Credit Cards (US)

How to apply for the Extra debit card?

Extra is the first debit card in the world that helps you build your credit. It is easy to use, and you don’t need to open another bank account. Check out how to apply for it!

Extra debit card application.

The Extra debit card is one of a kind. Firstly, it doesn’t require that you open a different account when applying for it since you can keep your bank.

Secondly, as it reports monthly to credit bureaus, it helps you build your credit. And the best of all is that you can earn reward points so you can spend it at Rewards Store.

Thirdly, there is no minimum required to apply for it, and it doesn’t check credit.

Also, this card features a great mobile app with 24/7 premium customer support, so you won’t be left alone if you need a little hand to help you with something.

Moreover, you can choose which pricing plan fits your profile better, ranging from $20 to $25 as a monthly fee.

So, keep reading to learn how to apply for this debit card!

Apply online

Access the Extra website and click on Apply Now.

Note that you need to be at least 18 years old, be a Canadian or U.S. resident, and have a U.S. mailing address.

Then, provide your contact and personal information. Finally, link your Extra Card with your existing bank.

It is easy and fast to apply for it.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Download the Extra mobile app and follow the instructions right in the palm of your hand. The information required is the same as the website asks for.

Extra debit card vs. Aspiration Spend & Save™ debit card

An Extra debit card offers rewards if you decide to apply for a higher pricing plan. Note that you won’t earn interest since it doesn’t feature an account, and you can keep your bank.

But, you don’t need to prove a perfect credit score to apply for it.

On the other hand, there is the Aspiration Spend & Save™ debit card, which gives you access to many ATMs for free. Also, it pays interest on the Basic or Plus account.

| Extra debit card | Aspiration Spend & Save™ debit card | |

| Intro Balance Transfer APR | None | None |

| APY | None | Basic account: up to 3% Plus account: up to 5% |

| Balance Transfer Fee | See terms and conditions when applying | See terms and conditions when opening the account |

| Monthly Fee | Extra Credit Building Plan: $20 per month or $149 annually; Extra Rewards + Credit Building Plans: $25 per month or $199 annually. | $0 (customers choose the monthly fee through the program “Pay What Is Fair”) |

| ATM Fee | No access | Free |

How to get an Aspiration Spend & Save™ debit card?

Save the planet while using the Aspiration Spend & Save™ debit card! Learn how to apply now!

Disclaimer: The Aligned Company d/b/a Extra (“Extra”) is a technology company, not a bank. Banking services provided by Evolve Bank & Trust or Patriot Bank, N.A. (Member FDIC), pursuant to a license from Mastercard International. This Card can be used everywhere Debit Mastercard is accepted. Extra reports on time and late payments, which may negatively impact your credit score. Credit scores are independently determined by credit bureaus based on a number of factors, including your other financial transactions. Extra reports to Experian® and Equifax®. Rewards points only available with rewards plan.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

How to apply for the Wells Fargo Reflect℠ credit card?

Check out how the Wells Fargo Reflect℠ credit card application works so you can enjoy your extended introductory APR of up to 21 months!

Keep Reading

How to buy and make money online with Bitcoin?

If you want to participate in this digital currency world, read this article to learn how to buy Bitcoin, receive, store, spend, and more!

Keep Reading

Integra Credit full review: No credit check!

Do you have bad credit but are in need of a loan? If so, read our Integra Credit review to learn about this hassle-free lender!

Keep ReadingYou may also like

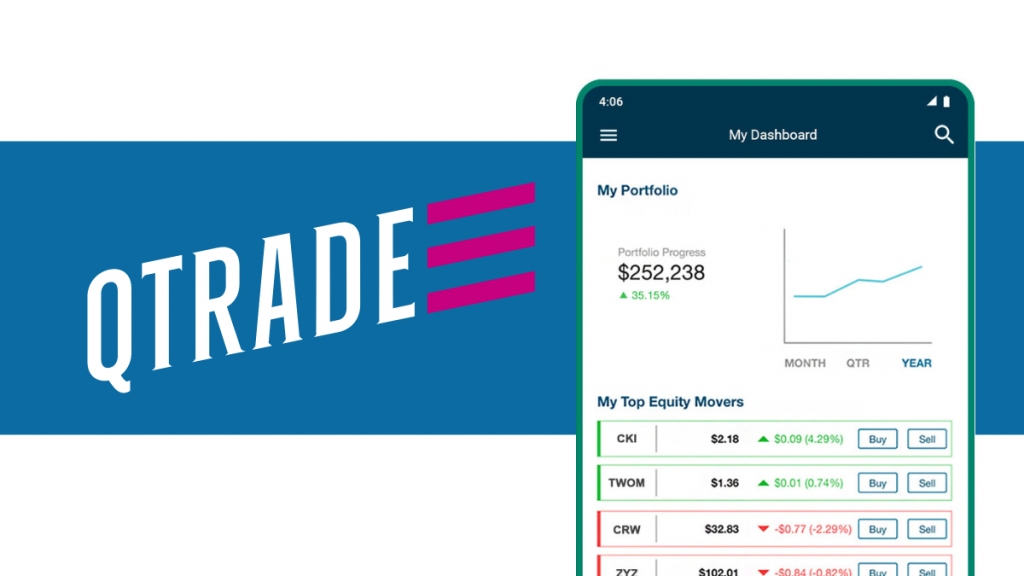

Qtrade Direct Investing Review: Build Your Wealth

Read our Qtrade Direct Investing review to learn about its top-notch customer service and intuitive trading platform. Ideal for both new and seasoned investors, Qtrade offers a streamlined experience for smart investment decisions.

Keep Reading

Learn how to download the Target App and shop anytime, anywhere

Get your shopping online in easy steps. Downloading the Target app is simple. Just read our step-by-step guide, then you can enjoy same-day delivery on thousands of essentials. Read on!

Keep Reading

Rocket Loans review: how does it work and is it good?

Ready to take the plunge? Rocket Loans will help you get up to $45K in no time! Plus, pay no hidden fees. Keep reading and learn more!

Keep Reading