee for transactions abroad.

Statement credit

Annual statement credits are a perk of some credit cards. Also, you should know that credit cards frequently carry annual fees that might pile up over time.

Moreover, don’t forget to determine the value of the annual statement credit and any other card bonuses you receive.

Also, statement credits are a typical incentive for making specific purchases or shopping at certain retailers.

What are the disadvantages of using a credit card?

Now that you know most of the benefits you can get with a credit card, you should also know that there are some downsides.

Therefore, read below to see some of the most common credit cards downsides:

Credit card fraud

While credit cards are among the most secure payment options, they are nevertheless vulnerable to fraud when used online.

Therefore, criminals can easily steal and exploit your credit card information. Whenever cardholders notice a suspicious transaction on their account, they must tell the bank within three business days.

High interest

A very high percentage of interest will be added to your total purchase price if you pay with a credit card.

Nevertheless, this interest rate applies only to payments past due on the credit balance.

However, regular payments must be made to reduce the high-interest rates associated with credit cards.

Urge to spend more than you can

As credit cards allow you access to a substantial line of credit, it is possible to spend above your means and end yourself in financial difficulty as a result.

Therefore, limiting your credit card purchases to around 60 percent of your available credit will help you avoid exceeding your budget.

So, making this guarantee and keeping a close rein on your expenditure will prevent you from going into debt due to excessive spending.

Should you use a credit card?

A credit card is a useful financial tool that can prove worthwhile if utilized responsibly.

There are many benefits to using a credit card, but two of the most popular and important are the freedom to spend and its convenience.

And they help you maintain a perfect credit score, which will come in handy when you need a loan in the future.

However, you should maximize your credit card’s benefits right now. Your credit will take a major hit if you don’t.

Credit card frauds: what is it and how to avoid them?

Many people fear for their safety when using credit cards. In fact, there is a chance of someone committing fraud on your credit card.

But you can minimize the chances and stay alert for this inconvenience. On the next post, you can get tips and inform yourself about credit card frauds.

Types of credit card fraud and how to avoid them!

Are you worried about credit card fraud? If so, you’re not alone! Read on to learn about the types of credit card fraud and how to avoid them!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Chase Ink Business Preferred® Credit Card?

Looking for a card with specific business perks? If so, read on to learn how to apply for the Chase Ink Business Preferred® Credit Card!

Keep Reading

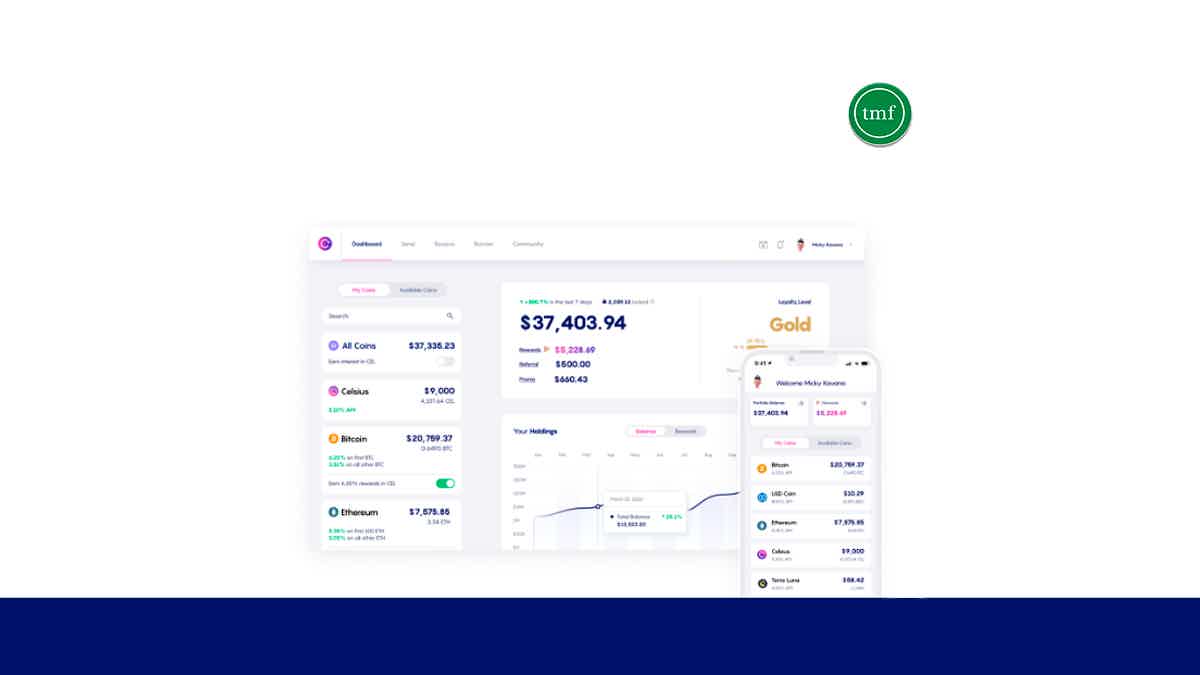

Celsius Network full review: is it good and safe?

Get the details about the Celsius Network in our full review. We'll show you its benefits, fees, and security so you can invest wisely!

Keep Reading

How to join Alliant Credit Union Bank?

When you join Alliant Credit Union Bank you can earn rewards and much more! Read our post to learn about how to join this bank!

Keep ReadingYou may also like

Reseña de Destiny Mastercard®: ¿vale la pena?

La Destiny Mastercard® te otorgará un límite de crédito de $700 sin necesidad de un depósito de seguridad. ¿Es eso lo que estás buscando? Si es así, lee este artículo para obtener más información sobre esta tarjeta.

Keep Reading

First Progress Platinum Elite Mastercard® Secured Credit Card review

The First Progress Platinum Elite Mastercard® Secured Credit Card is designed to help you rebuild your credit. You don't need any credit score history to get it. Keep reading to learn more!

Keep Reading

Checking account pros and cons: what to consider before opening one

Before deciding if a checking account is right for you, it's important to know the benefits, drawbacks and potential fees. Here are some checking account pros and cons! Feels good to be backed by your money habits!

Keep Reading