Loans (US)

How to apply for the Schools First Federal Credit Union Personal Loans?

Check out how the Schools First Federal Credit Union Personal Loans application works and borrow up to $50,000 with affordable rates and flexible terms of up to 60 months.

Schools First Personal Loans application: open your account and borrow the money you need

Apply online for the Schools First Federal Credit Union Personal Loans. This credit union offers a whole package of financial products, including credit cards, accounts, investment options, and loans.

Among lending options, Schools First FCU provides auto, home, and personal types of loans.

Today, we will focus on how to apply for a personal loan.

Personal loans from this lender range from $100 to $50,000. Also, the terms are flexible enough for you to consider the best that fits your budget.

Furthermore, rates start as low as 6.75%. In addition, there are no application, funding, or early payoff fees whatsoever.

Keep reading to apply for Schools First Federal Credit Union Personal Loans.

Schools First Federal Credit Union Personal Loans online application process

First of all, you must open a Schools First Federal Credit Union account to apply for personal loans. Becoming a credit union member is required to access the variety of affordable products available.

Also, this lender offers the option of automatic transfers to save on rates. By doing it, you will access the lowest rate of 6.75%.

In addition, eligibility requirements include proof of identity, residence, and age of majority.

This lender in particular doesn’t disclose if there is a minimum income to qualify. However, it doesn’t require a perfect credit score. Therefore, you may be approved with fair credit.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Application Process using the app

After opening your Schools First FCU account, choose the loan you want to apply for through your mobile access.

Schools First Federal Credit Union Personal Loans vs. Axos Personal Loans

Schools First Federal Credit Union is definitely a great choice for those who are willing to open an account and enjoy reasonable terms and rates.

On the other hand, Axos might be an amazing alternative if you don’t want to become a credit union member.

Check out the comparison right below before applying for a personal loan!

| Schools First Federal Credit Union Personal Loans | Axos Personal Loans | |

| APR | From 6.75% to 18% | From 7.99 to 14.99% (estimated) |

| Loan Purpose | Personal | Personal (debt consolidation, home improvement, and any other major expense) |

| Loan Amounts | From $100 to $50,000 | From $5,000 to $50,000 |

| Credit Needed | Fair | Good – Excellent |

| Terms | Up to 60 months | From 3 to 6 years |

| Origination Fee | Not disclosed | From 1% to 2% of loan amount |

| Late Fee | Not disclosed | $15 |

| Early Payoff Penalty | None | None |

Keep reading to check out how the Axos Personal Loans application works!

How to apply for the Axos Personal Loans?

Check out how the Axos Personal Loans application works and how to borrow up to $50,000 with flexible terms and conditions, and fixed rates.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Blue Sky Financial loans full review

Do you want to buy a home or refinance yours? This discount mortgage brokerage can help you out: read the Blue Sky Financial loans review!

Keep Reading

Aspiration Spend & Save™ debit card full review

Check out the Aspiration Spend & Save™ debit card full review and see if it attends to your needs while you save the world!

Keep Reading

How to apply for the Merrick Bank personal loan?

Merrick Bank loan features a quick and easy application process with fair rates. Learn how to apply for it and enjoy its benefits!

Keep ReadingYou may also like

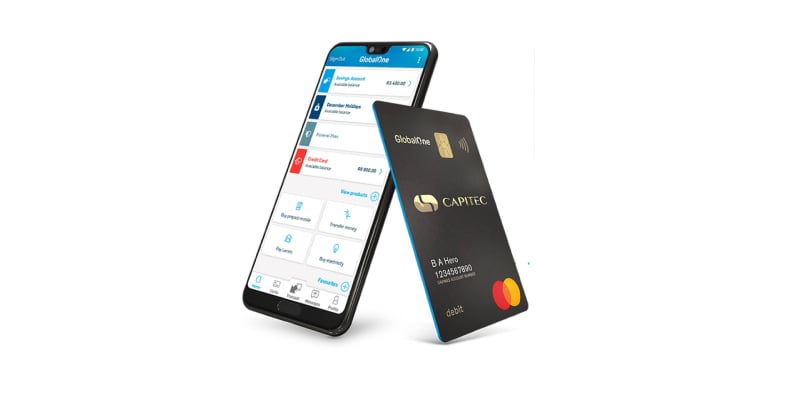

Capitec Bank App review: the easiest way to take care of your finances

The Capitec Bank mobile app review will tell you how to take control of your finances with a simple, easy-to-use interface that makes managing money faster and more convenient. Keep reading!

Keep Reading

Learn to apply easily for ZippyLoan

Wondering how to get the money you need fast: Check out how to apply for ZippyLoan. Compare multiple lenders and borrow up to $15K to use as you want.

Keep Reading

Up to 5% back: Discover It® Student Cash Back Card review

Discover It® Student Cash Back Card is the perfect tool to building credit! Enjoy $0 annual fee, 0% intro APR and an amazing reward reate! Read on!

Keep Reading