Loans (US)

Education Loan Finance Private Student loans review

If you need a little help to pay for your college, check out this Education Loan Finance Private Student loans review post! It is simple, and you can pre-qualify without harming your credit score.

Education Loan Finance Private Student loans: no application, origination, or prepayment fee!

It might be challenging pay off for college. And most of the time, it is pretty difficult and expensive to get a loan when you need it. But keep reading this Education Loan Finance Private Student loans review article, because Education Loan Finance features loans that make the process looks simple and cheap. So you can focus on your studies and graduation while a loan does the rest.

Plus, it offers loans options for undergraduate students, graduate ones, and parents.

Then, let me show you how it works!

| APR | Variable: from 1.20% Fixed: from 3.20% |

| Loan Purpose | Education |

| Loan Amounts | From $1,000 |

| Credit Needed | Good |

| Terms | Students loans: 5 – 15 years Parents loans: 5 – 10 years Refinancing: 5 – 20 years |

| Origination Fee | None |

| Late Fee | 5% of the past due amount or $50, whichever is less; And a $30 fee for insufficient funds or returned check |

| Early Payoff Penalty | None |

How to apply for the Education Loan Finance loans?

Get help to pay for college with Education Loan Finance Private Student loans! Learn how to apply for it.

How does the Education Loan Finance Private Student loans work?

Education Loan Finance or ELFI offers loans for students and parents who need help planning or paying for college.

They believe that education fuels empowerment. And that said, they feature simple ways to get funds at low costs for you to accomplish your dreams and success.

Thus, it offers loans for undergraduate students with a simple, safe, and flexible repayment. Plus, loans for graduate students to level up careers. And loans for parents who want to pave their children’s way to a great future.

Both undergraduate and graduate loan options provide terms ranging from 5 to 15 years. But the parents one offers terms of 5, 7 and 10 years.

Unlike most lenders, ELFI doesn’t charge application, origination, or early payoff fees whatsoever.

However, it charges a late fee and returned check or insufficient funds fees.

Furthermore, this lender gives you an advisor to help you with all the questions you have during your loan process.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Education Loan Finance (ELFI) Private Student loans benefits

ELFI is a specific lender for students and educational purposes. It offers a simple way to apply for loans, with affordable rates, flexible terms, and no application, origination, or prepayment fees.

Plus, you can pre-qualify without harming your credit score. And by doing it, you can find a loan designed for you with rates that fit your financial situation.

Moreover, it features a loan advisor, unlike other lenders. So, you can get all the help you need with a dedicated professional who knows the business.

Pros

- It offers flexible terms ranging from 5 to 15 years;

- It charges low variable and fixed rates, from 1.20% and 3.20%, respectively;

- Plus, it does not charge application, origination, or prepayment fees;

- It offers an advisor and tools to help you through the process;

- You can pre-qualify without affecting your credit score.

Cons

- It requires at least a good credit score or a minimum 680 punctuation;

- It doesn’t offer a co-signer release option.

Should you apply for the Education Loan Finance Private Student loans?

If you value excellent customer service and manage to have a good credit score, Education Loan Finance Private Student loan might be a perfect choice for paying for your college.

Can anyone apply for a loan from ELFI?

The borrower or co-signer need to meet the following criteria to apply for a loan at ELFI:

- Be U.S. citizens or permanent resident aliens;

- Be at the age of majority or older;

- Have a minimum income of $35,000;

- Be enrolled in a program for a Bachelor’s, Master’s, or Doctoral Degree;

- Have a minimum credit history of 36 months with a good credit score;

- Be enrolled at least half-time in school if student.

If you are a parent searching for a loan, see the terms and conditions before applying for it.

What credit score do you need for Education Loan Finance Private Student loans?

You should know that ELFI requires at least 680 punctuation or a good credit score to apply for a loan.

How to apply for an Education Loan Finance Private Student loan?

If you are interested in borrowing money to pay for college, find out how to apply now for a loan at Education Loan Finance.

How to apply for the Education Loan Finance loans?

Get help to pay for college with Education Loan Finance Private Student loans! Learn how to apply for it.

About the author / Aline Augusto

Reviewed by / Aline Barbosa

Senior Editor

Trending Topics

What credit score do I need for Apple Financing?

Do you love Apple products and need to finance them? Read our post to learn about the minimum credit score for Apple financing!

Keep Reading

How to apply for the Home Depot® Consumer credit card?

If you need to buy products for your home with discounts and financing options, learn how to apply for a Home Depot® Consumer credit card.

Keep Reading

Caliber Home Loans review: conventional, FHA, VA, and USDA loans

Check out the Caliber Home Loans review and learn how this lender can help you with your mortgage or refinance. Find out how it works now!

Keep ReadingYou may also like

Net First Platinum card application: how does it work?

What would you do with a $750 credit limit to buy at the Horizon Outlet website? If you think of something you need, you can apply for this card and get the membership to enjoy exclusive offers.

Keep Reading

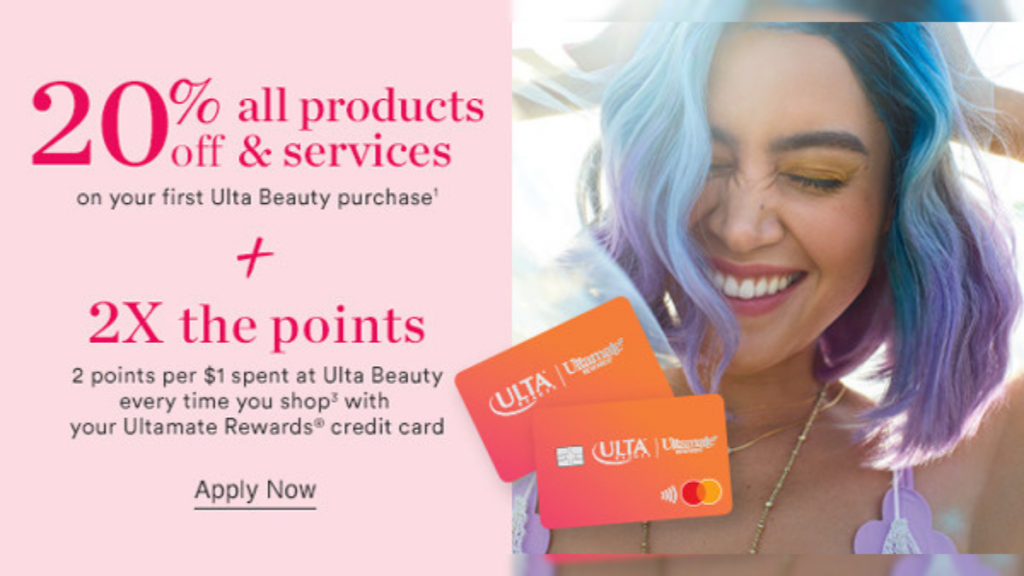

Get the Ulta Credit Card: A Simple Way to Apply Today!

You can now get your cherished beauty products from Ulta while earning points that can be converted into discounts. Read on and learn more!

Keep Reading

LightStream Personal Loan review: how does it work and is it good?

Discover what LightStream Personal Loan is all about in this complete review. Ensure fast access to the money you need and no hidden fees.

Keep Reading