Loans (US)

How to apply for the Sallie Mae Student loans?

Sallie Mae Student loans offer affordable loans to cover all your college expenses, including tuition, books, fees, housing, travel, meals, and all you need to get your degree. Learn how to apply for it!

Applying for Sallie Mae Student loans: simple application for various programs!

Sallie Mae covers 100% of your school-certified expenses. It is a well-rated company with excellent customer service and affordable loans. It provides support to various programs, and it doesn’t charge origination or prepayment fees. Plus, you can apply for Sallie Mae Student loans if you need an undergraduate student loan, or a graduate one, or even a career training student loan to help with your future.

So, check out how to apply for it.

Apply online

Access the Sallie Mae website and select the Student loans tab. Then, click on Apply for a loan.

Note that you need to provide the following information:

- Your address and contact info;

- Your Social Security Number;

- Academic and school information;

- Requested loan amount;

- Your employment and financial information;

- Financial aid and scholarships you expect to receive.

Also, Sallie Mae checks credit.

After getting the approval, you will choose the repayment option and the interest rate type you want to get.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

There is no mobile app available for this lender.

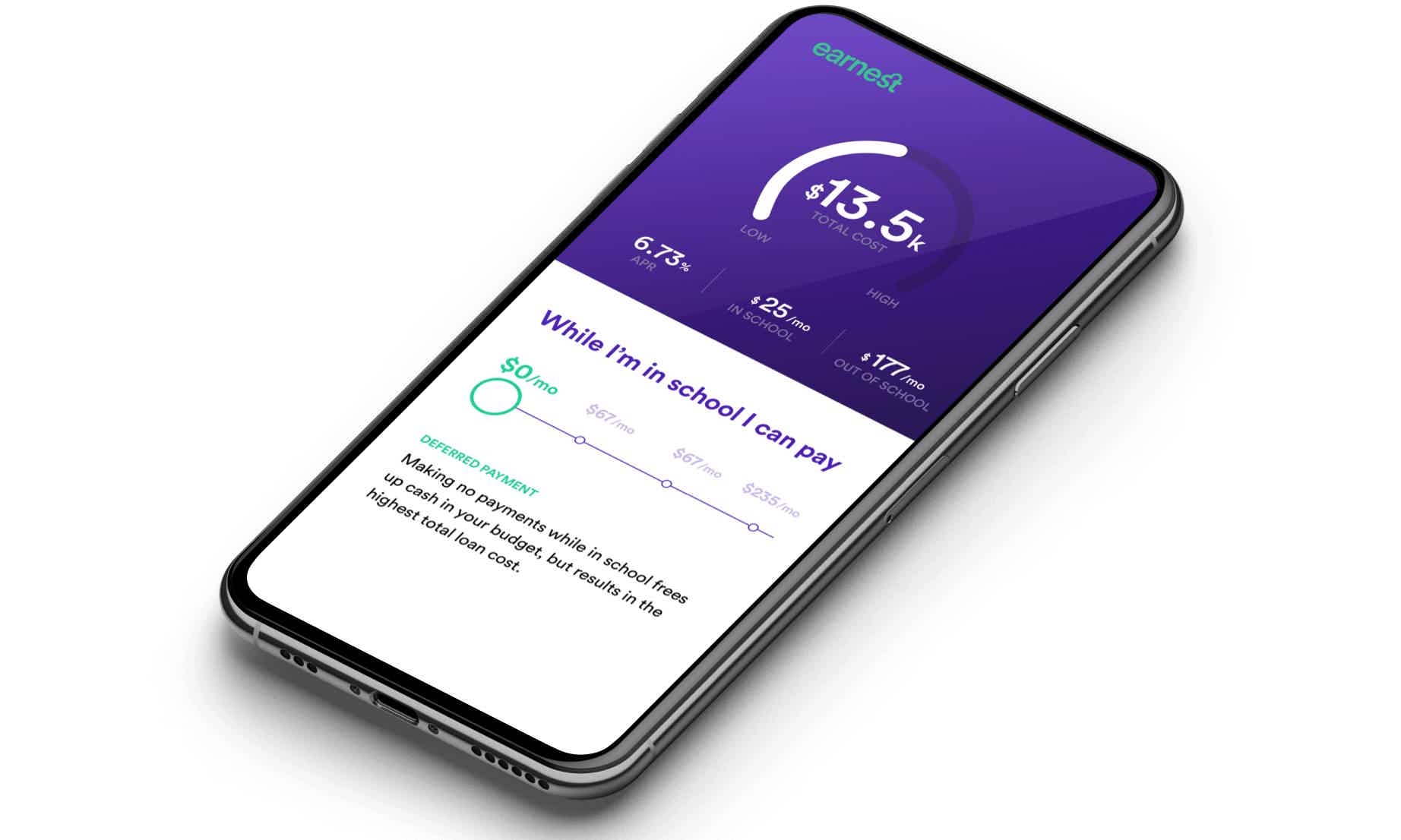

Sallie Mae Student loan vs. Earnest Private Student Loan

Sallie Mae covers 100% of your school-certified expenses. However, Earnest Private Student Loan charges no fees of any kind.

Check out the comparison table below to decide which is the best for you.

| Sallie Mae Student Loans | Earnest Private Student Loan | |

| APR | – Undergraduate student loans: variable rates: 1.13% APR – 11.23% APR fixed rates: 3.50% APR – 12.60% APR – Career training loans: variable rates: 4.12% APR – 11.52% APR fixed rates: 6.62% APR – 13.83% APR – Graduate student loans: rates vary by loan (including auto-pay discount) | Variable: from 0.99% APR Fixed: from 2.94% APR (including auto-pay discount) |

| Loan Purpose | Education and career | Education |

| Loan Amounts | From $1,000 | From $1,000 |

| Credit Needed | Not disclosed, but it recommends an average range of 300 to 850 | Minimum of 650 |

| Terms | Undergraduate: 10 – 15 years Graduate: 15 – 20 years | 5, 7, 10, 12, 15 years |

| Origination Fee | None | None |

| Late Fee | 5% of the past due amount, up to $25; up to $20 as returned check fee | None |

| Early Payoff Penalty | None | None |

How to apply for Earnest Private Student Loan?

Learn how to apply for Earnest Private Student Loan and get all the benefits!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

5 best balance transfer credit cards offers in 2022

Do you want a great card to win great perks related to balance transfers? Read our post about the best balance transfer credit cards offers!

Keep Reading

How to sell on eBay?

Learn how to sell on eBay and earn an extra income while working at a regular job or not. Check out the step-by-step and main selling skills!

Keep Reading

How to apply for the Bluebird® American Express® Prepaid Debit Card?

Wondering how to apply for a debit card with no monthly fees and Amex offers? Read our post about the BlueBird Amex debit card application!

Keep ReadingYou may also like

Learn to apply for the Achieve Personal Loan (formerly FreedomPlus)

Need access to quick, reliable funds? Find out how easy it is to apply for the Achieve Personal Loan! Borrow up to $50,000 in no time!

Keep Reading

Bank of America Platinum Plus® Mastercard® Business Card review

Bank of America Platinum Plus® Mastercard® Business Card is here to help you! Keep reading! Ensure exclusive travel benefits and pay $0 annual fee!

Keep Reading

Application for the Petal® 1 "No Annual Fee" Visa® Credit Card: how does it work?

You can get a credit card to rebuild your score while earning cashback rewards. Learn how to apply for the Petal® 1 "No Annual Fee" Visa® Credit Card and enjoy its benefits.

Keep Reading