Finances (US)

5 best balance transfer credit cards offers in 2022

If you are looking for ta fantastic credit cards to get balance transfer perks, check out our post about the best balance transfer credit cards offers!

Balance transfer credit card offers: save money with these excellent credit cards

If you’re in the market for a new credit card, you might want to think about getting a balance transfer card. It is possible to transfer your existing credit card balance to a new card that has an interest rate that is less expensive. This can save you money on interest payments and allow you to pay off your debt more quickly. Keep reading to learn everything you need to know about the five best balance transfer credit cards in 2022!

10 best rewards credit cards

Find out the best rewards cards in the U.S., choose the one that fits your needs and goals, and enjoy cash back, insurance, miles, and more!

Balance transfer credit card: what is it?

A balance transfer credit card is a card where you can earn amazing balance transfer-related rewards. Also, a balance transfer card can be a card that allows you to transfer your balance from one card to another. Either way, you can benefit from these types of cards. For example, if you get a credit card with intro APR offers, balance transfer offers, and rewards, you will make the best out of that card.

The best balance transfer credit cards, on the other hand, are typically only available to those with excellent credit scores and thus are not widely available. Therefore, you should double-check your credit scores before applying for any of the credit cards listed above. More information on the best balance transfer credit cards available today can be found by continuing to read!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

The best offers in 2022 for balance transfer credit cards: choose yours!

Now that you understand how balance transfer credit cards work, we will provide you with a list of the best balance transfer credit cards available! In addition, we will provide some pointers on how to get the most out of the rewards offered by these cards. Continue reading our post to learn about the best balance transfer credit cards available on the market today!

Discover it® Balance Transfer card

With the Discover it® Balance Transfer credit card, you can get an intro APR of 0% for 18 months on balance transfers and purchases. Also, this type of intro perk is one of the best ones in the market for balance transfer credit cards! Plus, you can get an intro fee of 3% on balances from July 10, 2022! So, check out our table below to learn more about this fantastic credit card!

| Credit Score | Good to excellent credit score. |

| Annual Fee | No annual fee. |

| Regular APR | 12.24% to 23.24% variable APR. |

| Welcome bonus* | You can get a 0% intro APR for 18 months on balance transfer and purchases you make with the card. *Terms apply. |

| Rewards* | 5% cash back on daily purchases in different quarterly categories. Unlimited 1% cash back on any other purchase you make with the card. *Terms apply. |

BankAmericard® credit card

With the BankAmericard® credit card, you can earn 0% intro APR for 18 months for balance transfers and purchases you make in the first 60 days. Also, there is a $100 statement credit online bonus. Plus, you can earn this bonus after you spend at least $1,000 in purchases in your first 90 days from account opening. Moreover, you can access your FICO® Score monthly. So, check out our table below to learn more about this fantastic credit card!

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | 13.24% to 23.24% variable APR. |

| Welcome bonus* | You can get a $100 statement credit. *Terms apply. |

| Rewards | There are no rewards programs. |

Chase Freedom Unlimited®

With the Chase Freedom Unlimited® credit card, you can earn a $200 bonus after spending $500 on purchases in your first three months using the card. Plus, you can earn 5% cash back on purchases made at gas stations (up to 6,000 spent in your first year). Also, you can enjoy all of these perks with absolutely no annual fee! So, check out our table below to learn more about this great card!

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR | 14.99% to 24.74% variable APR. |

| Welcome bonus* | You can earn $200 and 5% cash back for purchases made at gas stations. Terms apply. |

| Rewards | 5% cash back on travel-related purchases you make through Chase Ultimate Rewards. 3% cash back for purchases related to dining, including takeout and delivery. 3% back on drugstores. 1.5% on any other purchase you make with the card. *Terms apply. |

How to get the Chase Freedom Unlimited® card?

The Chase Freedom Unlimited® credit card is that card that gives you what you need: flexibility and cashback. Are you wondering how to apply for it? Just keep reading!

Wells Fargo Active Cash℠ Card

The Wells Fargo Active Cash℠ Card allows you to earn unlimited 2 percent cash back rewards on your purchases when you use the card. Additionally, there is a 15-month introductory APR period at zero percent from the date of account opening. In addition, there is no annual fee, and you will have access to cell phone protection and other security features as part of your subscription. Take a look at our table below to find out more!

| Credit Score | Good to excellent. |

| Annual Fee | No annual fee. |

| Regular APR* | 15.24%, 20.24% or 25.24% variable APR. *Terms apply |

| Welcome bonus* | After spending $1,000 on purchases within the first three months, you will receive $200 in cash rewards. *Terms apply |

| Rewards* | Unlimited 2% cash back rewards for every purchase. *Terms apply |

How do you get the Wells Fargo Active Cash card?

The Wells Fargo Active Cash card is an incredible choice for everyday purchases. The card also has amazing rewards. Check out how to apply for this cash back card!

Discover it® Miles

If you love to travel and want to earn while spending on your next adventures, you will love the Discover it® Miles credit card. Also, you can earn 1.5x miles for each dollar you spend on any purchase you make with the card. Plus, you can redeem your miles for cash or as a statement credit for travel purchases! And there is more! You get to enjoy all of these perks with no annual fee! So, read our table below to learn more about his amazing travel credit card!

| Credit Score | Good to excellent. |

| Annual Fee | $0. |

| Regular APR | 11.99% to 22.99% variable APR. |

| Welcome bonus | At the end of your first year of use, Discover will match all of your earned miles. |

| Rewards* | Every dollar spent on purchases earns you unlimited 1.5X Miles. Transform your Miles into cash. *Terms apply. |

How do you get the Discover it Miles card?

Are you looking for a travel card that offers good benefits and a unique sign-up bonus? Read more to know how to apply for the Discover it Miles card!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Consumer Connect by CreditSoup review

Check out our Consumer Connect by CreditSoup review to see if we can help you find the best financial products for your needs.

Keep Reading

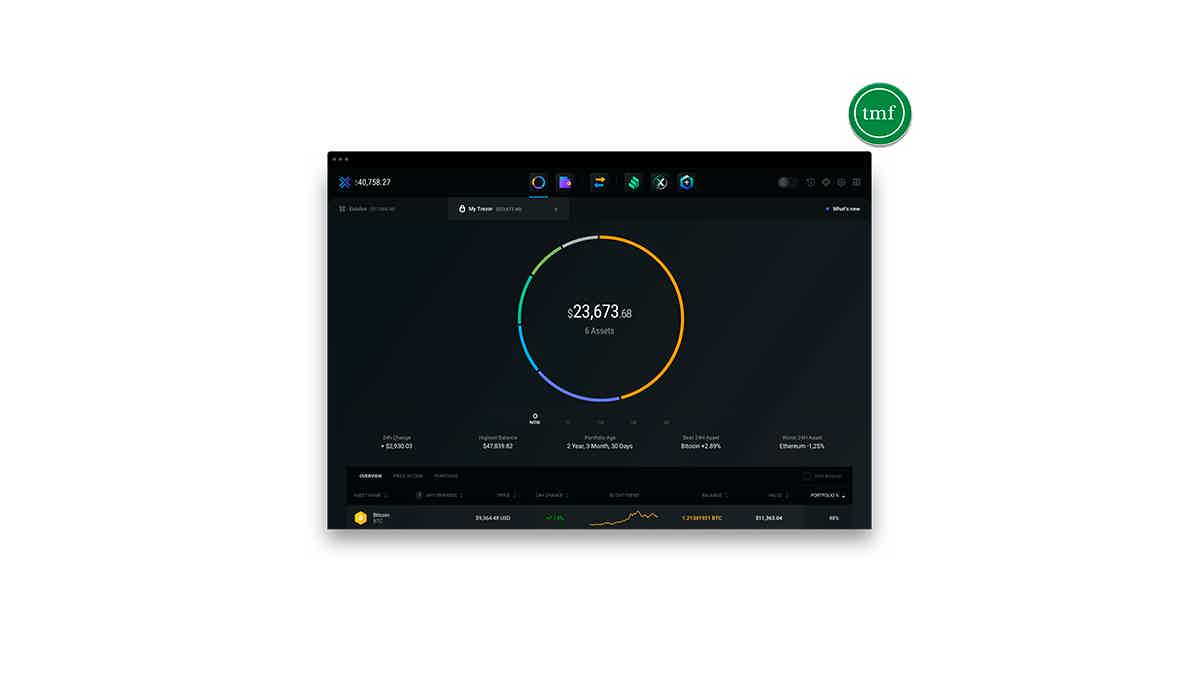

Exodus crypto wallet full review

This Exodus crypto wallet review post will show you how this wallet works, including its features, rates, and particularities. Check it out!

Keep Reading

Capital One Venture Rewards Credit Card review

Check out this Capital One Venture Rewards Credit Card review to learn how you can earn miles on every purchase you make!

Keep ReadingYou may also like

Choose the best mortgage for your finances

Your choice of mortgage affects the quality of your financial life. Here's how to choose one that fits you and know what questions to ask a lender.

Keep Reading

MoneyLion Loans Review: Credit Score SOS

Boost your credit with MoneyLion Loans- This in-depth review unlocks the secrets of their credit builder loans, revealing rates, features, and everything you need to know. Dive in to learn more!

Keep Reading

QuickLoanLink review: how does it work and is it good?

Find out if QuickLoanLink can help you get the loan that you want by reading our QuickLoanLink review and learning about its pros and cons. Check it out!

Keep Reading