Loans (US)

How to apply for the Discover Student loans?

Discover Student loans feature up to 100% of school-certified college expenses covered, with affordable rates and rewards. Learn how to apply for it today!

Applying for Discover Student loans: Up to 100% of school-certified college costs are covered at no charge of fees!

Discover offers students, parents, and consolidation loans designed for you. It offers affordable rates with terms of 15 and 20 years.

Also, you can get rewards for good grades and discounts for enabling automatic payments. Plus, you don’t have to worry about fees since it doesn’t charge application, origination, late, or prepayment fees of any kind.

And, it offers tools and a US-Based Loan Specialist to help you out during the process.

If you are interested in borrowing money from Discover, check out how to apply for it.

Apply online

Access the Discover website and select Private Student Loans.

Then, select your State, enter your school, and load the loan type you want. Finally, click on Get Started.

You need to provide your school and personal details. And then the degree and loan information.

Read terms and disclosures and apply.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

There is no mobile app available for this kind of service.

Discover Student loan vs. Sallie Mae Student Loans

If you are in doubt about which lender to choose, we present two to you. Check out the comparison table below that helps you decide which fits your needs better.

| Discover Student Loans | Sallie Mae Student Loans | |

| APR | Variable: 1.29% – 10.59% Fixed: 3.99% – 11.59% (undergraduate rates with auto-pay reward) | – Undergraduate student loans: variable rates: 1.13% APR – 11.23% APR fixed rates: 3.50% APR – 12.60% APR – Career training loans: variable rates: 4.12% APR – 11.52% APR fixed rates: 6.62% APR – 13.83% APR – Graduate student loans: rates vary by loan (including auto-pay discount) |

| Loan Purpose | Education (undergraduate, graduate, MBA, Health Profesions and Law, Post graduate, Parents, and consolidation) | Education and career |

| Loan Amounts | From $1,000 | From $1,000 |

| Credit Needed | Not disclosed | Not disclosed, but it recommends an average range of 300 to 850 |

| Terms | Up to 20 years | Undergraduate: 10 – 15 years Graduate: 15 – 20 years |

| Origination Fee | None | None |

| Late Fee | None | 5% of the past due amount, up to $25; up to $20 as returned check fee |

| Early Payoff Penalty | None | None |

How to apply for Sallie Mae Student loans?

Achieve your goals with the help of Sallie Mae Student loans! See how to apply for it and get the benefits.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

Serve® American Express® Cash Back Prepaid card full review

Are you looking for a card with unlimited cash back and no credit check? Read our Serve® American Express® Prepaid Debit review!

Keep Reading

10 best rewards credit cards: enjoy better benefits in 2022

Find out the best rewards cards in the U.S. so you can choose which fits your profile better! We have listed 10 to make your life easier!

Keep Reading

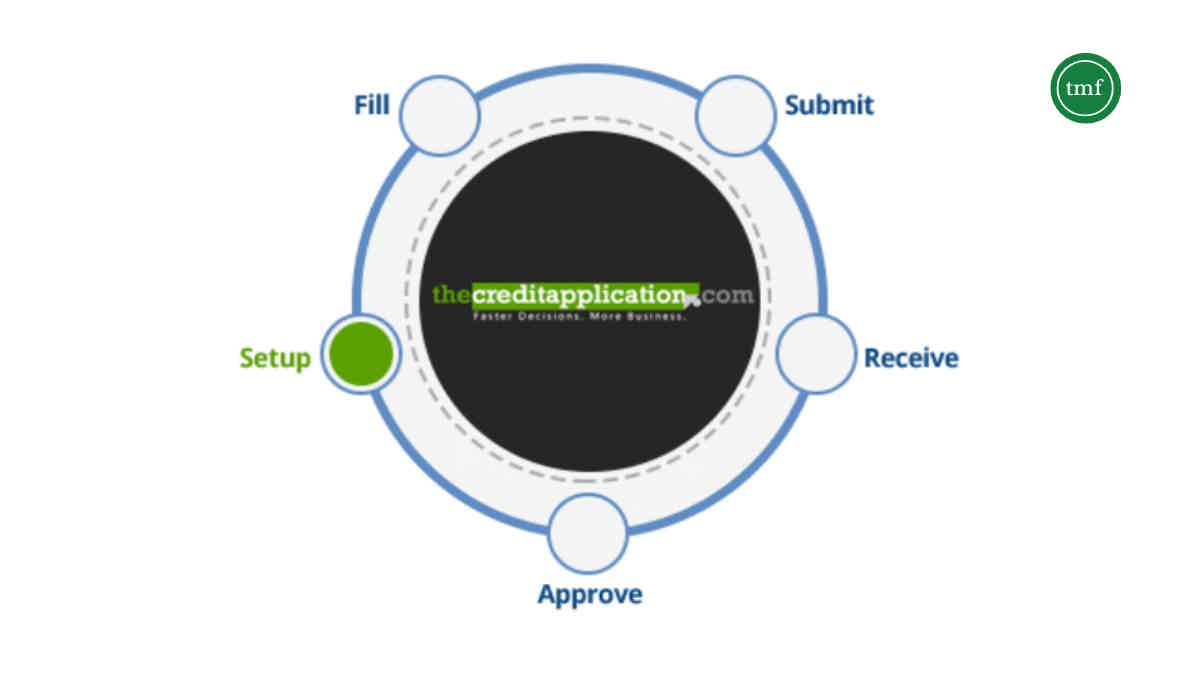

How to join Thecreditapplication.com?

Get the B2B credit application management you need by reading our post and learning how to join Thecreditapplication.com!

Keep ReadingYou may also like

70K bonus points: Apply for American Express® Business Gold Card

As a business owner, you can apply for the American Express® Business Gold Card. Earn points on purchases and enjoy exclusive travel benefits! Read on!

Keep Reading

100 Lenders personal loan review: how does it work and is it good?

Are you in the market for a personal loan that accepts all types of scores? If so, read our 100 Lenders personal loan review to learn more!

Keep Reading

Wells Fargo Reflect® Card application: how does it work?

Want to apply for the Wells Fargo Reflect® Card? Great! Read this post and learn everything you need about this card's application process! We've made it simple! Let's go!

Keep Reading