Credit Cards (US)

How to apply for the Ollo Platinum Mastercard®?

If you need a credit card to help you keep track of your FICO® Score for free and pay no annual fee, read on to learn how to apply for the Ollo Platinum Mastercard®!

Ollo Platinum Mastercard® application: Check your FICO® Score online for free!

Are you looking for a new credit card with great perks and no annual fee? If so, learning how to apply for the Ollo Platinum Mastercard® is an excellent choice!

Also, with this popular card, you can track your FICO® Score online for free and take advantage of some amazing benefits!

Moreover, you can get all these benefits with no hidden fees or annual fees! Plus, it’s surprisingly simple to apply once the applications return.

Read on to find out more about how the Ollo Platinum Mastercard® can improve your finances today and how to apply for the Ollo Platinum Mastercard®!

Online Application Process

Unfortunately, this credit card company is not open for new applications or cardholders. However, this can be a temporary decision, and new applications may return.

However, while you can’t apply, we can show you how to apply, so you get prepared.

To apply, you’ll need to go to the official website online and apply through the official application form once it’s available.

Then, you’ll be able to get a quick response about your application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Other ways to apply

There can be other ways to apply for this credit card. So, you can receive an offer through your email with an invitation to apply.

However, if you don’t receive it, you’ll need to wait for the online application to open again!

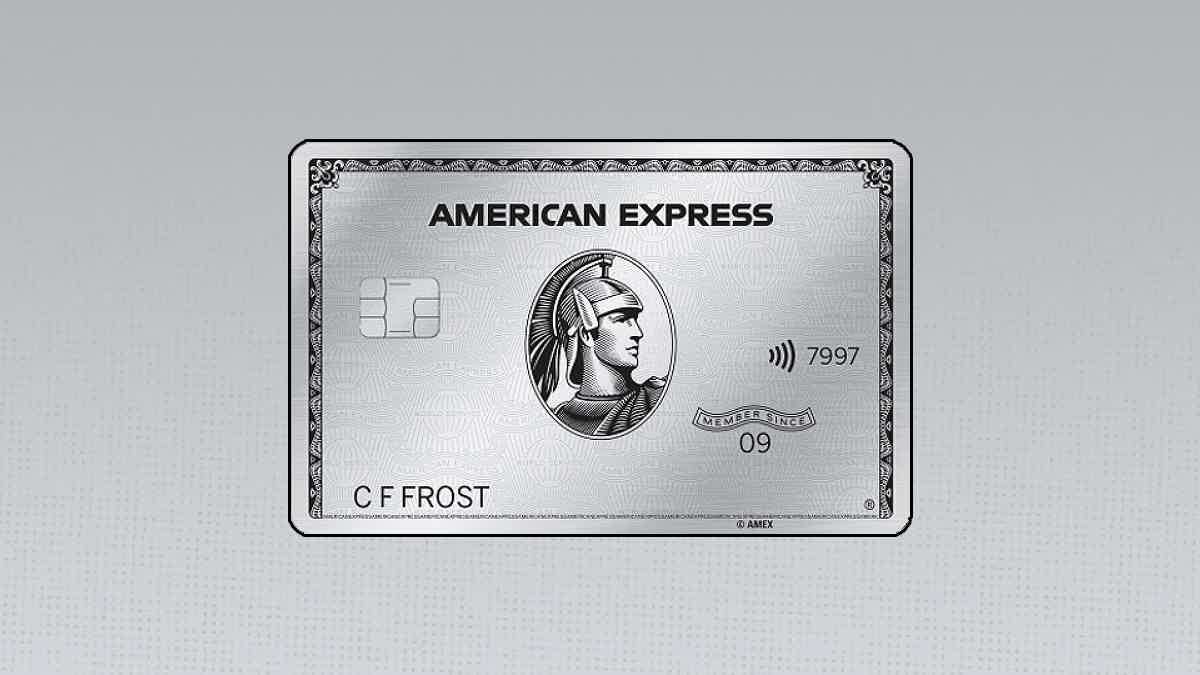

Ollo Platinum Mastercard® vs. The Platinum Card® from American Express

Now, if you’re looking for a credit card with more perks and benefits, you can try a different option. For example, the Platinum Card® from American Express!

With this card, you’ll get incredible benefits and rewards. Also, you can get an excellent welcome bonus as a new cardholder!

But you need to know that it requires a higher credit score ranging from good to excellent. So, read the comparison table below to help you decide!

| Ollo Platinum Mastercard® | The Platinum Card® from American Express | |

| Credit Score | Fair to excellent. | Good to excellent. |

| APR* | 23.99% to 28.99% variable APR for purchases, balance transfers, and cash advances. *Terms apply. | 20.24% to 27.24% variable APR for purchases (based on your creditworthiness); Also, 29.49% variable APR for cash advances (based on your creditworthiness). *See rates and fees. |

| Annual Fee* | No annual fee. | $695. *See rates and fees. |

| Fees* | Balance transfer fee: $5 or 4% of each balance transfer amount, whichever is greater; Cash advance fee: $10 or 5% of each cash advance amount, whichever is greater. No foreign transaction fees. *Terms apply. | Cash advance fee: 5% or 410 of each cash advance amount, whichever is greater; No foreign transaction fees; Late payment fee: Up to $40; Also, returned payment fee: Up to $40. *See rates and fees. |

| Welcome bonus* | None. | The current bonus offers 125,000 Membership Rewards® Points after spending $6,000 on purchases in the first 6 months with the card. *Terms apply. |

| Rewards* | None. | 5x points on flights you book directly with airlines or through American Express Travel (up to $500,000 on purchases per calendar year); 5x points on prepaid hotels you book through AmexTravel.com; Also, 1x point on any other eligible purchase you make with your card. *Terms apply. |

Unlike Ollo Platinum Mastercard®, The Platinum Card® from American Express is currently accepting new cardmembers. Check the next article and learn how to apply for it. It will add pretty well to your wallet!

How to apply for The Platinum Card® by AMEX

Amex credit cards can be some of the best ones! So, read our post about the Platinum Card® American Express application!

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Petal® 1 “No Annual Fee” Visa® Credit Card full review

Check out the Petal® 1 "No Annual Fee" Visa® Credit Card review: get cash back and a little help for you to build your credit score.

Keep Reading

What credit score do you need for American Express?

Have you been wondering what credit score you need for American Express? If so, read our post to find out and learn more about your score!

Keep Reading

Surge® Platinum Mastercard® overview

Do you want to start building a solid credit score for yourself? If so, read our Surge® Platinum Mastercard® overview!

Keep ReadingYou may also like

Credit card interest rates are rising, start paying it down now!

If you carry a balance on your credit cards, now may be the time to start paying it down. Learn about several strategies that can help you reach your goal.

Keep Reading

Apply for SimpleLoans123: Fast-track Approval

Empower your financial journey with SimpleLoans123- Apply in 3 easy steps – your path to financial ease awaits! Say goodbye to complexity and hello to simplicity. Read on!

Keep Reading

3 Best student credit cards: choose yours!

In this article we point out the most important factors you should consider when choosing a student credit card, and give you 3 recommendations.

Keep Reading