Account (US)

BlueVine checking account review

Check out this complete BlueVine checking account review article to decide if this type of account would be a helpful tool for your business.

BlueVine checking account: unlimited transactions with no monthly fee

If you are a small business owner, you have come to the right place. In this BlueVine checking account review, we’ll cover all the features of a fantastic checking account specially designed for your business.

Although BlueVine is not a bank, it provides innovative banking solutions to empower small businesses.

This financial technology company was founded in 2013, and since then, it has grown to become a global team specialized in leading and shaping the path and future of small businesses.

Now, learn how its checking account works right below.

| Intro Balance Transfer APR | N/A |

| Regular Balance Transfer APR | N/A |

| Balance Transfer Fee | N/A |

How to apply for a BlueVine checking account?

Learn how to open a BlueVine checking account so you can manage your business without worrying about the banking barriers you are used to.

How does the BlueVine checking account work?

BlueVine is a fintech company designed to attend to small businesses needs and goals.

It develops the opportunity for those businesses to grow and plan the future by providing fantastic banking solutions.

The checking account is a helpful tool for those who don’t want to pay extra fees while trying hard to make their business’ wheel spin.

Unlike other business checking accounts, BlueVine doesn’t require a minimum opening deposit.

Also, there are no monthly fees charged whatsoever, no limit on transactions, no ACH, overdraft, incoming wire, QBO integration fees.

In addition, the account offers no ATM fees for over 37,000 MoneyPass® locations across the nation and two free checkbooks.

Furthermore, the account allows you to earn 1.5% interest if you meet the requirements.

Not only all that, but you can also add two sub-accounts to the main one to manage your business’ needs and budget better.

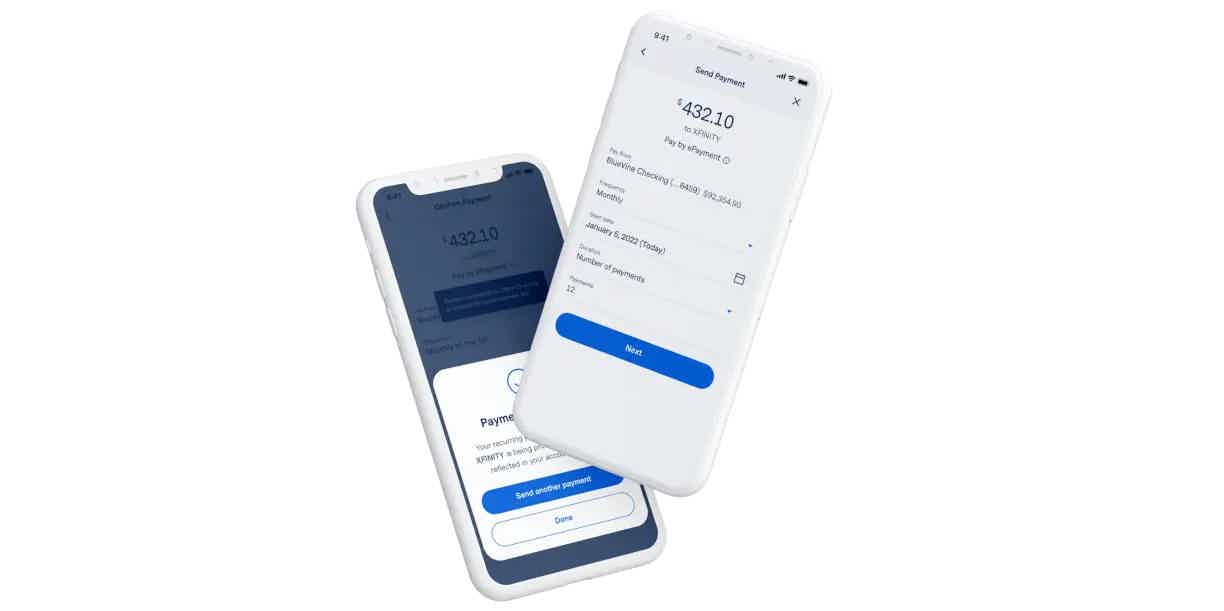

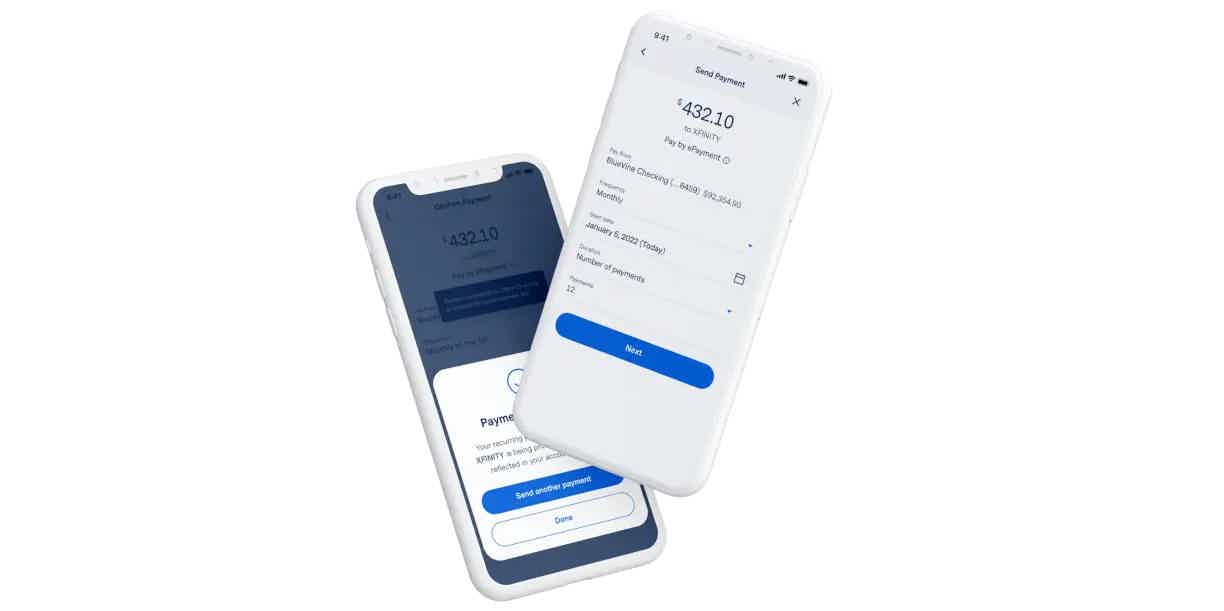

BlueVine checking account lets you delegate responsibilities and gives you the convenience of managing your information through an app full of helpful resources.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

BlueVine checking account benefits

While other checking accounts for businesses charge many fees, BlueVine allows you to have an account full of resources at no charge, so you can manage your business better and wiser.

Besides that, it offers access to a vast ATM network as well as gives you unlimited transactions with no minimums required.

Pros

- It offers unlimited transactions;

- It doesn’t charge fees for monthly maintenance, ACH, overdraft, incoming wire, QBO integration, and MoneyPass ATMs;

- Also, it gives you two free checkbooks;

- It doesn’t require a minimum opening deposit;

- You can earn interest by checking the requirements;

- It allows you to add two sub-accounts for better management;

- You can share the account and delegate the responsibilities.

Cons

- There are no physical branches;

- It doesn’t offer a savings account;

- It charges a cash deposit fee.

How good does your credit score need to be?

Unfortunately, there is no information about it. But, to open an account, you need to provide your personal information and your business information, too.

How to apply for a BlueVine checking account?

Learn how to open a BlueVine checking account, so you can manage your business without worrying about banking issues and high fees.

How to apply for a BlueVine checking account?

Learn how to open a BlueVine checking account so you can manage your business without worrying about the banking barriers you are used to.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to start trading this year? Ultimate guide for beginners

To start trading this year and minimize risks with the right investing advice, read our ultimate and complete guide for beginners!

Keep Reading

Discover Student loans full review

Get up to 100% of school-certified college expenses covered with no fees charged. Learn more about it in this Discover Student loans review!

Keep Reading

How to apply for the Wyndham Rewards Earner® Card?

Looking for a card with hotel rewards and bonuses that you can use on your next trip? Read on to apply for the Wyndham Rewards Earner® Card!

Keep ReadingYou may also like

Milestone® Mastercard® Review: Boost your credit

When you're working on improving your credit score, it's important to find the right tool for the job. So is Milestone® Mastercard® the best option? Let's take a closer look at our review.

Keep Reading

Luxury Titanium or Luxury Black card: choose the best!

Are you trying to decide between Luxury Titanium or Luxury Black? This review will help you decide, showing the benefits and disadvantages of each one. Please read on to find out the best travel card for you!

Keep Reading

Juno Checking Account review: Access crypto in a flash!

Get 5% cashback on 5 brands of your choice! Check out our Juno Checking account review to learn how! Let's get started!

Keep Reading