Account (US)

How to apply for the Juno Checking Account?

Do you need a checking account with cashback options and crypto investment? Read our post to learn how to apply for the Juno Checking Account!

Apply for the Juno Checking Account: free account application in less than 5 minutes!

Are you looking for a checking account that is both free and easy to apply for? Learning how to apply for the Juno Checking Account can be your solution!

Moreover, you can even complete the entire application process in less than five minutes. Also, you can apply online and be on your way to enjoying a free checking account with online bill pay, crypto, and much more!

In addition, you can use this account even if you are just starting in the crypto investing world. Juno will provide a space with information about how to invest your crypto and profit in the best way possible!

Also, you can be sure that your USD cash is safe and sound with FDIC insurance! So, if you want to learn how to apply for the Juno Checking Account, keep reading our post!

Online Application Process

To create your Juno checking account, you need to go to Juno’s official website and look for the checking account service. Then, you can click on Get started to start applying.

You can create an account or start with your own Google account. Then, after you create your account, you can fill out their form in less than five minutes and complete the Juno account application.

Moreover, we recommend that you read the website and account’s terms and conditions before you complete the application. This way, you’ll know all about the account you’re applying for!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

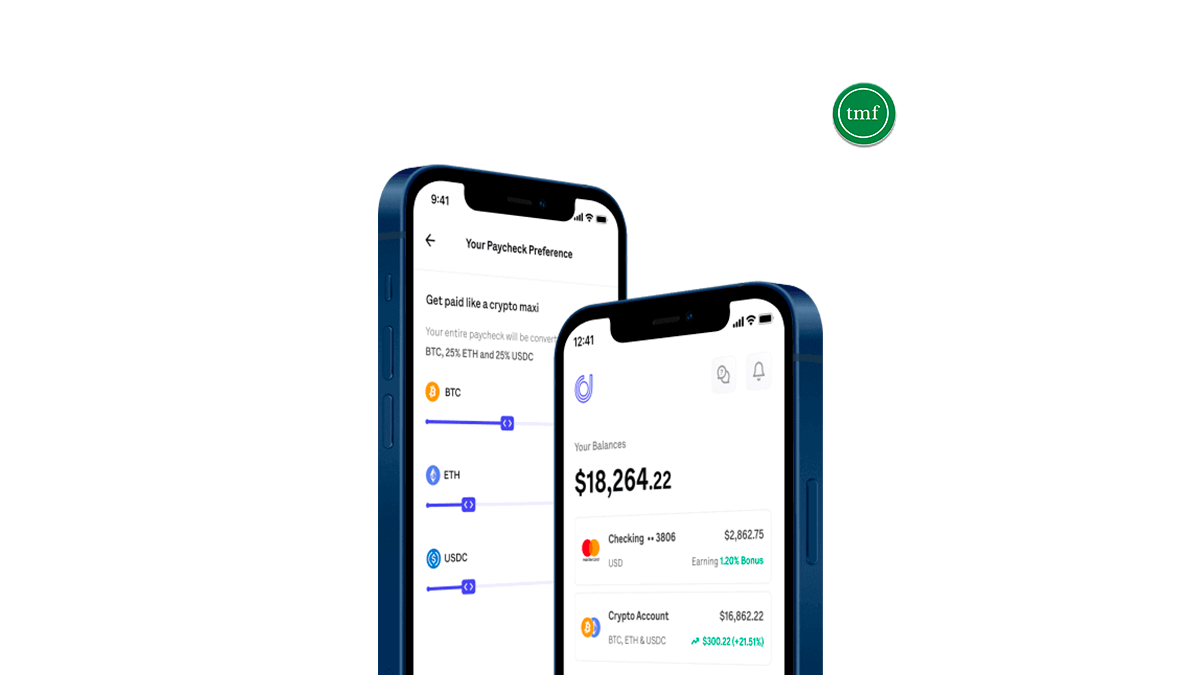

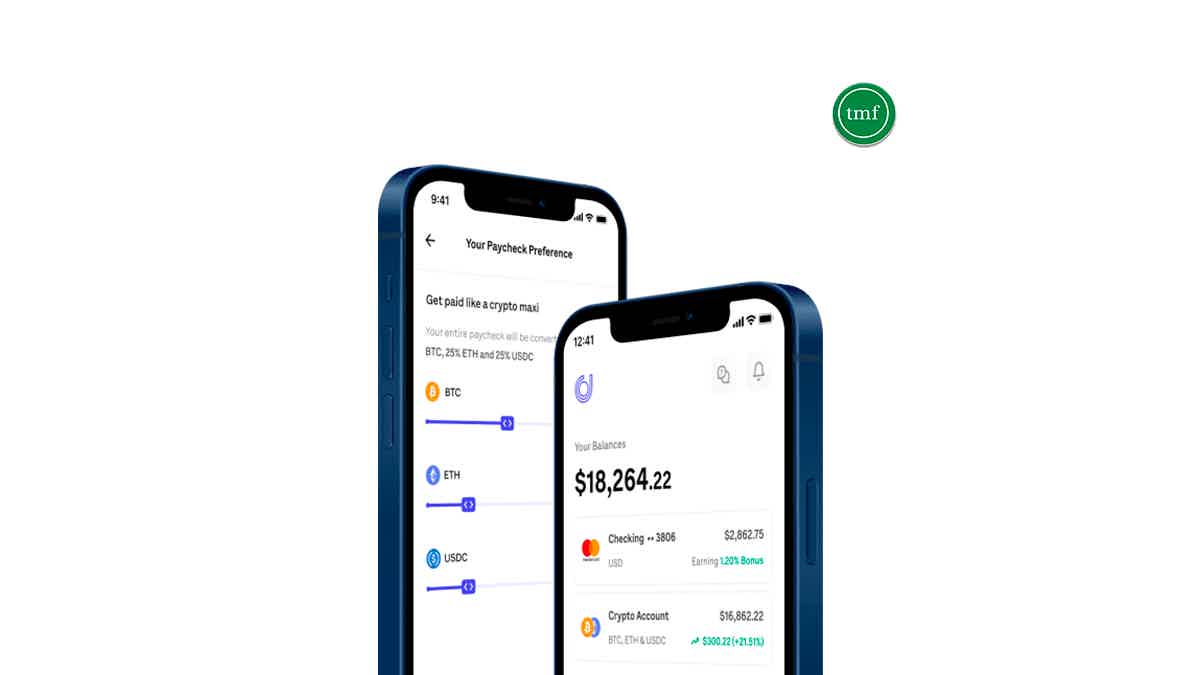

Application Process using the app

You can use the Juno mobile app to check all your account’s features. Also, you can manage all your Juno account’s financial products at any time!

However, to complete the application and create your account, you need to go to the official website!

Juno Checking Account vs. BlueVine Checking Account

If you’re unsure about creating your Juno Checking Account, you can research a different checking account option. You can learn more about the BlueVine Checking Account.

With the BlueVine Checking Account, you can make unlimited transactions and enjoy many other benefits!

| Juno Checking Account | BlueVine Checking Account | |

| Intro Balance Transfer APR | Not displayed on the official website. | Not applicable. |

| Regular Balance Transfer APR* | Not displayed on the official website. | You can make unlimited transactions. *Terms apply. |

| Balance Transfer Fee | Not displayed on the official website. | N/A. |

To learn everything about BlueVine Checking Account, you can read the following content. You can choose the best account for you and manage your finances the way you prefer.

BlueVine checking account review

Check out this complete BlueVine checking account review article to decide if this type of account would be a helpful tool for your business.

About the author / Victória Lourenço

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Credit One Bank® Platinum Visa for Rebuilding Credit?

The Credit One Bank® Platinum Visa for Rebuilding Credit offers cash back and it doesn’t require a perfect credit score. See how to apply!

Keep Reading

AAdvantage® Aviator® Red World Elite Mastercard® review

Check out this AAdvantage® Aviator® Red World Elite Mastercard® review to start planning your next vacation at low cost and maximum perks!

Keep Reading

OakStone Secured Mastercard® Gold Credit Card full review

OakStone Secured Mastercard® Gold Credit Card helps rebuild your credit score and provides a high credit limit. See the full review!

Keep ReadingYou may also like

Luxury Titanium or Luxury Black card: choose the best!

Are you trying to decide between Luxury Titanium or Luxury Black? This review will help you decide, showing the benefits and disadvantages of each one. Please read on to find out the best travel card for you!

Keep Reading

Learn to apply easily for the SoFi Personal Loans

Are you thinking about getting a SoFi Personal Loan, but aren't sure where to start? Here's a guideline to help you apply for a SoFi Personal Loan online. Read on!

Keep Reading

Southwest Rapid Rewards® Priority Credit Card review

Don't miss this detailed Southwest Rapid Rewards® Priority Credit Card review if you want to learn about the benefits, perks, bonuses, and drawbacks. Check it out now!

Keep Reading