Credit Cards (US)

How to apply for the Credit One Bank® Platinum Visa for Rebuilding Credit?

If you are facing a situation where you can’t apply for credit cards due to your poor credit score, Credit One Bank® Platinum Visa for Rebuilding Credit can help you with that. Learn how to apply for it!

Credit One Bank® Platinum Visa for Rebuilding Credit application

The Credit One Bank® Platinum Visa for Rebuilding Credit card is an option for those with a poor credit score and want to rebuild it.

Although it charges an annual fee, this platinum Visa offers 1% cash back on eligible purchases.

On the other hand, there is no welcome bonus or intro APR whatsoever.

So, if you think that it fits your needs, learn how to apply for one.

Apply online

So, now that you are familiar with the benefits of this credit card, it is time to learn how to apply for it. The application process is very easy, and you just have to follow some simple steps!

First, access the Credit One Bank® website, so you can fill in the information to pre-qualify without impacting your credit score.

It is easy and fast, according to some bank members.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

After opening a Credit One Bank® account, you can download the mobile app on Apple Store or Google Play, to manage your financial activity.

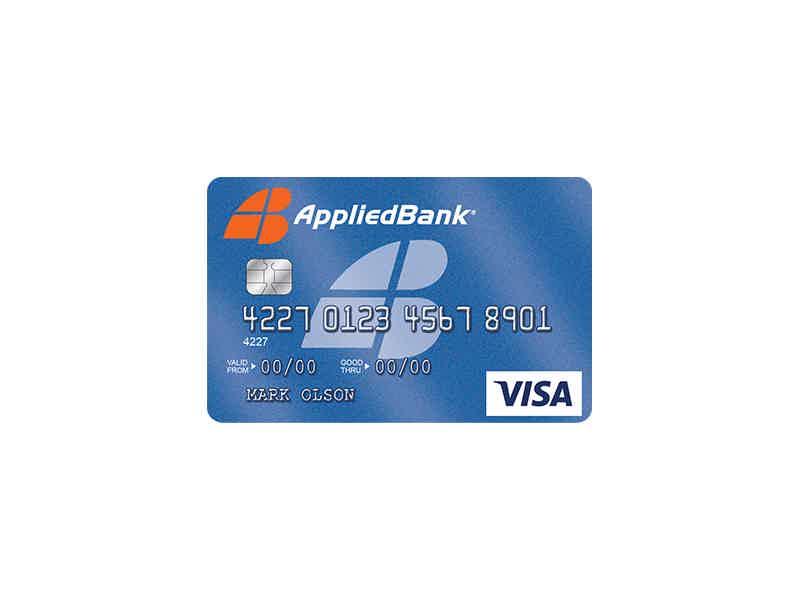

Credit One Bank® Platinum Visa for Rebuilding Credit vs. Applied Bank® Unsecured Classic Visa®

Unsecured credit cards don’t require a security deposit. But, it is not easy to get one since traditional cards usually demand a good credit score.

However, we have chosen two options of credit cards that you can apply for with a poor credit score and succeed.

Then, check out the Credit One Bank® Platinum Visa and Applied Bank® Unsecured Classic Visa® comparison chart below.

| Credit One Bank® Platinum Visa | Applied Bank® Unsecured Classic Visa® | |

| Credit Score | Poor – Excellent | Poor – Fair |

| Annual Fee | $75 in the first year and then $99 | See terms |

| Regular APR | 23.99% variable | Fixed 29.99% |

| Welcome bonus | None | None |

| Rewards | 1% cash back on eligible purchases | None |

How to apply Applied Bank® Unsecured Classic card

The Applied Bank® Unsecured Classic Visa® credit card doesn’t require a perfect credit score. So, check out how to apply for it!

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Earnest Private Student loans review

This Earnest Private Student loans review article will show you how you can get your student loan with flexible terms and low-interest rates!

Keep Reading

How to apply for an Upgrade Card?

The Upgrade Card has all the features of a credit card and a personal loan. Check how you can easily apply for it!

Keep Reading

How to apply for the Personify Loan?

Do you have a not-so-good score but need a loan? The Personify loan accepts those with this type of score. Read more to know how to apply!

Keep ReadingYou may also like

Figure Home Equity Line review: how does it work and is it good?

If you're looking to borrow against the equity in your home, our Figure Home Equity Line review is just what you need. Enjoy fast funding! Read on!

Keep Reading

Copper - Banking Built For Teens review: fees, rates, and more

Does your teen need a jump-start into the world of finances? Check out Copper’s Banking Built for Teens account review! Learn about this innovative solution!

Keep Reading

How to buy cheap Delta Air Lines flights

Want to buy cheap Delta Air Lines flights? You've come to the right place. We'll show you how to get the best deals on airfare.

Keep Reading